How is treasury stock shown on the balance sheet?

How is treasury stock shown on the balance sheet quizlet

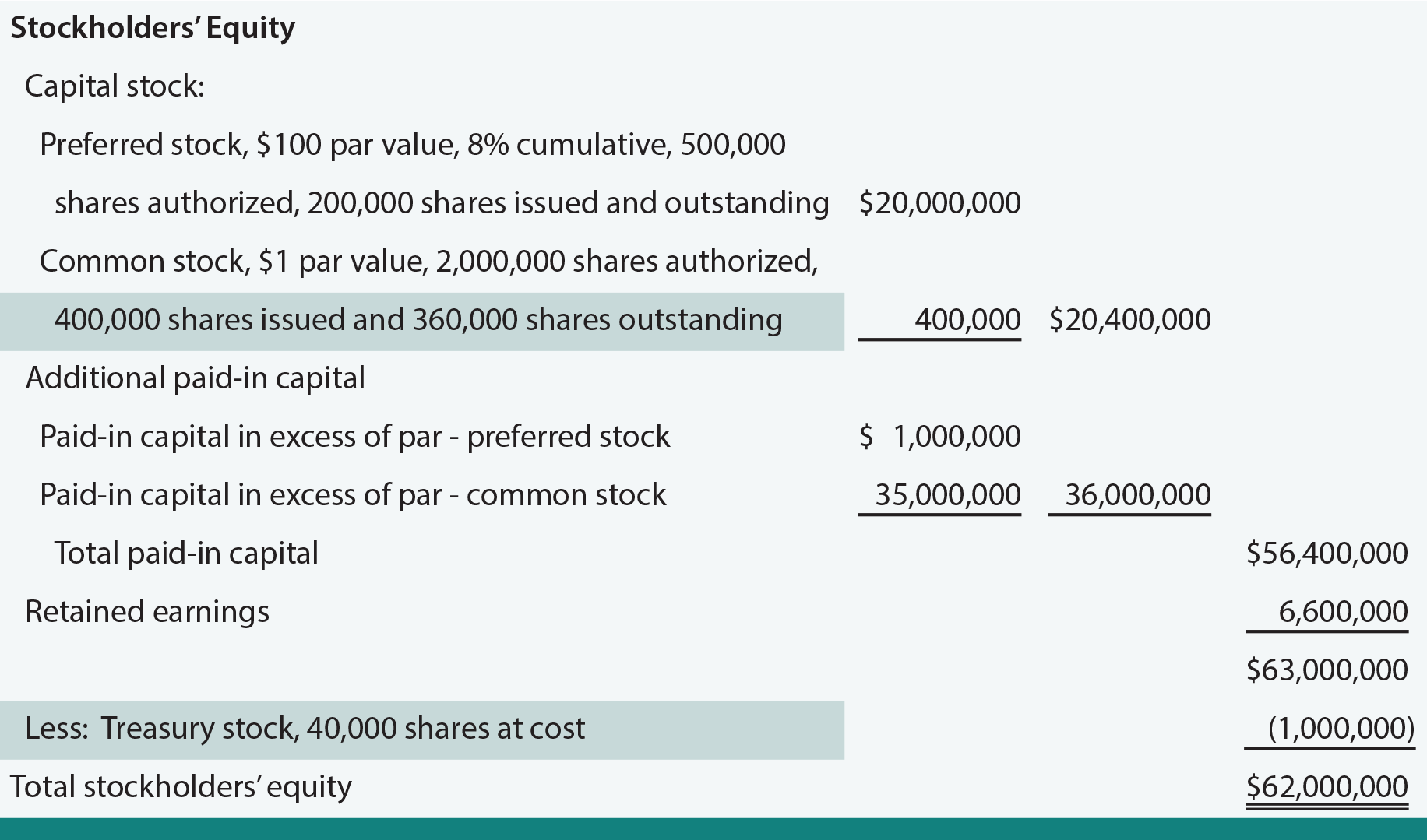

Normally, treasury stock is listed as the last account shown under the stockholders equity section of the balance sheet. The only item shown after the treasury stock account balance is the summary heading "Total Stockholders' Equity".

