How long does a disputed transaction take to refund?

How long does it take to get money back after a dispute

A provisional credit should take 2-3 days to process. However, it may take weeks, or even months, before a dispute is finally settled. This will depend on whether the merchant decides to fight the dispute, and if they later escalate it to arbitration.

Cached

Will I get my money back in a disputed transaction

Generally, you'll have two options when disputing a transaction: refund or chargeback. A refund comes directly from a merchant, while a chargeback comes from your card issuer. The first step in the dispute process should be to go directly to the merchant and request a refund.

How long does it take for a dispute transaction to go through

The credit card issuer must acknowledge your dispute within 30 days, and you won't be responsible for paying the charge or interest that would accrue on the charge during the investigation.

Cached

How long does it take for a bank to respond to a dispute

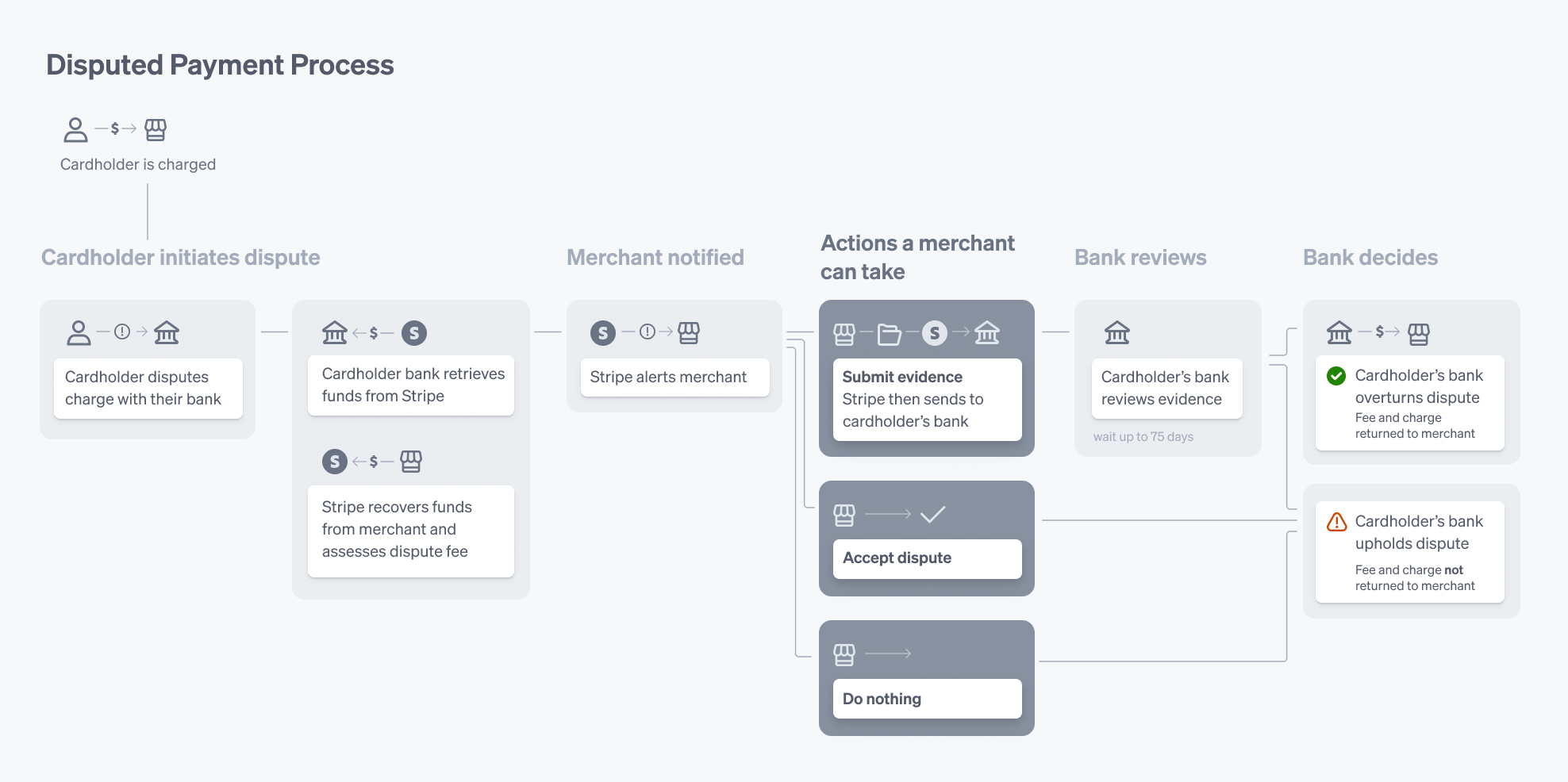

If you submit evidence, the issuer also has a limited amount of time (usually 60–75 days, depending on the card network) to evaluate the evidence and decide the outcome. The full lifecycle of a dispute, from initiation to the final decision from the issuer, can take as long as 2-3 months to complete.

Cached

What happens if you falsely dispute a charge

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

What happens if you accidentally dispute a charge

The bottom line. If you dispute a credit card charge by mistake, contact your card issuer and explain the situation. You could also follow up with the merchant if required.

Do banks investigate disputed charges

Do Banks Really Investigate Disputes Yes. They do so as a protection service for their customers so that they don't have to worry about the ever-increasing sophistication of fraud.

How do banks investigate disputed transactions

The bank initiates a payment fraud investigation, gathering information about the transaction from the cardholder. They review pertinent details, such as whether the charge was a card-present or card-not-present transaction. The bank also examines whether the charge fits the cardholder's usual purchasing habits.

Who pays when you dispute a charge

You shouldn't have to make payments toward the disputed amount, but keep in mind that you're still responsible for making payments toward the rest of your credit card balance during the investigation. If the investigation is resolved in your favor, you won't have to pay the disputed amount.

What happens after you dispute a transaction

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

What happens if your bank denies your dispute

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

What are the chances of winning a bank dispute

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Do banks really investigate disputes

Do Banks Really Investigate Disputes Yes. They do so as a protection service for their customers so that they don't have to worry about the ever-increasing sophistication of fraud.

What is a good excuse to dispute a charge

We can divide all valid disputes into one of five basic categories: criminal fraud, authorization errors, processing errors, fulfillment errors, or merchant abuse.

Can I dispute a charge if I got scammed

Consumers have the right to dispute a credit card charge, whether it was posted in error, fraudulent in nature or the merchant didn't provide satisfactory goods or services.

What happens if I lie and dispute a charge

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

Can a bank dispute be denied

Receiving a dispute denial

After conducting an investigation, your card issuer may deny your dispute. For example, if the issuer may not find evidence that the transaction you disputed was unauthorized.

What happens if you dispute a charge on your debit card

In most cases, yes, you can dispute a debit card charge by requesting a "chargeback" through the bank. The bank will investigate the transaction and if they find the transaction to be incorrect or due to fraud, they will issue a refund to your card.

What happens if I falsely dispute a charge

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

How do banks investigate disputes

Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.