How long do closed accounts affect credit?

Can I get closed accounts removed from my credit report

You cannot remove a closed accounts from your credit report unless the information listed is incorrect. If the entry is an error, you can file a dispute with the three major credit bureaus to have it removed, but the information will remain on your report for 7-10 years if it is accurate.

How much does credit score drop for a closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Cached

Is it true that after 7 years your credit is clear

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Why do closed accounts still show on my credit report

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. That's because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score. You can check your free credit report on NerdWallet to see when an account is reported as being closed.

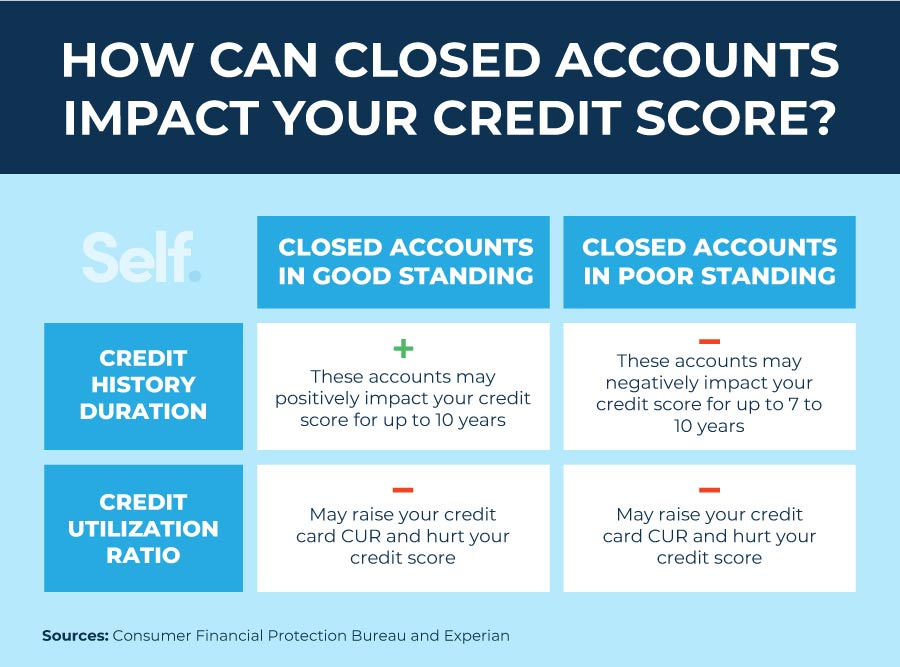

Is it good to have closed accounts on your credit report

Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score.

What is the best way to remove closed accounts from credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Do lenders see closed accounts

If you wrote to your creditor, canceled your account and got acknowledgement that the account was closed, it should come as no surprise that it shows up as “closed” on your credit reports. Closed accounts in good standing will typically remain on your report for 10 years.

Should I pay off closed accounts

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

How long after 7 years does your credit clear

Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

Should I pay off closed accounts on credit report

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time.

When should closed accounts be removed from credit report

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Should I remove old closed accounts from credit report

You only need to consider removing a closed account if it has an adverse payment history. Otherwise, an account that is in good standing is OK to leave. It shows future lenders you can pay off a loan and make payments on time.

Do closed accounts affect buying a house

In closing, for most applicants, a collection account does not prevent you from getting approved for a mortgage but you need to find the right lender and program.

Do unpaid closed accounts go away

Wait for the accounts to fall off

How long do closed accounts stay on your credit report Negative information typically falls off your credit report 7 years after the original date of delinquency, whereas closed accounts in good standing usually fall off your account after 10 years.

Do I still owe money on a closed account

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

Should I pay a debt that is 7 years old

Although the unpaid debt will go on your credit report and cause a negative impact to your score, the good news is that it won't last forever. Debt after 7 years, unpaid credit card debt falls off of credit reports. The debt doesn't vanish completely, but it'll no longer impact your credit score.

Do you still need to pay off a closed account

You can still make payments on a closed credit card account, you just cannot make purchases with it. To pay off a balance, continue making payments the same way you did before it was closed. You can usually do this online or, if you get a paper bill, via check.

Do closed accounts hurt your score

But you may not be aware that long after you close a credit account or pay off a loan, your borrowing history may remain on your credit report. That means the closed account can continue to affect your score, for better or worse, possibly for many years.

Why does a closed account hurt my credit

Although the act of closing an account is not considered negative, closing a credit card account may increase your overall credit utilization rate. Your utilization rate measures the amount of total available credit you are using on your revolving accounts, and is an important factor in most score models.

Does closed accounts look bad

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.