How long does Carvana pre approval last?

What does it mean to be pre approved on Carvana

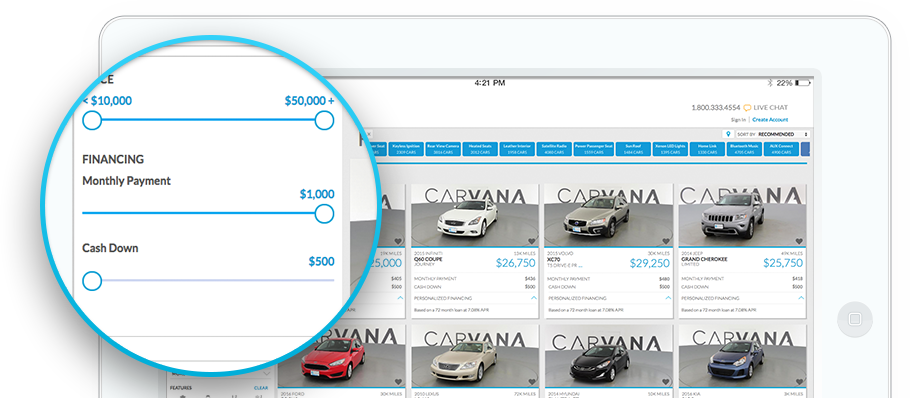

When you pre-qualify with Carvana, you see real, personalized terms without affecting your credit score. Though your terms will not change, we do complete a formal credit inquiry when you schedule your delivery or pickup.

Cached

Will Carvana deny me after pre approval

If you got Carvana pre-approval and then were denied a car loan, don't stress. You may have been denied due to a change in your credit or even a simple clerical error or typo.

Cached

What FICO score does Carvana use

Carvana has no minimum credit score or credit history requirements and says it extends credit to customers with a broad range of credit profiles. This includes car buyers with bad credit — typically FICO scores below 630 — who may have trouble getting loans from traditional dealerships and lenders.

Cached

Does Carvana verify income

Carvana performs an income verification to help calculate your yearly income and ensure we're providing you the correct financing terms to set you up for financial success with your vehicle loan. Carvana also performs an employment verification to confirm that you're an active employee at the company indicated.

How long does Carvana take to verify documents

within 1-2 days

Once you've uploaded your documents, we'll typically verify that we have everything we need within 1-2 days. However, we may extend beyond that timeframe on occasion and we appreciate your patience as we work to quickly verify your documents.

How long does Carvana take to approve order

The review typically begins within about 24-48 hours of you uploading your documents, so if we're able to verify everything we need, it may be approved right away. However, we may need you to upload additional documents to complete verification after the intial review.

Does Carvana approve easily

99% of customers who apply get approved and your terms are good for 45 days. There's no impact to your credit and you can see your actual down payment and monthly payment on all vehicles in our inventory.

Can you get declined after pre-approval car loan

Banks, credit unions and online lenders may not approve your car loan if they can't verify the information you provided on your application, even if you were preapproved beforehand. Most lenders will give conditional approval after only a cursory examination of your financial details.

Does Carvana run a hard credit

After you find the Carvana car you want to buy and schedule your delivery or pickup, Carvana will check your credit, which generates a hard credit inquiry and could impact your credit scores.

Can I be denied by Carvana

Carvana considers working with consumers regardless of their credit history — although there are age and income minimums. Because it doesn't require people to have minimum credit scores for a car loan, you might qualify for a Carvana loan even if you have low credit scores.

Is it hard to get financed through Carvana

Need more reasons Get approved online in just 2 minutes. 99% of customers who apply get approved and your terms are good for 45 days. There's no impact to your credit and you can see your actual down payment and monthly payment on all vehicles in our inventory.

How fast is the Carvana process

Options for receiving payment are: Certified Check ACH direct deposit into your checking or savings account The ACH transfers normally take between 2-5 business days. The appointment is fast, we confirm the basic details about your vehicle and complete final sale documents, ensuring you're paid as quickly as possible.

How do I know if my Carvana purchase was approved

If no additional items are required, or all additional items are submitted and approved, you will receive an email confirming your delivery or pickup appointment. To note, underwriting means our team is in the process of verifying the order details you placed!

How long does a pre-approval last for a car

30 to 60 days

Most preapprovals are only valid for a limited time — usually 30 to 60 days. An since they require a hard credit check which can bring your score down, you don't want to have to apply for a loan again.

How long does a vehicle loan pre-approval last

30-60 days

Keep in mind that a pre-approval only lasts for 30-60 days on average. You don't want to take too long finding a car, or you'll have to complete the pre-approval process again.

Does Carvana deny financing

All credit types welcome

Carvana considers working with consumers regardless of their credit history — although there are age and income minimums. Because it doesn't require people to have minimum credit scores for a car loan, you might qualify for a Carvana loan even if you have low credit scores.

Is Carvana a good option for bad credit

Yes. As long as you are 18 years or older†, make at least $4k per year, and have no active bankruptcies, you can finance your purchase through Carvana. To get started, you can fill out the financing application here. Don't worry, filling out the application will not impact your credit!

What bank does Carvana use

GM Financial (Manufacturer banks often only finance if the vehicle is purchased directly from them) Golden1 Credit Union.

Do pre approvals expire

For this reason, a mortgage preapproval typically lasts for 60 to 90 days. Once it expires, you'll need to connect with your lender again with your updated paperwork and apply for a new preapproval letter.

Can a pre-approval last 6 months

Most mortgage preapproval letters last between 60 – 90 days. Your mortgage preapproval will list how much you're approved to borrow, your interest rate and other terms and conditions. Typically, borrowers should wait until they're ready to actively search for a home before they get preapproved.