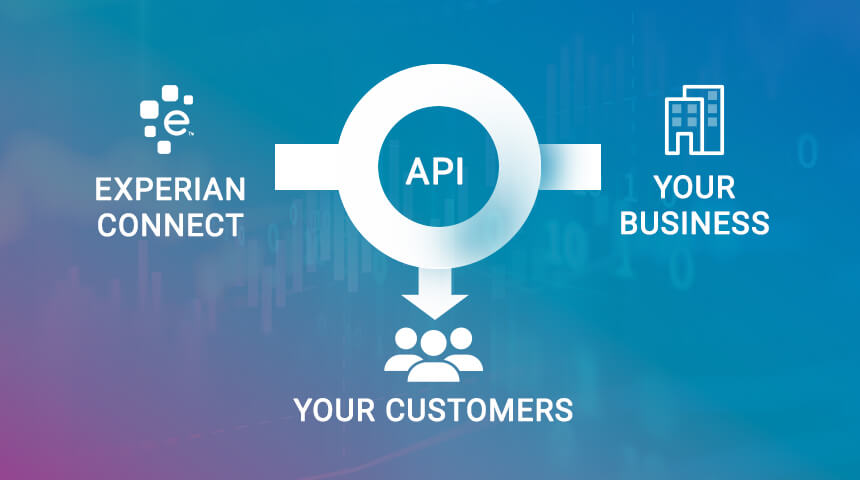

How does Experian API work?

How do I use Experian API

Create an account. To make your first API request you'll first need to create a Developer Portal account.Register your first application. Now you have successfully registered, you are ready to create an application and test our range of APIs.Get an access token.Send your first request.

What is Experian API

An Application Programming Interface (API) specifies a set of operations, inputs, outputs, and underlying types that allows you to build your software by leveraging the data and functionality provided by Experian.

How does Experian get its data

The personal data we hold is sourced from trusted data partners who have direct contact with you already, and where appropriate notice has been given for them to pass your information to Experian for use in our products and services – these partners include lifestyle surveys, publishers, competition and money saving / …

What is credit API

The CRS eCredit Data API™ gives you easy access to data and products across all three credit bureaus as well as select alternative data providers. A single, seamless, secure connection opens up a world of possibilities for businesses that need credit data and services.

How to use API to make money

Charging for API access

One of the most common ways businesses make money from API is by charging for access to their API. It can do it through a subscription model, where users pay a fee to access the API monthly or annually.

How to verify data in API

How to validate API validation can be accomplished in a variety of ways, but the most common are static analysis, dynamic analysis, and fuzz testing. Static analysis is the process of manually going through an API's code to look for security holes.

What database does Experian use

Experian's ConsumerView U.S. database in a snapshot: Data on more than 300 million individuals and 126 million households.

What does API stand for in lending

What is API APIs, or application programming interfaces, are tools that enable software to communicate and preform a series of tasks. In banking terms, we grant secured access to financial services to third-party platforms, helping companies build products around banking services.

How accurate is Experian data

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Why is Experian score always higher

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureaus—which is also unusual.

How does API work in banking

Banking API is the process of exposing banking functions as a web service so that they can be accessed by third-party companies. This makes business processes more efficient, as it allows different parts of the organization to work together in a coordinated manner.

How is API used in payments

A payment API facilitates your company's routine and benefits customers with a wide range of payment methods. Know more! A payment API connects e-commerce platforms with the financial institutions involved in the online payment process.

What does an API do for dummies

APIs, or Application Programming Interfaces, are like a set of rules and protocols that allow different software programs to talk to each other and share data or functionality. For example, when you use a weather app on your phone, it's probably using an API to get the current weather data from a service.

How API works for beginners

APIs, or Application Programming Interfaces, are a critical component of web development and programming. They provide a way for different applications and systems to communicate with each other, exchanging data and enabling functionalities.

What is the best way to authenticate API

#1 API Key (identification only) One of the easiest ways to identify an API client is by using an API key.#2 OAuth2 token. OAuth2 is a comprehensive industry standard that is widely used across API providers.#3 External token or assertion.#4 Token Exchange.#5 Identity facade for 3 legged OAuth.

What exactly you will verify in API testing

API test actionsVerify correct HTTP status code. For example, creating a resource should return 201 CREATED and unpermitted requests should return 403 FORBIDDEN, etc.Verify response payload.Verify response headers.Verify correct application state.Verify basic performance sanity.

Is Experian the most accurate

While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus. The credit scores that you receive from each of these bureaus could be the same, depending on which scoring model they use.

How do APIs work in payments

A payment API works by seamlessly adding payment processing capabilities to your existing software and mobile apps. Essentially, it allows one or more programs to interface and communicate with other programs, allowing merchants and eCommerce retailers to better manage the payment experience.

Which score is more accurate FICO or Experian

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Is Experian a true FICO score

FICO® Score 2 is the "classic" FICO® Score version available from Experian. FICO® Score 4 is the version of the classic FICO® Score offered by TransUnion. FICO® Score 5 is the Equifax version of the "classic" FICO® Score.