How long does it take Credit One to verify?

How long does it take to get Credit One verification

Credit One will find your credit card application in its records and tell you whether it is approved, denied, or still pending. It can take up to 21 days to receive your final Credit One application status: approved or denied.

What is Credit One verification process

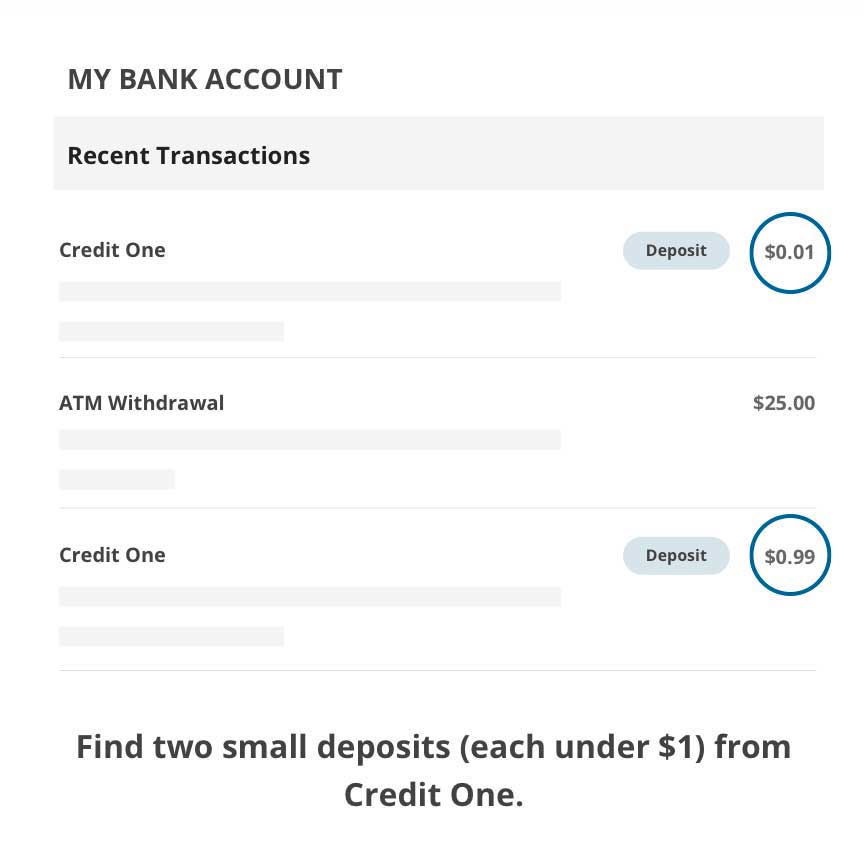

By 'Start Verification Process', you authorize Credit One Bank to initiate a verification process by making two small deposits between $.01 and $.99. You will need to validate the two deposit amounts by visiting the Application Status page and entering the two deposit amounts.

CachedSimilar

How do I find out if I am approved for Credit One

You can check the status of your application at any time by visiting our Application Status page. Enter your last name and Social Security number to verify your identity, then click "Check Status."

Cached

Why is my Credit One application taking so long

The most common reasons for a pending application are the need for more information and/or the verification of information from your application. Once you have supplied the necessary information or documentation, your application can be processed.

Cached

Does Credit One give instant approval

Decision timeframe: You could be instantly approved for a Credit One credit card if you apply online. The process could also take up to three weeks. Checking your status: You can check your Credit One application status online.

How much will Credit One approve me for

If approved for a Credit One card, applicants can expect a minimum credit line of $300 to $500 initially, depending on the card and their credit standing. Credit One cards are designed for people of various credit levels, from bad to good credit or better.

How much does Credit One Bank approve you for

All Credit One cards start off with a credit limit of $300 to $500. You can be considered for a credit limit increase with a history of consistent on-time payments.

What is the highest credit limit for Credit One

Key Features of the Credit One Bank Platinum Visa for Rebuilding CreditCredit Limit. This card carries a minimum credit limit of $300 and a maximum credit limit of $1,500.Credit Limit Increase.Earning Cash Back Rewards.Redeeming Cash Back Rewards.Free FICO Score Each Month.Important Fees.Credit Required.

Does 7 10 days mean denial

7-10 Days Status Message

A 7-10 day message typically means that your application has been denied.

What is Credit One highest credit limit

Key Features of the Credit One Bank Platinum Visa for Rebuilding CreditCredit Limit. This card carries a minimum credit limit of $300 and a maximum credit limit of $1,500.Credit Limit Increase.Earning Cash Back Rewards.Redeeming Cash Back Rewards.Free FICO Score Each Month.Important Fees.Credit Required.

What is the highest limit Credit One gives

This card's maximum credit limit is $1,500. If you intend to use Credit One Bank Unsecured Visa as your family's everyday spending card, that may be too low, unless your cash flow is sufficient to pay off purchases as you make them. Some competing secured cards have spending limits as high as $5,000 or $10,000.

Is it hard to get approved for a Credit One card

The credit score you need for a Credit One credit card is at least 300-700, depending on the card. Credit One credit cards are available to applicants with credit scores ranging from bad to good or better. So, it's possible to be approved despite having a damaged credit score or limited credit history.

How much does credit one bank approve you for

All Credit One cards start off with a credit limit of $300 to $500. You can be considered for a credit limit increase with a history of consistent on-time payments.

What is the normal credit limit for one card

But even with good credit, the average credit limit you can expect to get with a first credit card is generally between $500 and $1,000. Average credit: If you have fair credit, expect a credit limit of around $300 to $500. Poor credit: Credit limits between $100 and $300 are common for people with poor credit scores.

How many credits cards is too many

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

What does it mean when you are not instantly approved for a credit card

A bank or lender will take a quick look at your credit score and credit history before deciding whether to issue you an instant approval credit card. Some instant approval credit cards are conditional, in the sense that a lender may revoke the approval decision after conducting a more thorough review of your credit.

What is the minimum credit limit on a Credit One platinum card

$300

Minimum initial credit limit of $300

While it might not seem like much, the Platinum Rewards Visa card's low initial minimum credit limit is meant to help cardholders, not hold them back.

Is it easy to get a $10,000 credit limit

Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

How much should I use at the $2000 credit limit

According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

What is the highest credit limit for a Credit One card

This card's maximum credit limit is $1,500. If you intend to use Credit One Bank Unsecured Visa as your family's everyday spending card, that may be too low, unless your cash flow is sufficient to pay off purchases as you make them. Some competing secured cards have spending limits as high as $5,000 or $10,000.