How long do consumer accounts stay on credit report?

How do I get consumer financial accounts off my credit report

Send a written request to remove the account from your credit report directly to the creditor that reported the information to the credit bureau, McClary says. Ask politely if the creditor will remove the account now that it is no longer active.

Cached

How long does consumer debt stay on credit report

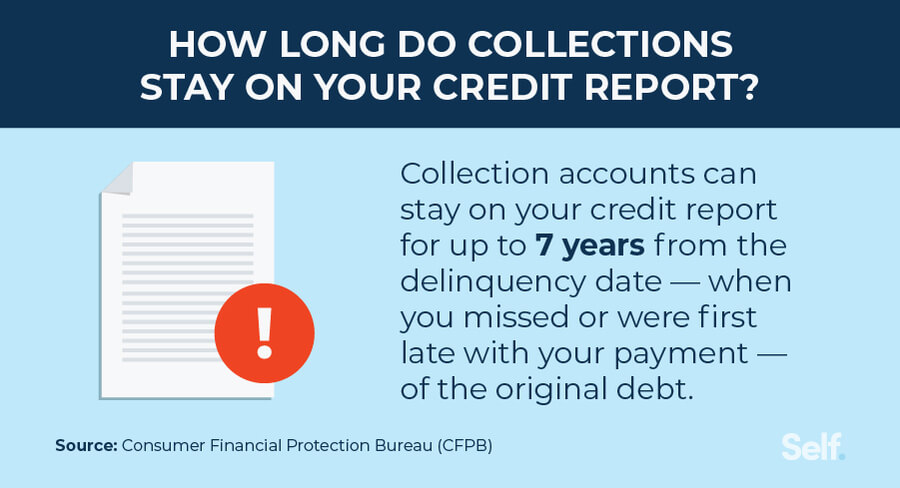

seven years

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Cached

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

What are consumer accounts on credit report

A consumer credit report is a statement that depicts your credit activity and most recent credit profile. It shows the status of an individual's credit accounts, whether open, closed, or delinquent, credit limits, account balances, and payment history.

What does too many consumer finance company accounts mean on credit report

A mix of installment loans and credit cards is considered beneficial to your score, while having too many finance company accounts or credit cards is considered negative for your credit score.

Does a consumer credit report hurt your credit

No, requesting your credit report will not hurt your credit score. Checking your own credit report is not an inquiry about new credit, so it has no effect on your score.

How long before a debt becomes uncollectible

four years

The statute of limitations on debt in California is four years, as stated in the state's Code of Civil Procedure § 337, with the clock starting to tick as soon as you miss a payment.

Can a debt collector restart the clock on my old debt

Keep in mind that making a partial payment or acknowledging you owe an old debt, even after the statute of limitations expired, may restart the time period. It may also be affected by terms in the contract with the creditor or if you moved to a state where the laws differ.

Is a 10 year old debt still be collected

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

What is considered a consumer account

Consumer account means a checking, savings or money market Account established by an individual primarily for personal, family or household purposes.

Does consumer finance accounts hurt your credit

If you cannot pay your debt, your consumer finance company can turn to a debt collector to get funds. If your credit account goes into collections, that information will appear on your credit reports, and getting to that point will substantially harm your credit scores.

Is a consumer report the same thing as a credit report

In summary, a credit report has a singular purpose: to determine your risk factor before lending you money. Your consumer report fleshes out an entire personality profile to assess your suitability for whatever the person or company needs from you.

What is the greatest disadvantage of consumer credit

Disadvantages of Consumer Credit

The main disadvantage of using revolving consumer credit is the cost to consumers who fail to pay off their entire balances every month and continue to accrue additional interest charges from month to month.

What is the 777 rule with debt collectors

One of the most rigorous rules in their favor is the 7-in-7 rule. This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period. Also, they must not contact the individual within seven days after engaging in a phone conversation about a particular debt.

Can a 10 year old debt still be collected

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

How long does a consumers opt out decision remain in effect

five years

The election of a consumer to opt out must be effective for a period of at least five years (the “opt-out period”) beginning when the consumer's opt-out election is received and implemented, unless the consumer subsequently revokes the opt-out in writing or, if the consumer agrees, electronically.

What is the difference between consumer and non consumer accounts

Consumer debt is a debt incurred by an individual for primarily personal, family, or household purposes. Anything else is non-consumer debt.

Does a consumer loan increase your credit score

However, if you make regular EMI repayments, you do not need to worry, as this will eventually increase your credit score. Note that defaulting on your loan repayment can significantly hamper your credit score.

Who keeps records of consumer credit reports

We're the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly.