How long are 941X refunds taking?

Can I track my employee retention credit refund

Employers who have claimed the Employee Retention Tax Credit (ERC) and are waiting for their refund can check the status of their return through two primary methods as noted on the IRS “Where's My Refund” website, specifically the Business Tax Return section.

Cached

When can I expect my ERTC refund

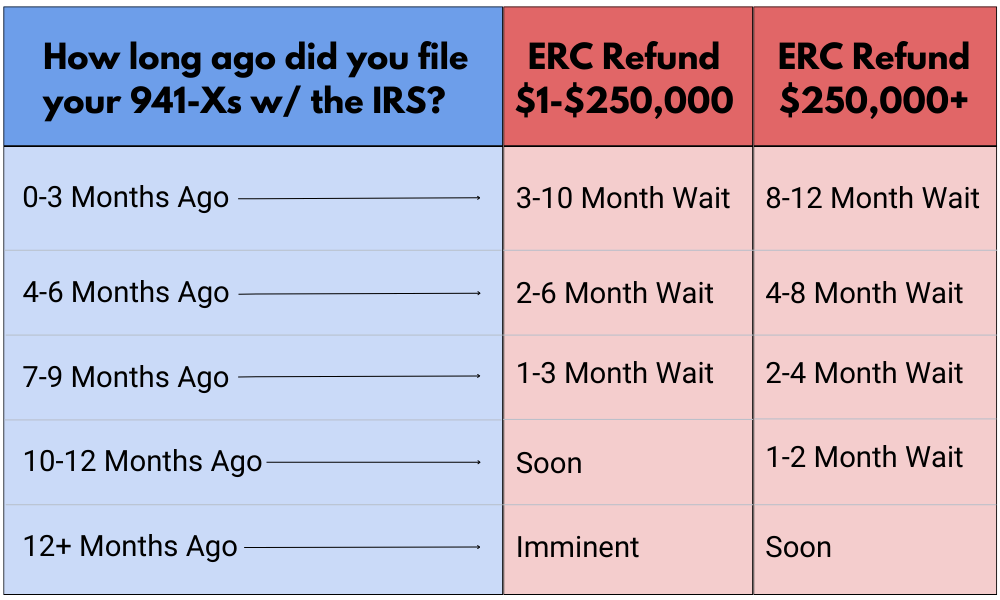

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

Cached

How long is the IRS 941x processing time

approximately five to six months

If you filed your business's ERC claim with the Form 941-X:

Currently, the IRS has been processing these claims within approximately five to six months from the date they received them.

Cached

How do I check the status of my 941x refund

Q: How do I check the status of my 941x refund A: You can check the status of your 941x refund by logging into your account on the IRS website. Once you are logged in, click on the “My Account” tab and then select the “Payments” option.

Why is my ERC refund taking so long

The way the IRS handles retroactive filings for companies looking to claim the ERC also contributes to longer wait times. Trained IRS staff must hand-process claims that are made on amended payroll returns. Additionally, the IRS has had staffing issues in recent years, compounding the delays.

Can I track my 941x refund

Q: How do I check the status of my 941x refund A: You can check the status of your 941x refund by logging into your account on the IRS website.

What is the backlog for IRS 941x

Just days before the release of the April 2023 draft version of Form 941-X (Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund), the Internal Revenue Service (IRS) announced a staggering backlog of nearly one million unprocessed Forms 941-X.

How long does it take to get ERC refund 2023

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

Why are employee retention credit refunds taking so long

In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.

Is IRS ERTC retroactive

Employers may file Form 941-X up to three years after the original payroll taxes were due, which is typically on April 15. Thus, employers may claim the 2023 ERTC until April 15, 2024, and the 2023 ERTC until April 15, 2025.

Why are ERC refunds taking so long

In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.

How long does it take to receive the ERC credit

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business. Early on in the process, refunds took four to six weeks.

How do I claim my ERC credit retroactively

Eligible employers can claim the ERTC retroactively by filing Form 941-X for each quarter they paid qualifying wages. They can file this form up to three years after the original payroll taxes were due.

How long are ERC refunds taking 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.