Is treasury stock an asset on the balance sheet

Treasury Stock is a contra equity item. It is not reported as an asset; rather, it is subtracted from stockholders' equity.

Cached

What is treasury stock on the balance sheet ______

Treasury stock is reported in the ______. Reason: Treasury stock is a contra-equity account and is reported in the equity section of the balance sheet.

Is treasury stock included in total stockholders equity

Treasury stock reduces total shareholders' equity on a company's balance sheet. This figure is subtracted from a company's total equity, as it represents a smaller number of available shares for investors once it is repurchased.

How is treasury stock reported in the financial statements quizlet

Treasury stock should be reported in the financial statements of a corporation as a deduction from total paid-in capital and retained earnings.

Where does paid-in capital from treasury stock go on balance sheet

shareholders’ equity section

Paid-in capital is recorded on the company's balance sheet under the shareholders' equity section.

Why is treasury stock negative on the balance sheet

When stock is “retired” into Treasury Stock cash or some form of debt is used to pay for the stock, the diminishment of the cash asset or the addition of a liability to pay for the stock requires an entry into Equity that diminishes it. For that reason, Treasury Stock is always a negative entry to Equity.

Where is treasury stock listed in the stockholders equity section of the balance sheet

The stockholders' equity section has two main headings: paid-in capital and retained earnings. Treasury stock is listed under its own heading in the stockholders' equity section below the retained earnings heading.

Where does paid in capital from treasury stock go on balance sheet

shareholders’ equity section

Paid-in capital is recorded on the company's balance sheet under the shareholders' equity section.

Which stock is recorded in the balance sheet

Preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on the balance sheet in the stockholders' equity section. Information regarding the par value, authorized shares, issued shares, and outstanding shares must be disclosed for each type of stock.

Where is treasury stock reported on a corporation’s balance sheet

shareholders’ equity section

Treasury stock is recorded in the shareholders' equity section of the balance sheet of a corporate. Treasury stock is a contra equity account that addresses the number of shares bought back from the open market; it decreases shareholders' equity by the sum paid for the stock.

Do you include treasury stock as retained earnings

If you know the total equity and the other components, you can figure the company's retained earnings. The other components of equity include preferred shareholders' equity, common shareholders' equity, treasury stock, additional paid-in capital and foreign currency translation gains and losses.

What is the difference between treasury stock and paid in capital

Capital stocks are the shares outstanding for a company. They may be purchased, and with them, an investor gains voting rights and sometimes dividends. Treasury stock, or treasury shares, are shares a company owns. They do not carry voting power and do not pay out dividends.

Is treasury stock positive or negative on balance sheet

negative number

On the balance sheet, treasury stock is listed under shareholders' equity as a negative number. It is commonly called "treasury stock" or "equity reduction". That is, treasury stock is a contra account to shareholders' equity.

Does treasury stock result in a gain or loss

A gain on the reissuance of treasury shares should be credited to additional paid-in capital. A loss on the reissuance of treasury shares may be debited to additional paid-in capital to the extent previous net gains from sales or retirements of the same class of stock are included in additional paid-in capital.

Where should treasury stock be reported in the financial statements of a corporation

Treasury stock should be reported in the financial statements of a corporation as a deduction from total paid-in capital and retained earnings.

What goes in stockholders equity on balance sheet

Preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on the balance sheet in the stockholders' equity section. Information regarding the par value, authorized shares, issued shares, and outstanding shares must be disclosed for each type of stock.

How do you account for treasury shares

A gain on the reissuance of treasury shares should be credited to additional paid-in capital. A loss on the reissuance of treasury shares may be debited to additional paid-in capital to the extent previous net gains from sales or retirements of the same class of stock are included in additional paid-in capital.

Is treasury stock included in the earnings per share calculation

The treasury stock method is used to calculate the net increase in shares outstanding if in-the-money options and warrants were to be exercised. This information is included in the calculation of diluted earnings per share, expanding the number of shares and therefore reducing the amount of earnings per share.

Why is treasury stock negative on balance sheet

When stock is “retired” into Treasury Stock cash or some form of debt is used to pay for the stock, the diminishment of the cash asset or the addition of a liability to pay for the stock requires an entry into Equity that diminishes it. For that reason, Treasury Stock is always a negative entry to Equity.