How earned income credit is calculated?

How does IRS calculate earned income

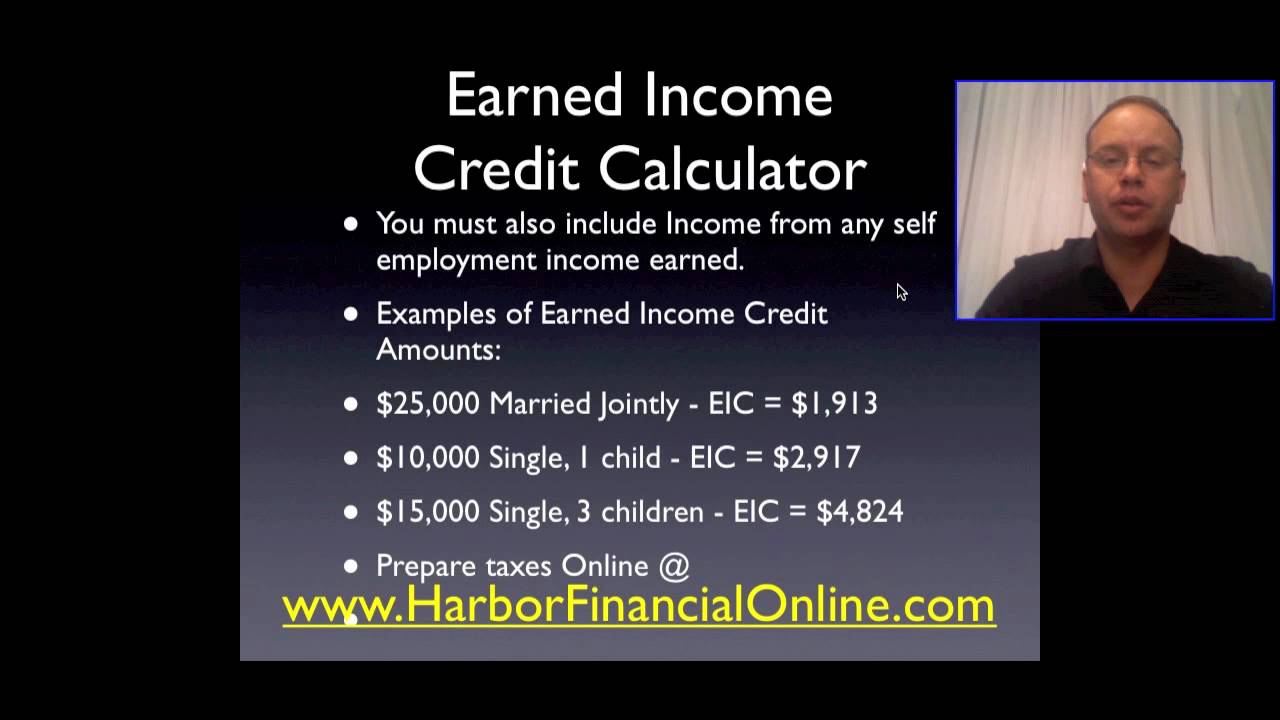

For the year you are filing, earned income includes all income from employment, but only if it is includable in gross income. Examples of earned income are: wages; salaries; tips; and other taxable employee compensation. Earned income also includes net earnings from self-employment.

How much earned income credit will I get

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2023 as a working family or individual earning up to $30,000 per year. You must claim the credit on the 2023 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

What is earned income credit based on

To claim the Earned Income Tax Credit (EITC), you must have what qualifies as earned income and meet certain adjusted gross income (AGI) and credit limits for the current, previous and upcoming tax years. Use the EITC tables to look up maximum credit amounts by tax year.

Cached

Is EITC automatically calculated

The earned income credit or EIC is automatically calculated by the program and many factors contribute to how it is calculated.

Cached

What disqualifies you from earned income credit

For the EITC, we don't accept: Individual taxpayer identification numbers (ITIN) Adoption taxpayer identification numbers (ATIN) Social Security numbers on Social Security cards that have the words, "Not Valid for Employment," on them.

How is the Earned Income Tax Credit distributed

By design, the EITC only benefits people who work. Workers receive a credit equal to a per-centage of their earnings up to a maximum credit. Both the credit rate and the maximum credit vary by family size, with larger credits available to families with more children.

Why am I not getting the full EIC

The most common reasons people don't qualify for the Earned Income Tax Credit, or EIC, are as follows: Their AGI, earned income, and/or investment income is too high. They have no earned income. They're using Married Filing Separately.

Why is my EIC so low this year

Why is my tax refund smaller this year Congress expanded the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for 2023 only to provide continued relief due to the COVID-19 pandemic. Since this expansion has ended, your tax refund may be less than the year before.

Why is my earned income credit so low this year

Why is my tax refund smaller this year Congress expanded the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for 2023 only to provide continued relief due to the COVID-19 pandemic. Since this expansion has ended, your tax refund may be less than the year before.

Will the IRS figure my EIC

If you can claim the EIC, you can either have the IRS figure your credit, or you can figure it yourself. To figure it yourself, you can complete a worksheet in the instructions for the form you file. To find out how to have the IRS figure it for you, see chapter 4.

What are the 6 rules you must meet to claim the earned income credit

Earned Income Tax Credit eligibility if you have no childrenYou must not be a dependent of another taxpayer.You can't be a qualifying child of another person.You must live in the United States for more than half the year.You must meet age requirements (at least age 25 but under age 65 at the end of the year)

Why would EIC be denied

Most errors happen because the child you claim doesn't meet the qualification rules: Relationship: Your child must be related to you. Residency: Your child must live in the same home as you for more than half the tax year. Age: Your child's age and student or disability status will affect if they qualify.

Is EITC calculated after deductions

The Earned Income Tax Credit you can reduce your taxes and increase your tax refund. The EITC allows you to keep more of your hard-earned money. The credit is based on your total earned income or your total Adjusted Gross Income (AGI), whichever is higher.

What is an example of the Earned Income Tax Credit

Example of the EITC

If a taxpayer has a total tax liability of $1,000 and a credit of $1,500, then the taxpayer should be entitled to a refund of $500.

How do you maximize EIC

To maximize your chances of receiving a refund as early as possible, follow these tips:Gather all the documents you need to file your return, such as 1099s and W-2s.File your return as soon as you receive all necessary documents.Double check your tax return to ensure it's correct.File electronically.

How can I maximize my earned income credit

To maximize your chances of receiving a refund as early as possible, follow these tips: Gather all the documents you need to file your return, such as 1099s and W-2s. File your return as soon as you receive all necessary documents. Double check your tax return to ensure it's correct.

Does EIC increase refund

It is also refundable, so even if you do not have enough tax liability to eat up the credit, the EIC will increase your refund, which you'll get as a check from the IRS.

How do I maximize my earned income credit

To maximize your chances of receiving a refund as early as possible, follow these tips: Gather all the documents you need to file your return, such as 1099s and W-2s. File your return as soon as you receive all necessary documents. Double check your tax return to ensure it's correct.

Can you make too much to get earned income credit

If you earned less than $59,187 (if Married Filing Jointly) or $53,057 (if filing as an individual, surviving spouse or Head of Household) in tax year 2023, you may qualify for the Earned Income Tax Credit (EITC).

What disqualifies you from EIC

EITC income requirements

Retirement income, Social Security income, unemployment benefits, alimony, and child support don't count as earned income. More restrictions: You must have $11,000 or less in investment income and you can't file a foreign earned income exclusion form.