How does the Truth and lending Act work?

What does the Truth in Lending Act required to be disclosed

The Truth in Lending Act, or TILA, also known as regulation Z, requires lenders to disclose information about all charges and fees associated with a loan. This 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit.

Cached

What is a real life example of the Truth in Lending Act

Examples of the TILA's Provisions

For example, loan officers and mortgage brokers are prohibited from steering consumers into a loan that will mean more compensation for them, unless the loan is actually in the consumer's best interests.

Cached

What violates the Truth in Lending Act

Some examples of violations are the improper disclosure of the amount financed, finance charge, payment schedule, total of payments, annual percentage rate, and security interest disclosures. Under TILA, a creditor can be strictly liable for any violations, meaning that the creditor's intent is not relevant.

What are the 6 things in the Truth in Lending Act

Lenders have to provide borrowers a Truth in Lending disclosure statement. It has handy information like the loan amount, the annual percentage rate (APR), finance charges, late fees, prepayment penalties, payment schedule and the total amount you'll pay.

CachedSimilar

What are at least 6 things Truth in Lending Act must clearly disclose to consumers

Total of payments, Payment schedule, Prepayment/late payment penalties, If applicable to the transaction: (1) Total sales cost, (2) Demand feature, (3) Security interest, (4) Insurance, (5) Required deposit, and (6) Reference to contract.

Who must follow the Truth in Lending Act

Among other requirements, the Act requires creditors who deal with consumers to make certain written disclosures concerning finance charges and related aspects of credit transactions (including disclosing an annual percentage rate) and comply with other mandates, and requires advertisements to include certain …

Does the Truth in Lending Act apply to personal loans

TILA covers most types of credit transactions including car purchases and leases, home mortgages and refinancing, personal loans and lines of credit, credit cards, private student loans and payday loans.

What types of loans are covered under the Truth in Lending Act

12 CFR Part 1026 – Truth in Lending (Regulation Z)Mortgage loans.Home equity lines of credit.Reverse mortgages.Open-end credit.Certain student loans.Installment loans.

What happens if you fail to comply with Truth in Lending Act

A criminal case may also be filed against the creditor. Any person who willfully violates any provision of Truth in Lending Act shall be fined by not less than P1,000 or more than P5,000 or imprisonment for not less than 6 months, nor more than one year or both.

What are examples of TILA violations

Some typical TILA violations that a borrower may assert include:Failure to send interest rate and payment change notices.Failure to promptly credit mortgage payments.Failure to provide a timely payoff statement upon request.Failure to send periodic mortgage statements.

What loans does the Truth in Lending Act apply to

TILA's provisions cover two types of credit: open-end and closed-end. Open-end: Open-end credit includes home equity lines of credit (HELOCs), credit cards, reverse mortgages and bank-issued cards. Closed-end: A closed-end credit has a set amount, like home equity loans, mortgage loans and car loans.

What does the Truth in Lending Act require that creditors must inform customers in writing of the amount of the

Helping to ensure that lenders provide meaningful disclosures to borrowers, using terminology that consumers can understand. This includes requiring lenders to provide written information about interest rates, and all fees and finance charges associated with a loan or credit card.

What types of loans are covered under the TILA

TILA's provisions cover two types of credit: open-end and closed-end.Open-end: Open-end credit includes home equity lines of credit (HELOCs), credit cards, reverse mortgages and bank-issued cards.Closed-end: A closed-end credit has a set amount, like home equity loans, mortgage loans and car loans.

What is the statute of limitations for the Truth in Lending Act

All TILA actions for damages must be brought within one year of the alleged violation. 15 U.S.C. § 1640(e).

Does the Truth in Lending Act apply to auto loans

The federal Truth in Lending Act (TILA) requires lenders to give you specific disclosures about important terms, including the APR, before you are legally obligated on the loan. Since all lenders must provide the APR, you can use the APR to compare auto loans.

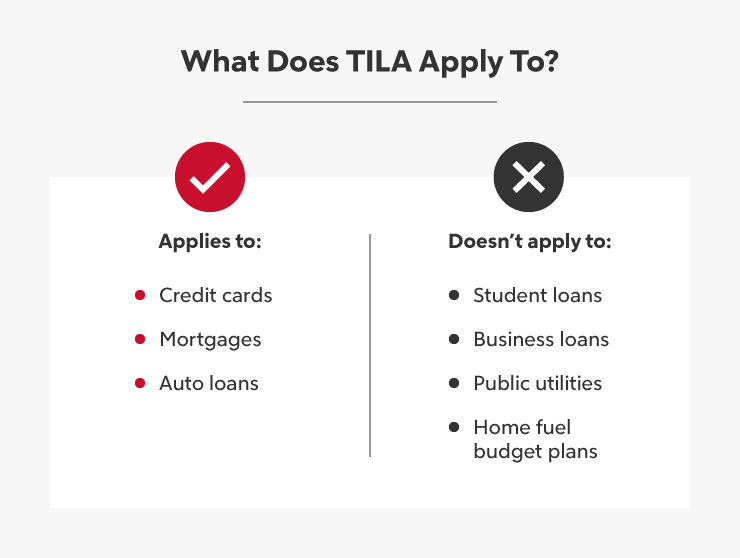

What loans are exempt from Truth in Lending

The Truth in Lending Act (and Regulation Z) explains which transactions are exempt from the disclosure requirements, including: loans primarily for business, commercial, agricultural, or organizational purposes.

What does the Truth and Lending Act protect you against

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

Which is a condition for the Truth in Lending Act to apply

TILA applies to consumer transactions with the following characteristics: the lender is in the business of extending credit for loan of money, sale of property, or furnishing a service; the debtor is a person; a finance charge may be imposed; and.

What is a common problem and violation of TILA

Violations of TILA can range from simple omissions to outright predatory lending practices such as intentionally misleading the borrower as to the terms of the loan.

What transactions are exempt from TILA

Public utility credit; Credit extended by a broker-dealer registered with the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC), involving securities or commodities accounts; Home fuel budget plans; and. Certain student loan programs.