How impactful is a soft credit check?

Does a soft credit check affect anything

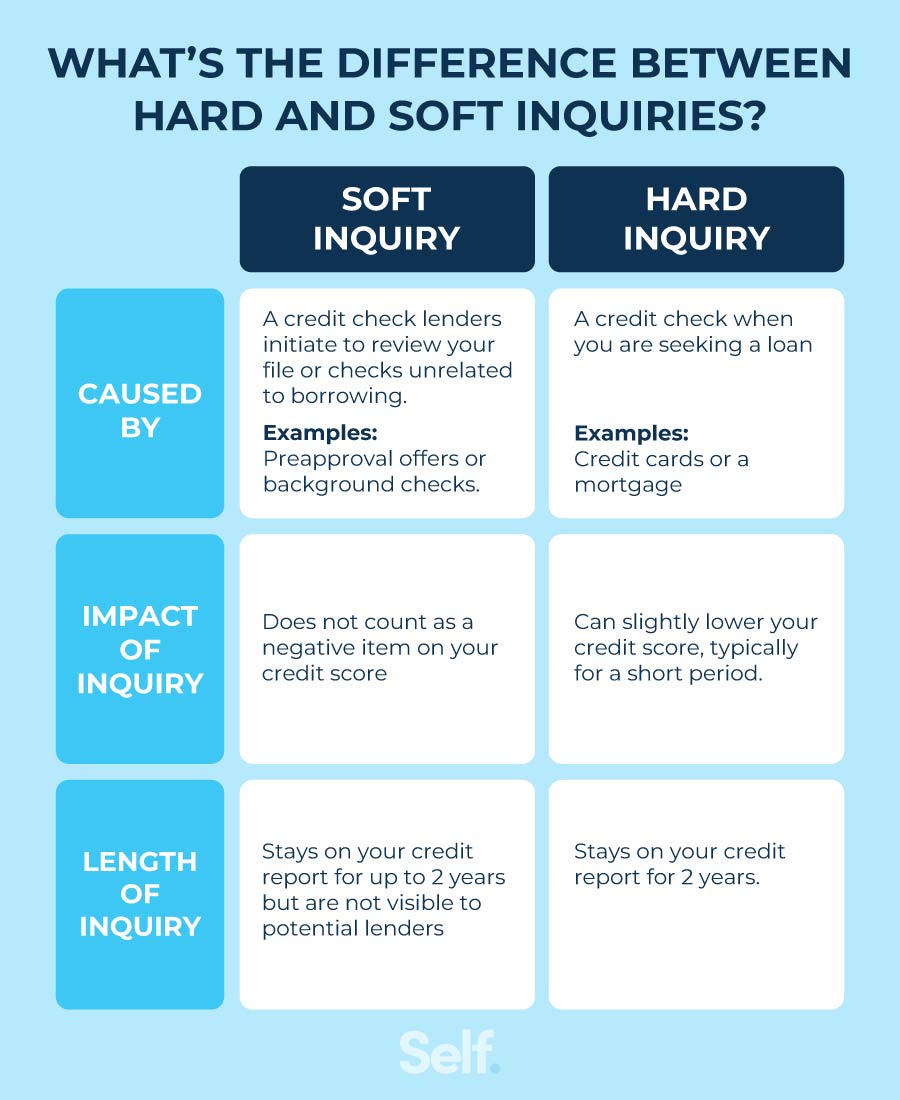

There are two types of credit score inquiries lenders and others (like yourself or your landlord) can make on your credit score: a "hard inquiry" and a "soft inquiry." The difference between the two is that a soft inquiry won't affect your score, but a hard inquiry can shave off some points.

How many points does a soft credit check drop your score

A soft inquiry does not affect your credit score in any way. When a lender performs a soft inquiry on your credit file, the inquiry might appear on your credit report but it won't impact your credit score.

Cached

Is a soft credit pull accurate

To put it simply, a soft pull credit check is as accurate as a hard pull credit check. They are both very accurate.

Cached

Will I fail a soft credit check

Can I 'fail' a soft credit check Don't worry, you can't 'fail' a soft credit check. With a soft search, you're not actually applying for anything – so it won't result in a lender's decision.

Do lenders care about soft inquiries

Soft inquiries or soft credit pulls

These do not impact credit scores and don't look bad to lenders. In fact, lenders can't see soft inquiries at all because they will only show up on the credit reports you check yourself (aka consumer disclosures).

How long does a soft pull stay on your credit

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

How long do soft credit checks stay on report

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

Why did my credit score drop 50 points in a week

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

Do companies see soft pulls

Major credit card companies often do soft pulls to see if you're pre-qualified for a credit card. That way they can send you the most relevant offers and try to get you to sign up.

Do soft pulls show up as inquiries

Hard and soft inquiries, sometimes referred to as credit checks, are requests to view your credit report by lenders, landlords, employers and companies that are authorized to do so. Both hard and soft inquiries will show up on your credit report.

Do soft inquiries fall off

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

How far back does a soft credit check go

Soft searches do not affect your credit score and aren't visible to potential lenders. They will only be visible to you and will remain on your credit report for around 12-24 months, depending on the type of soft search.

What do lenders see when they do a soft pull

A soft credit check shows the same information as a hard inquiry. This includes your loans and lines of credit as well as their payment history and any collections accounts, tax liens or other public records in your name.

Do lenders see soft pulls

Soft inquiries are also not disputable. However, remember that potential lenders won't be able to see them (except for insurance companies and debt-settlement companies as we've noted earlier).

How many soft inquiries is too many

Soft inquiries don't drop your credit score, so there isn't a number that could be considered too much.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why is my credit score going down if I pay everything on time

A short credit history gives less to base a judgment on about how you manage your credit, and can cause your credit score to be lower. A combination of these and other issues can add up to high credit risk and poor credit scores even when all of your payments have been on time.

Do soft inquiries count

Unlike hard inquiries, soft inquiries won't affect your credit scores. (They may or may not be recorded in your credit reports, depending on the credit bureau.) Since soft inquiries aren't connected to a specific application for new credit, they're only visible to you when you view your credit reports.

How long do soft pulls stay on credit

12-24 months

Hard inquiries are taken off of your credit reports after two years. But your credit scores may only be affected for a year, and sometimes it might only be for a few months. Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores.

Does a soft pull affect buying a house

Unlike a hard pull, a soft pull won't impact your credit score. Your mortgage lender wants to make sure that both credit reports match, and if they don't, you may need to provide additional documentation or send your loan application through underwriting a second time.