How is petty cash fund recorded?

What is the journal entry for petty cash

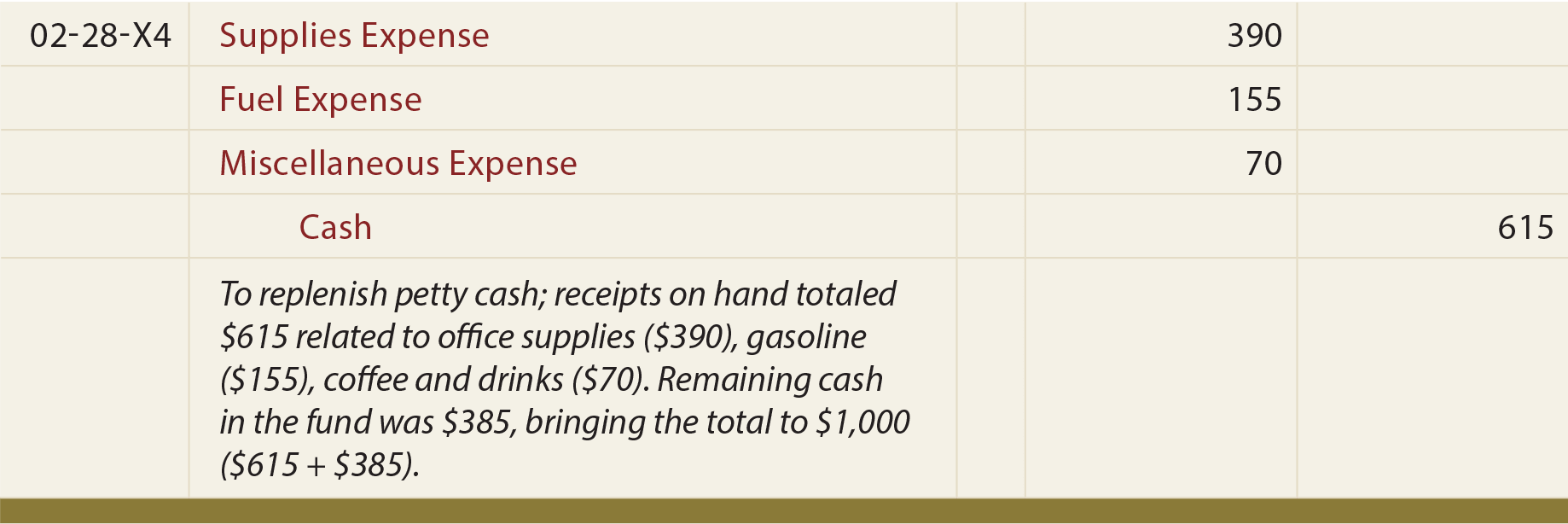

The petty cash journal entry is a debit to the petty cash account and a credit to the cash account. The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund. The cashier creates a journal entry to record the petty cash receipts.

Cached

What is petty cash How is it recorded

Petty cash is a nominal sum which is preserved in hand to cover minor expenses, such as reimbursements or other office-related expenses. Like other funds, petty cash will also be subject to regular reconciliations, with every transaction being recorded in the official statements and other records.

How is petty cash recorded on balance sheet

Petty cash is a current asset and should be listed as a debit on the balance sheet. When first funding a petty cash account, the accountant should write a check made out to "Petty Cash" for the desired amount of petty cash and then cash the check at the company's bank.

Where is petty cash recorded

Petty cash appears within the current assets section of the balance sheet. This is because line items in the balance sheet are sorted in their order of liquidity. Since petty cash is highly liquid, it appears near the top of the balance sheet.

Is petty cash an asset or expense

current asset

Yes. Petty cash is a current asset. Current assets are assets that provide economic benefit within one year. Since petty cash funds can resolve scenarios with readily available cash, this can be considered as providing economic benefits.

How do I record petty cash in Quickbooks

Select the Save account under ▼ dropdown and choose Bank Accounts. In the Tax form section ▼ dropdown, select Cash on hand. Enter Petty Cash in the Account name field. The opening balance will be created when you move money from the checking account by writing a check or transferring funds.

Is petty cash balance an asset or expense

Explanation: The balance of a petty cash book is an asset as it is treated as a current asset. Having any remaining balance or unused balance from the petty cash fund also becomes an asset because the business has saved the money from being spent.

How do I categorize petty cash in Quickbooks

Create a petty cash account in the New category panel

Select Select category, then select Bank & credit cards. Select Select. From the Account type▼dropdown, choose Cash on hand. The opening balance will be created when you move money from the checking account by writing a check or transferring funds.

What expense category is petty cash

miscellaneous expenses

The petty cash account covers business-related expenses generally categorized as miscellaneous expenses. Business owners usually keep a small amount of cash in a safe or lockbox that they use to pay for unexpected items.

What accounting type is petty cash

The petty cash account is a current asset and is recorded as a debit in the balance sheet.

Is petty cash an expense or income

Petty cash is not considered an expense. The petty cash balance is present on the company balance sheet with cash in the bank and cash on hand. It is not present in the company's income statement.

Which accounting system is used to record transactions in the petty cash book

Most transactions in the petty cash book are recorded in the cash account. There are two systems to record expenses in the petty cash book, the ordinary petty cash system and the petty cash system.

Does petty cash fall under expenses

It's important to account for petty cash uses in your general ledger because it is an expense recorded in your financial records, like the balance sheet.

How do I record petty cash transactions in QuickBooks

Petty CashGo to the +New button.Select Expense.In the Payee field, select the vendor.Select the account you used to pay for the expense and enter the date for the expense.Make sure to enter all necessary details.Once done, click Save and close.

How do I categorize petty cash in QuickBooks

Create a petty cash account in the New category panel

Select Select category, then select Bank & credit cards. Select Select. From the Account type▼dropdown, choose Cash on hand. The opening balance will be created when you move money from the checking account by writing a check or transferring funds.

What is petty cash classified as in accounting

What type of account is petty cash Petty cash is a current asset listed as a debit on the balance sheet. An accountant will typically write a cheque to "Petty Cash" to fund the petty cash account and cash this cheque at the company's bank.

How are petty cash transactions accounted for

When a petty cash fund is in use, petty cash transactions are still recorded on financial statements. No accounting journal entries are made when purchases are made using petty cash, it's only when the custodian needs more cash—and in exchange for the receipts, receives new funds—that the journal entries are recorded.

How do I record petty cash transactions in Quickbooks

Petty CashGo to the +New button.Select Expense.In the Payee field, select the vendor.Select the account you used to pay for the expense and enter the date for the expense.Make sure to enter all necessary details.Once done, click Save and close.

What is the difference between undeposited funds and petty cash

Petty Cash is used when dealing with physical cash, you know, dollars and coins. A petty cash account is sometimes used by a business for small purchases that can't be made by electronic means, like to plug a parking meter. Undeposited Funds is used to temporarily hold funds before depositing them into a bank account.

How do you manage petty cash transactions

Petty cash is small amounts of cash that branches or departments reserve for incidental or minor expenses. Petty cash or a petty cash management system is based on the imprest system. You credit the petty cash fund with an initial starting amount. The branches can then use the fund to pay for incidental expenses.