How does PayPal pay in 4 work?

Does PayPal Pay in 4 automatically take money out

After your down payment, your 3 subsequent repayments will be taken automatically from the confirmed payment method you provided at the time of application. Currently, your PayPal balance can only be used for one-time repayments that you initiate through the PayPal app or the PayPal website.

Cached

How often does PayPal Pay in 4 work

You also need an existing PayPal account that's in good standing. Pay in 4 allows you to break up payments for select online purchases into four equal installments. The first payment is due at the time of purchase, while the remaining payments are due every two weeks until you pay off the balance.

Cached

How long does PayPal Pay in 4 take to process

If you do not complete your Pay in 4 transaction, the pending authorization will be automatically voided by PayPal within 72 hours of the pre-authorization hold. Although PayPal has released the hold on your funds, this may take up to 1-5 business days to process through your financial institution.

What happens if PayPal Pay in 4 doesn’t go through

There will be no fees to use PayPal Pay in 4. However, if your payment is late, PayPal will be in touch to remind you of the missed payment. If payment still isn't made after this, the PayPal collections agency will contact you to arrange payment. Please note, your credit score could be affected if payment isn't made.

Can you have 2 PayPal Pay in 4 at once

You can even have multiple Pay in 4 plans at the same time. According to the PayPal website, as long as you see the option for Pay in 4 at checkout, you can choose a new Pay in 4 plan.

Why did PayPal deny me Pay in 4

When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

How much does PayPal Pay in 4 approve you for

between $30 to $1,500

How can I pay with Pay in 4 Pay in 4 will appear as a payment method for eligible shopping cart values between $30 to $1,500 when you check out with PayPal. Upon applying, you'll receive a decision within seconds, although not every application will be approved.

