How long are Ertc credits taking?

How long does it take to get your refund from ERTC

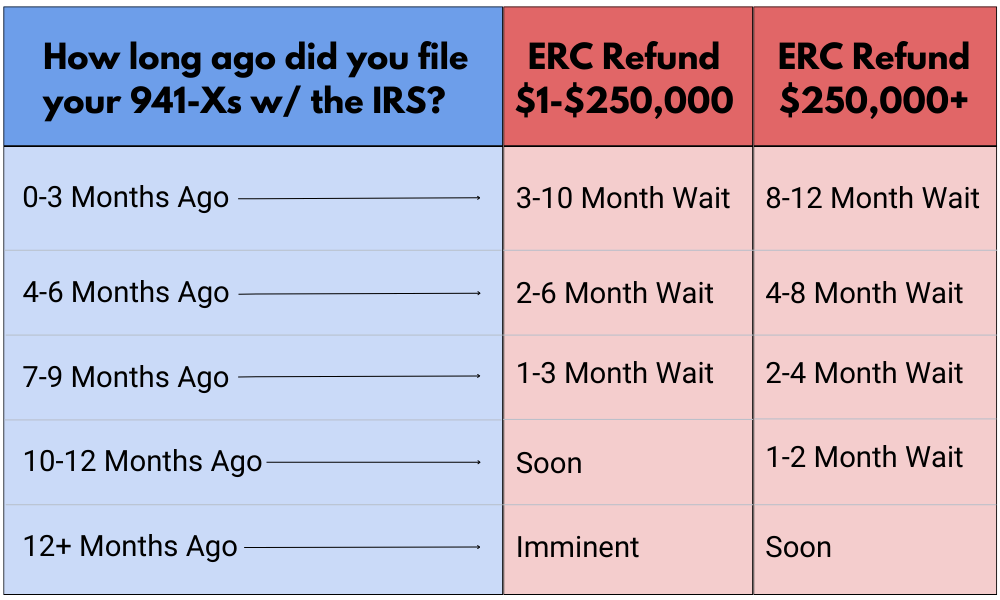

Most employers can expect to receive their ERTC refund within six months to a year after filing their return.

Cached

Why is my ERC refund taking so long

The way the IRS handles retroactive filings for companies looking to claim the ERC also contributes to longer wait times. Trained IRS staff must hand-process claims that are made on amended payroll returns. Additionally, the IRS has had staffing issues in recent years, compounding the delays.

Cached

How long does it take to get ERC refund 2023

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

Cached

How long does it take to get ERC money

How Long Does It Take To Receive The ERC Refund While every eligible small business owner should claim the ERC refund, it's important to understand that this isn't a fast funding solution. Taxpayers claiming the credit early in the process generally wait four to nine months to receive their refund checks from the IRS.

Cached

Can I track my ERTC refund

Employers who have claimed the Employee Retention Tax Credit (ERC) and are waiting for their refund can check the status of their return through two primary methods as noted on the IRS “Where's My Refund” website, specifically the Business Tax Return section.

Why haven’t I received my ERC refund

The IRS, like many other businesses in the United States, has been hit by COVID-19, which has caused service delays. As a result, many businesses that registered for the ERC refund have been waiting longer than expected. To check the status of your refund, you can call the IRS at 877-777-4778.

Can I track my ERC refund

Employers who have claimed the Employee Retention Tax Credit (ERC) and are waiting for their refund can check the status of their return through two primary methods as noted on the IRS “Where's My Refund” website, specifically the Business Tax Return section.

How is the ERC paid out

The ERC credit is a tax refund paid to businesses through a paper check mailed from the IRS.

Why is ertc taking so long

Why Are Employee Retention Credit Refunds Taking So Long One reason so many eligible businesses have experienced such ERC refund delays is the large amount of 941-X forms the IRS has received. As of February 8, 2023, the agency lists its total inventory of unprocessed Forms 941-X at approximately 557,000.

How is ERC money paid out

The ERC credit is a tax refund paid to businesses through a paper check mailed from the IRS.

How hard is it to get the ERC credit

Applying for the Employee Retention Credit is complicated. Determining your business' ERC eligibility can be difficult, and calculating your credit amount is even more challenging. If you overclaim your ERC refund, your company will likely have to pay back the extra credit with penalties and interest.

Do you have to pay taxes on ERTC refund

ERC refunds are not taxable income for California.

What is the status of my ERC refund IRS

How Do I Check on the Status of the Employee Retention Credit You can call the IRS at (800) 829-4933 to check the status of your refund.

How is ERC money received

The ERC credit is a tax refund paid to businesses through a paper check mailed from the IRS.

How are ERC credits received

ERC credits are calculated based on the qualifying wages paid to employees during eligible employer status. For most companies taking advantage of this program, the refundable tax credits are well in excess of the payroll taxes paid by the employers.

Is the IRS paying interest on ERC refunds

In addition to paying out the refund amount requested, the IRS adds interest to the refunds for the time value of money.

How do I check the status of my 941x refund

The IRS phone number to check on the status of amended returns is 866-464-2050.

How does ERC get paid

How Is the ERC Credit Paid The ERC credit is a tax refund paid to businesses through a paper check mailed from the IRS. It is not a future credit against the next quarter's tax liabilities — it's cash in your company's pocket. Business owners are free to use their ERC refund check as they please.

How do I check the status of my ERTC refund

How Do I Contact the Irs About My Employee Retention Tax Credit For the specifics of your refund status, call the IRS helpline at (800) 829-4933.

How do I get my refund from ERTC

The ERC is a refundable tax credit that was designed to encourage employers to keep their employees on payroll during the pandemic. ERC refunds are claimed via an amended payroll tax return, Form 941-X, for each applicable qualifying quarter in 2023 and 2023.