How does the 3.8% investment tax work?

How is 3.8 net investment income tax

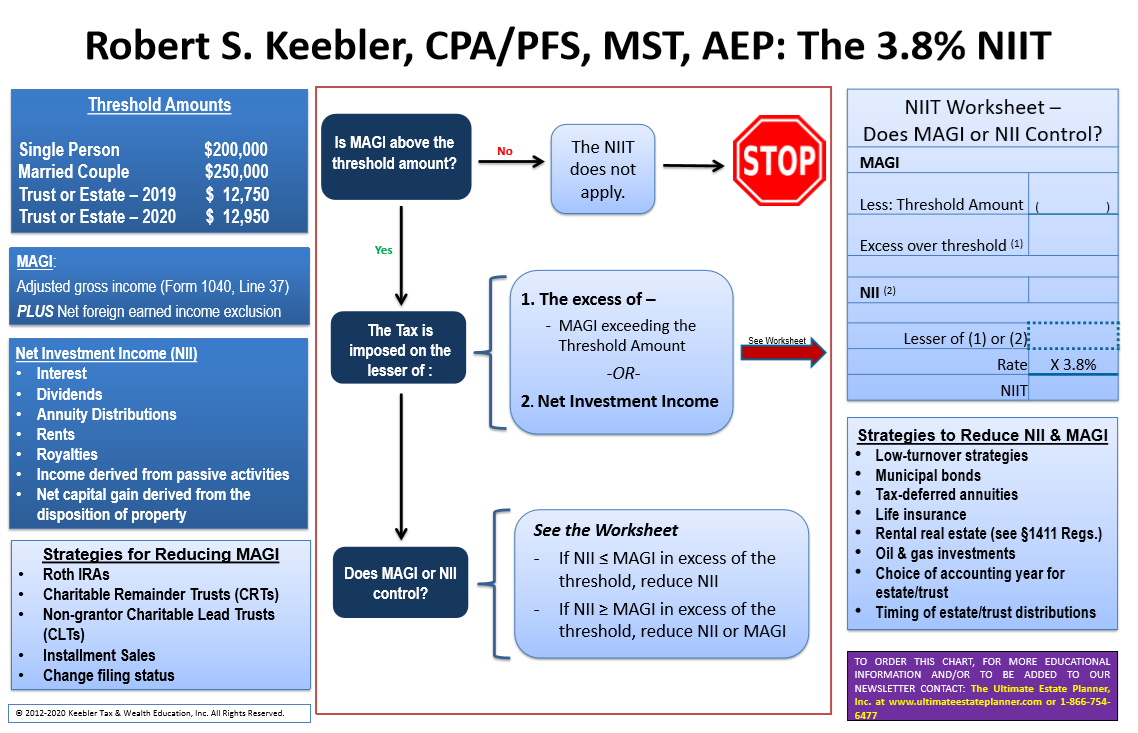

NIIT is a tax on net investment income. Those who are subject to the tax will pay 3.8 percent on the lesser of the following: their net investment income or the amount by which their modified adjusted gross income (MAGI) extends beyond their specific income threshold.

Cached

Does 3.8% surtax apply to capital gains

Many investors selling real estate or other high value investments are often surprised to find out that their tax liability could be subject to an extra 3.8% surtax in addition to the applicable short-term or long-term capital gains tax rates.

Cached

What is small business 3.8% tax

Cost to Taxpayers:

Investment income is subjected to 3.8% tax. Expands 3.8% tax to all small business income over $400,000 (not indexed). Claims small businesses use loophole to avoid this tax. Investment income tax rate is 3.8%.

What is the 3.8% tax on high earners

Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

CachedSimilar

How can we avoid the 3.8% Medicare surtax

Look for ways to minimize your AGI. The lower your AGI (the number at the bottom of the TAX-FORM 1040) the lower the amount of your income will be subject to the 3.8% surtax.

How can I avoid NIIT tax

The NIIT does not apply to any portion of a gain that is excluded from regular income tax. Therefore, gains from sale of a principal residence are excluded from the NIIT unless the gain exceeds the principal residence exclusion amount of $250,000 (for a single filer) or $500,000 (if filing jointly with your spouse).

How do I avoid paying 3.8% Medicare Surtax

If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax. Your adjusted gross income is the number on the bottom of your IRS Form 1040.

How do I avoid Medicare 3.8% Surtax

You can: 1) increase your contribution to your 401(k) plan, 2) add dollars to the plan as part of a catch-up contribution (if you're age 50 or older) or 3) create a new qualified plan. These pre-tax contributions lower the amount of wages that are counted in MAGI.

Can LLC owners deduct up to 20% of their business income

You Must Have Qualified Business Income. Individuals who earn income through pass-through businesses may qualify to deduct from their income tax an amount equal to up to 20% of their "qualified business income" (QBI) from each pass-through business they own. (IRC Sec. 199A).

Does an LLC get 20% deduction

The pass-through deduction allows qualified business owners deduct up to 20% of their net business income from their income taxes. This allows business owners to reduce their income tax liability up to 20%. The deduction is scheduled to last through 2025.

Who pays the 3.8 Medicare tax

If you are a taxpayer in the top federal and California tax brackets, you are also likely going to be subject to an additional 3.8% Medicare surtax on of your investment income. The only bright side of getting hit with the Medicare surtax is that it means you are making more money than 90% of Americans.

Who pays the 3.8% Medicare surtax

If you are a taxpayer in the top federal and California tax brackets, you are also likely going to be subject to an additional 3.8% Medicare surtax on of your investment income. The only bright side of getting hit with the Medicare surtax is that it means you are making more money than 90% of Americans.

What does 3.8% Medicare surtax apply to

A Medicare surtax of 3.8% is charged on the lesser of (1) net investment income or (2) the excess of modified adjusted gross income over a set threshold amount. The threshold is $250,000 for joint filers, $125,000 for married filing separately, and $200,000 for all other filers.

How is NIIT tax calculated

Net investment income is calculated by adding up all of the income you earned from investments in the past tax year and subtracting any related expenses.

Why do I owe net investment income tax

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT). But you'll only owe it if you have investment income and your modified adjusted gross income (MAGI) goes over a certain amount.

At what income does the Medicare surcharge kick in

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2023 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

What is the income limit to avoid Medicare surcharge

If you filed individually and reported $97,000 or less in modified adjusted gross income (MAGI) on your 2023 tax return, you won't be charged higher rates for Medicare Part B (medical coverage) and Part D (prescription coverage) in 2023. For joint filers, the income limit is $194,000 or less.

How can a LLC avoid paying too much taxes

As an LLC owner you're able to reduce taxes by:Changing your tax classification.Claiming business tax deductions.Using self directed retirement accounts.Deducting health insurance premiums.Reducing taxable income with your LLC's losses.

How much can an LLC write off each year

How Much Can an LLC Write Off For the most part, there is no limit to the amount that an LLC can claim as a deduction for the business.

Who qualifies for the 20% pass-through deduction

To qualify for the deduction, your taxable income cannot exceed a threshold. Your business can qualify for the 20% pass-through deduction if you: Make less than $157,500 (Single, Married Filing Separately, Head of Household) Make less than $315,000 (Married filing jointly)