How is EIC amount determined?

What determines how much EIC you get

More In Credits & Deductions

To claim the Earned Income Tax Credit (EITC), you must have what qualifies as earned income and meet certain adjusted gross income (AGI) and credit limits for the current, previous and upcoming tax years. Use the EITC tables to look up maximum credit amounts by tax year.

Cached

What is the income limit to claim EIC

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

Cached

Why am I not getting the full EIC

The most common reasons people don't qualify for the Earned Income Tax Credit, or EIC, are as follows: Their AGI, earned income, and/or investment income is too high. They have no earned income. They're using Married Filing Separately.

Do you get more earned income credit the more you make

Earned Income Tax Credit (EITC): What It Is, How to Qualify in 2023-2023. In general, the less you earn, the larger the credit.

Is the lower the income the higher the EIC

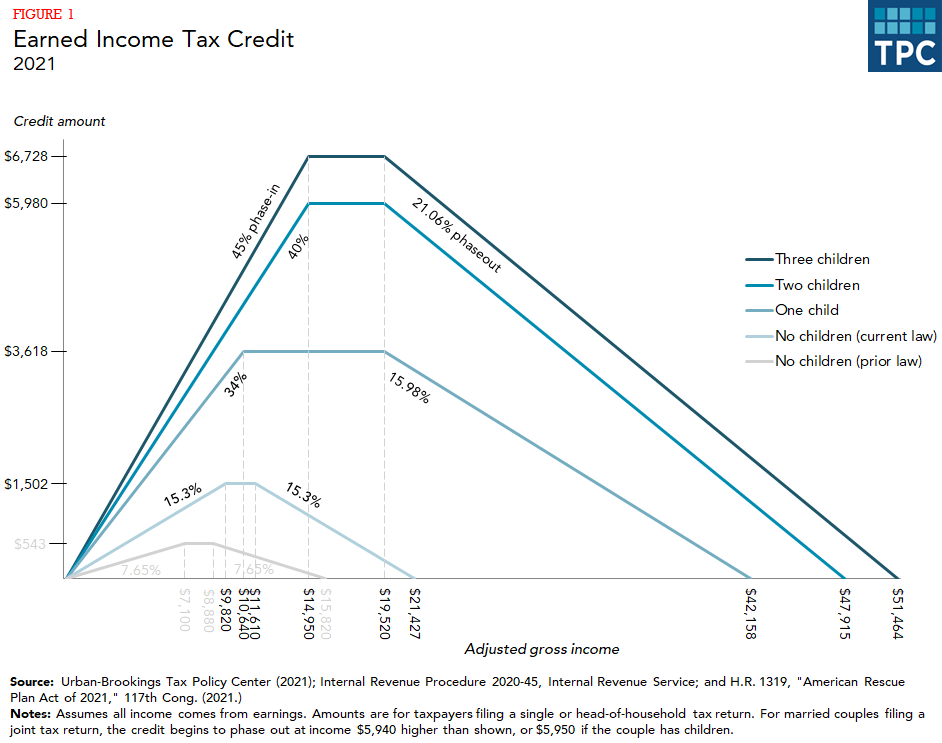

Working households qualify for an EITC based on their earnings. Beginning with the first dollar of earnings, a low-income household's EITC increases (or “phases in”) as their earnings increase, until the credit reaches its maximum amount.

Is EIC and EITC the same

The Earned Income Tax Credit (EITC), sometimes called EIC, is a tax credit for workers with low to moderate income. Eligibility for the tax credit is based on various factors including family size, filing status and income.

What age does EIC stop

65

be age 25 but under 65 at the end of the year, not qualify as a dependent of another person; and. live in the United States for more than half of the year.

How do you maximize EIC

To maximize your chances of receiving a refund as early as possible, follow these tips:Gather all the documents you need to file your return, such as 1099s and W-2s.File your return as soon as you receive all necessary documents.Double check your tax return to ensure it's correct.File electronically.

Does income affect EIC

The credit amount rises with earned income until it reaches a maximum amount, then gradually phases out. Families with more children are eligible for higher credit amounts. You cannot get the EITC if you have investment income of more than $10,300 in 2023.

Can you claim both EITC and child tax credit

The child tax credit is a credit for having dependent children younger than age 17. The Earned Income Credit (EIC) is a credit for certain lower-income taxpayers, with or without children. If you're eligible, you can claim both credits. Was this topic helpful

Can a 70 year old get EIC

Expanded EITC for people who do not have qualifying children

There is no upper age limit for claiming the credit if taxpayers have earned income.

Does EIC increase refund

It is also refundable, so even if you do not have enough tax liability to eat up the credit, the EIC will increase your refund, which you'll get as a check from the IRS.

Is EIC separate from child tax credit

The child tax credit is a credit for having dependent children younger than age 17. The Earned Income Credit (EIC) is a credit for certain lower-income taxpayers, with or without children. If you're eligible, you can claim both credits.

Is there a difference between EIC and EITC

The Earned Income Credit (EIC), otherwise known as Earned Income Tax Credit (EITC) is a valuable credit for low-income taxpayers who work and earn an income of a certain amount. This credit is highly valuable and is often missed — allowing you to keep more of your hard-earned money.

At what age does EIC stop

If you're claiming the EITC without any qualifying children, you must be at least 25 years old, but not older than 65. If you're claiming jointly without a child, only one spouse needs to meet the age requirement.

Can you get earned income credit if you get Social Security

Am I eligible for the EITC if I get Social Security or SSI Yes, if you meet the qualifying rules of the EITC. Receiving Social Security or SSI doesn't affect your eligibility for the EITC.

When to expect tax refund 2023 with EITC

The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

Can one parent claim the child tax credit and the other claim EIC

Generally, only one person may claim the child as a qualifying child for purposes of the head of household filing status, the child tax credit/credit for other dependents, the dependent care credit/exclusion for dependent care benefits, the dependency exemption and the EITC.

Is it good to claim EIC

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.