Does PayPal pay in 4 hurt my credit score

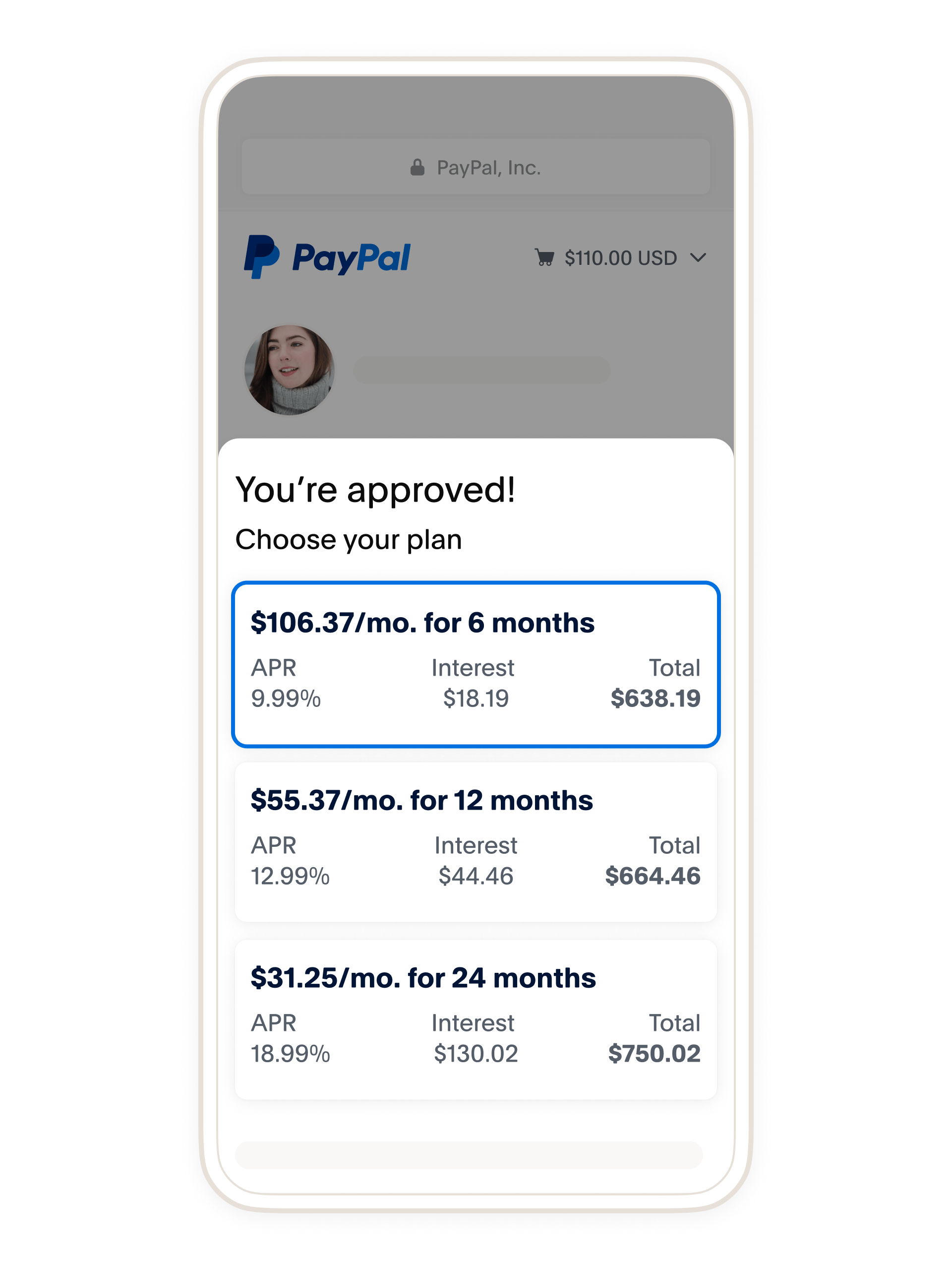

While PayPal Pay in 4 doesn't build credit, the Pay Monthly program could potentially help or hurt your credit score. Both programs have the potential to harm your financial standing if you overextend yourself by financing too many purchases. This could even increase your credit card debt if you're not careful.

Why was my PayPal payment declined 4

If your payment was declined, you may need to: Confirm the email address associated with PayPal. Update the expiry or billing address associated with your credit or debit card. Confirm your credit or debit card so we know you're the card owner.

Does PayPal Pay in 4 hurt my credit score

Does Pay in 4 Affect Your Credit Score PayPal may perform a soft check on your credit when you apply for Pay in 4, but this will not affect your score. A soft credit check gives the lender the ability to review your credit report and determine creditworthiness.

What is PayPal 4 limit

Fee free. PayPal does not charge any fees for its service, including no late fees. Credit limits. PayPal Pay in 4 is available for purchases between $30 and $2,000.

How much does PayPal pay in 4 approve you for

between $30 to $1,500

How can I pay with Pay in 4 Pay in 4 will appear as a payment method for eligible shopping cart values between $30 to $1,500 when you check out with PayPal. Upon applying, you'll receive a decision within seconds, although not every application will be approved.

Why was i denied PayPal pay in 4

When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

Does PayPal Pay in 4 affect credit score

PayPal's “Pay in 4” only uses a soft credit pull, but PayPal Credit does a full credit check. One hard inquiry isn't going to tank your score, but consumers should know that some BNPL services do use a hard credit check.

What happens if you make a purchase on PayPal but have no money in the connected bank account

You don't need to have money in your PayPal account to use PayPal. If you link a bank account to your PayPal account, we'll take the money directly from your bank account when you make a purchase or send money.

How do I get approved for PayPal 4 payments

Eligibility. To be eligible for PayPal Pay in 4, you must purchase an eligible item that costs between $30 and $1,500 from a participating online merchant that accepts PayPal. You also must be at least 18 years old and live in an eligible state.

Why did PayPal deny me pay in 4

When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

What happens if I owe PayPal money and I never Pay

If you refuse or cannot make payments with PayPal then will likely sell your debt or refer to you to a debt collector who will continue to contact you until your debt is paid. Your credit score will also be affected.

What happens if you don’t Pay in 4 with PayPal

Missing a repayment could have adverse consequences, including restricting your PayPal account, our taking legal action against you, and/or reporting the default information to a Credit Reporting Body (“CRB”) which may impact your ability to obtain, and the cost of, further credit.

What happens if you don’t Pay PayPal Pay in 4

If you miss a Pay in 4 payment instalment, the PayPal BNPL option will no longer be available. It remains frozen until the balance is paid. In more extreme cases where a balance remains unpaid for a long time, you may lose the ability to use other PayPal services.