How is credit card billing cycle determined?

How is credit card payment date determined

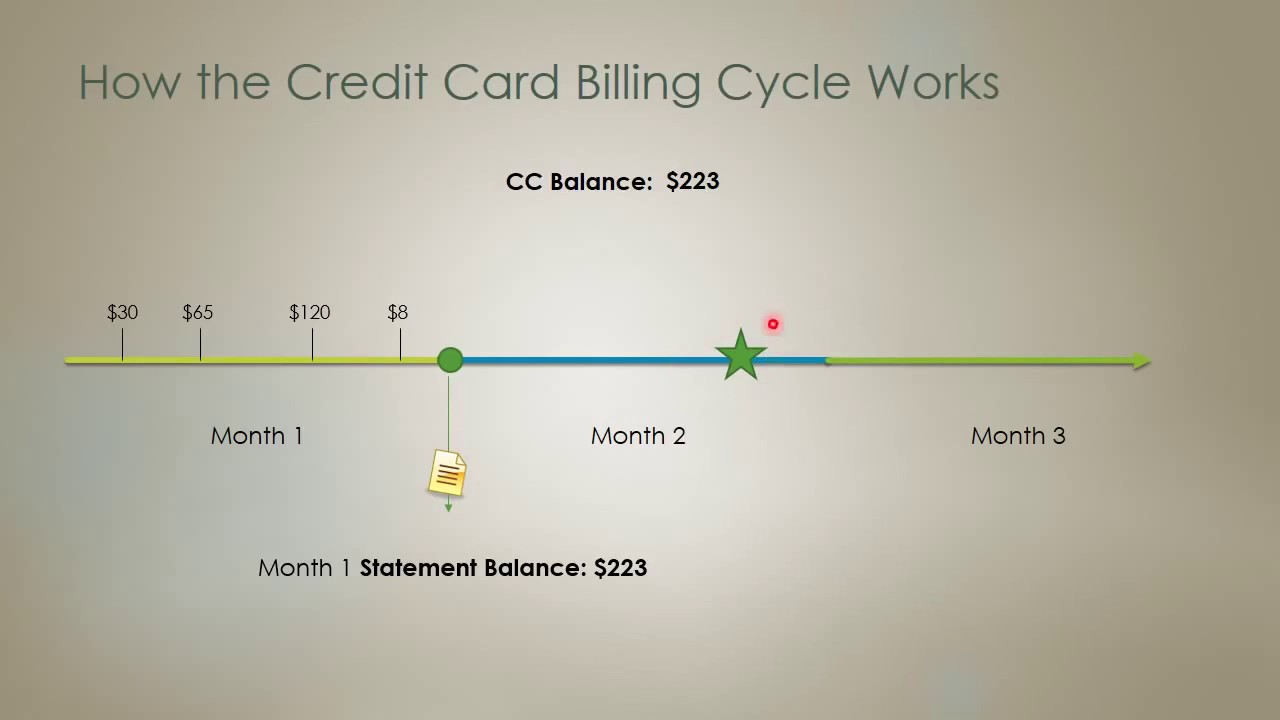

A credit card's billing cycle is generally 28 to 31 days long. The transactions during the billing cycle are added to your previous balance (if any) and determine your statement balance at the end of each cycle. Your bill will then be due a few weeks later, and a new billing cycle starts right away.

Cached

What is the best date for credit card billing cycle

28th of every month is a sweet spot. Reason is as some banks report credit utilisation to CIBIL on 30/31 and some on Billing date. So if the date is kept on 28th no need to remember the credit utilisation reporting date for each card.

What are the two most important dates in your credit card billing cycle

If you have a credit card, there are two very important dates you'll want to keep track of—the statement closing date and the payment due date.

How many days before the due date should I pay my credit card

Paying credit card bills any day before the payment due date is always the best way to avoid penalties. Paying credit card bills any day before the payment due date is always the best. You'll avoid late fees and penalties. However, making payments even earlier can have even more benefits.

Is it better to pay credit card before due date or on due date

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

How does the 15 3 rule work

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Should I pay credit card before billing date

You should always pay your credit card bill by the due date, but there are some situations where it's better to pay sooner. For instance, if you make a large purchase or find yourself carrying a balance from the previous month, you may want to consider paying your bill early.

What are the 3 important dates for credit cards

Here are 4 important dates to remember on your credit cards:Credit card billing cycle:Credit card statement closing date:Credit card payment due date:Annual fees due dates:

Is it better to pay your credit card before or on due date

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

Is it bad to pay your credit card bill multiple times a month

Is it bad to make multiple payments on a credit card No, there is usually no harm to making multiple payments on a credit card. The only caveat to be aware of is if your linked payment account has a low balance, you run the risk of incurring an overdraft fee if you don't monitor your funds closely.

Does paying twice a month increase credit score

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.

What happens when you make 2 credit card payments a month

When you make multiple payments in a month, you reduce the amount of credit you're using compared with your credit limits — a favorable factor in scores. Credit card information is usually reported to credit bureaus around your statement date.

What happens if I pay credit card before due date

By making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower, as well. This can mean a boost to your credit scores.

What is the 2 3 4 rule for credit cards

2/3/4 Rule

Here's how the rule works: You can be approved for up to two new credit cards every rolling two-month period. You can be approved for up to three new credit cards every rolling 12-month period. You can be approved for up to four new credit cards every rolling 24-month period.

What is the 91 3 rule credit card

line of credit. so what this means. is that you are going to wait 91 days and. three full statement cycles before you decide. to ask either for a credit limit increase. or for a new line of credit all together. to maximize the amount of funding that you get.

Is it bad to pay off credit card multiple times a month

There is no limit to how many times you can pay your credit card balance in a single month. But making more frequent payments within a month can help lower the overall balance reported to credit bureaus and reduce your credit utilization, which in turn positively impacts your credit.

What is the 15 3 rule for credit

The Takeaway

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

What is the 15 3 rule for credit card

The Takeaway

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

Is it bad to pay off your credit card multiple times a month

There is no limit to how many times you can pay your credit card balance in a single month. But making more frequent payments within a month can help lower the overall balance reported to credit bureaus and reduce your credit utilization, which in turn positively impacts your credit.