How does piggybacking credit work?

Can piggybacking help credit score

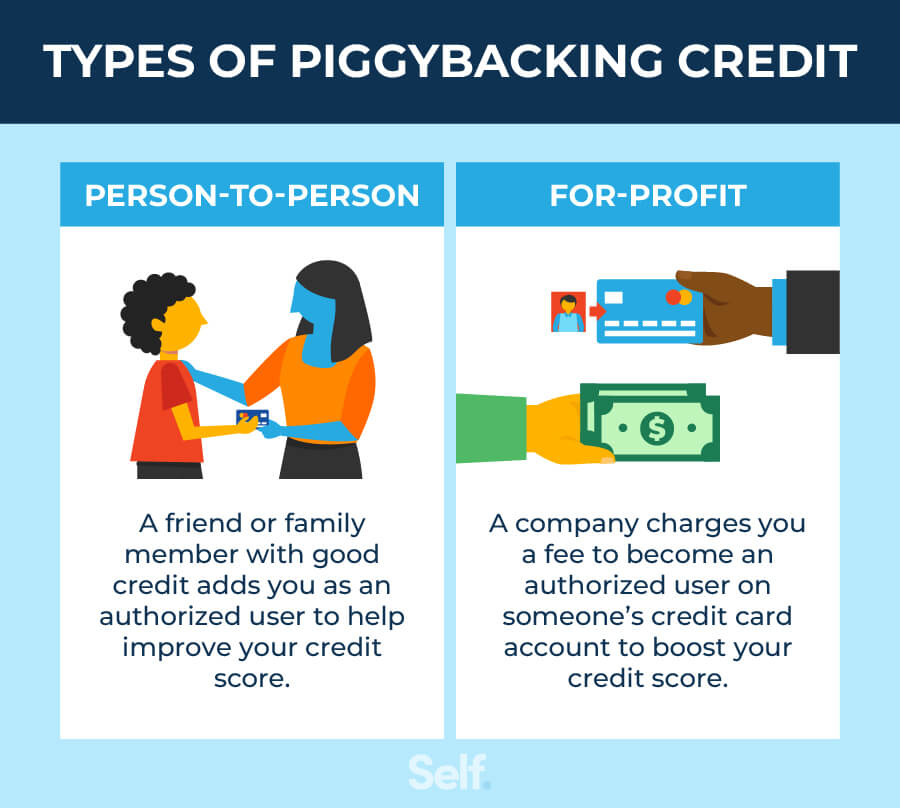

Piggybacking might be a good tool for someone who hasn't built their credit history and needs a boost. Building credit takes time and by piggybacking off someone with an established credit history, you can improve your credit score much faster.

Cached

How fast does piggybacking credit work

How Long Does Piggybacking Credit Take Before I See the Tradelines on My Credit Report The account you are piggybacking on can show up on your credit report in as little as 11 days, depending on several factors relating to the particular tradeline.

Cached

What are the cons of piggybacking credit

Pros and cons of for-profit piggybacking

Of course, the major con with the for-profit option is that it costs money. Also, the other person may start with good credit, but that may change once you're added as an authorized user. Additionally, using for-profit piggybacking could increase your risk of identity theft.

Cached

How much does credit piggybacking cost

Depending on the line of credit you choose, it can cost as much as $4,000. You have to give up your personal information. To become an authorized user, you must provide the company with your name, address, birthdate and Social Security number. This puts you at risk of fraud and identity theft.

Cached

How long does it take for authorized user to show on credit report

around 30 days

How Long Does It Take for an Authorized User To Show Up on a Credit Report If this information is reported, it will typically show up on your credit report in around 30 days. However, some lenders do not report authorized users to credit bureaus, in which case the authorized user may not appear at all.

How can I raise my credit score with two payments

Making all your payments on time is the most important factor in credit scores. Second, by making multiple payments, you are likely paying more than the minimum due, which means your balances will decrease faster. Keeping your credit card balances low will result in a low utilization rate, which is good for your score.

How fast will my credit score go up as an authorized user

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

Is it hard to get a piggyback loan

Is it hard to get a piggyback loan It's gotten easier to find lenders who allow piggyback loans. Borrowers need higher credit scores — usually FICO scores of 680 or higher — to get approval. Both loan amounts must fit within the borrower's debt-to-income ratio, or DTI.

Will adding someone as an authorized user help their credit

When you add an authorized user to your credit card account, information from the account — like the credit limit, payment history and card balance — can show up on that person's credit reports. That means their credit can improve as a result of being added to a credit account you keep in good standing.

Does adding a second user help their credit

When you add an authorized user to your credit card account, information from the account — like the credit limit, payment history and card balance — can show up on that person's credit reports. That means their credit can improve as a result of being added to a credit account you keep in good standing.

Why did my credit score drop when I was added as an authorized user

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

How much will my credit score go up if I become an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

How to get a 700 credit score in 2 months

Here's what you need to do.Make every payment on time.Keep your credit utilization low.Don't close old accounts.Pay off credit card balances.Ask your card issuer to increase your limit.Use the authorized user strategy.Put your bill payments to work.Use a rent reporting company.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

Can you be denied as an authorized user

American Express authorized users can be denied if they are younger than 13 years old or if they have a bad history with Amex, such as past defaults or lawsuits with the company.

What is the 10 15 rule for loans

The 10/15 rule

If you can manage to pay 10% of your mortgage payment every week (in addition to your usual monthly payment) and apply it to the principal of your loan, you can pay off your 30-year mortgage in just 15 years. * Points are equal to 1% of the loan amount and lower the interest rate.

What is one advantage to a piggyback loan

Pros Of Piggyback Loans

One of the most common reasons to get a piggyback loan is to avoid paying private mortgage insurance (PMI), which protects the lender from default. It's cheaper for the homeowner to get two mortgages, and the interest is usually tax deductible.

How much will my credit score go up if I am added as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

How long does it take for authorized user to show on credit score

around 30 days

How Long Does It Take for an Authorized User To Show Up on a Credit Report If this information is reported, it will typically show up on your credit report in around 30 days. However, some lenders do not report authorized users to credit bureaus, in which case the authorized user may not appear at all.

How long does it take to go from a 500 credit score to a 700

around 12 to 18 months

Average Recovery Time

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.