How does the opportunity tax credit work?

How do I get the full $2500 American Opportunity credit

To be eligible for AOTC, the student must:Be pursuing a degree or other recognized education credential.Be enrolled at least half time for at least one academic period* beginning in the tax year.Not have finished the first four years of higher education at the beginning of the tax year.

Cached

Do you have to pay back the American Opportunity Tax Credit

American Opportunity Tax Credit

Up to $1,000 (or 40 percent of the total credit) is refundable even if a filer doesn't owe income tax. If you don't owe any taxes, you will receive the entire $1,000 as part of your tax refund .

Cached

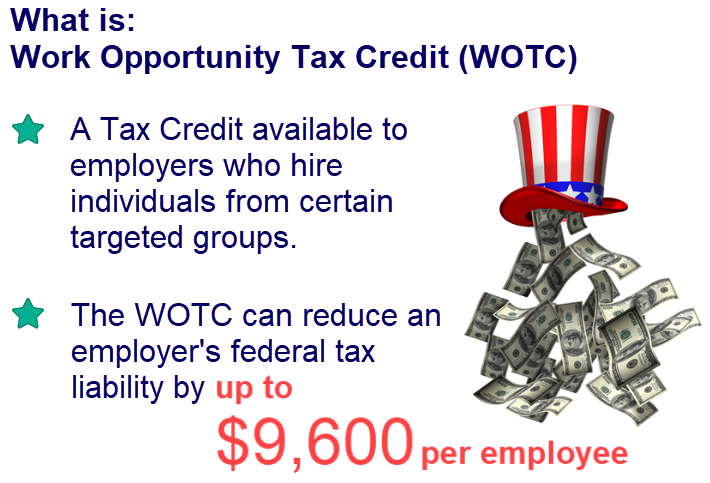

How is the work opportunity tax credit calculated

In general, the WOTC is equal to 40% of up to $6,000 of wages paid to, or incurred on behalf of, an individual who: is in their first year of employment; is certified as being a member of a targeted group; and. performs at least 400 hours of services for that employer.

Cached

Is the American Opportunity Tax Credit worth it

The American opportunity credit is generally the most valuable education tax credit, if you qualify. You can claim these education tax credits and deductions as a student if you're not claimed as a dependent on anyone else's tax return.

Why do I not get the full American Opportunity credit

You must be pursuing a degree or other recognized educational credential. You must be enrolled at least half-time for at least one academic period that began in the tax year. You must be in your first four years of higher education, which means you can't claim the credit if you are in your fifth, sixth, etc.

How do I know if I got the American Opportunity credit

If you paid qualified educational expenses during a specific tax year to an eligible intuition, then you will receive Form 1098-T. Colleges are required to send the form by January 31 each year, so you should receive it shortly after that. Some colleges may make it available to you electronically.

How many times can you claim the American Opportunity credit on your taxes

Years of study – The student must not have completed the first four years of post-secondary education as of the beginning of the taxable year. This definition is also determined by the school. Claiming the AOTC previously – You can only claim the American Opportunity Tax Credit four times.

Can I claim AOTC with no income

The AOTC is part refundable and part nonrefundable- so if you can claim it you can complete your return and try to efile it but you may be required to mail it (because you have no income).

Do employees benefit from WOTC

Although the tax credit only applies to employers, the WOTC program may benefit employees by making career opportunities available to those who otherwise might have had a hard time landing a job. Such individuals include ex-felons, veterans and food stamp recipients.

What is the average credit for WOTC

Although the actual value of the issued tax credits would actually vary based on hours worked, and category the employee came in under, we are using the average tax credit value of $2,400. This would give us a potential total value of 2023's tax credits at up to an impressive $6.1 Billion.

What is the key benefit of the American Opportunity Tax Credit

The American Opportunity Tax Credit is a tax credit to help pay for education expenses paid for the first four years of education completed after high school. You can get a maximum annual credit of $2,500 per eligible student and 40% or $1,000 could be refunded if you owe no tax.

Can I claim the American Opportunity Credit if my employer pays my tuition

The educational assistance plan must be written and meet certain other requirements, under IRC §127. However, none of the expenses paid by the employer can be used as a basis for any other deduction or credit such as the American opportunity credit or the lifetime learning credit.

Why am I not getting the American Opportunity Tax Credit

Claiming the American Opportunity Tax Credit

Single taxpayers who have adjusted gross income between $80,000 and $90,000. Joint tax filers when adjusted gross income is between $160,000 and $180,000. The credit is unavailable to taxpayers whose adjusted gross income exceeds the $90,000 and $180,000 thresholds.

How do I know if my child received the American Opportunity Credit

Look for form 8863. Is it there If yes, lines 8 and/or 19 will tell you how much (if any) credit was claimed. If you don't see Form 8863, there was no way to claim any refundable or nonrefundable credits that year.

Can you only claim American Opportunity credit every year

You can claim AOTC, for any semester or other academic period if you take at least half the full-time course load for the first four years of college.

Can I claim the American Opportunity credit every year

The American Opportunity Education Credit is available to be claimed for a maximum of 4 years per eligible student.

Why do I not qualify for American Opportunity Credit

For tax year 2023, the credit begins to phase out for: Single taxpayers who have adjusted gross income between $80,000 and $90,000. Joint tax filers when adjusted gross income is between $160,000 and $180,000.

What expenses do not qualify under AOTC

The AOTC allows an annual $2,500 tax credit for qualified tuition expenses, school fees, and course materials. Room and board, medical costs, transportation, and insurance do not qualify, nor do qualified expenses paid for with 529 plan funds.

What is the downside of WOTC

One of the main problems with the WOTC, its critics say, is that it doesn't address the many forces that create barriers for marginalized workers. DeMond Bush is exactly the kind of person the WOTC was designed to help. He survived abuse as a child, became homeless at 14 and started selling drugs as a teenager.

What does WOTC do for employees

The WOTC has two purposes: To promote the hiring of individuals who qualify as a member of a target group, and. To provide a federal tax credit to employers who hire these individuals.