How long does it take Fidelity to process?

How long does it take for Fidelity to pay out

When will my funds be available EFTs in and out of Fidelity accounts are generally received within 1-3 business days, though the funds may be immediately available for trading. Electronic funds transfers (EFTs) are not processed on Saturdays, Sundays, or New York Stock Exchange and bank holidays.

How long does it take to get $100 from Fidelity

within 10 calendar days

When will I receive the cash reward Once the qualification period (15 calendar days) has ended and you have at least $50 in your new Fidelity account, Fidelity will deposit $100 into the account within 10 calendar days.

How long does it take Fidelity to verify bank account

Fidelity validates bank account information through a test transaction (prenote) process that takes seven to ten business days. Fidelity will send an electronic check to your bank to verify that the ABA routing number and checking account number provided are valid.

How long does it take for Fidelity to settle a trade

2 business days

According to industry standards, most securities have a settlement date that occurs on trade date plus 2 business days (T+2). That means that if you buy a stock on a Monday, settlement date would be Wednesday.

Does Fidelity do instant deposits

A general money transfer into your Fidelity account via EFT, bank wire, or mobile check deposit may be immediately available for trading.

How long does it take for money to show up in Fidelity 401k

For the current payroll period, it takes the employer 10 days to deposit amounts withheld into the plan.

Is Fidelity better than Robinhood

Robinhood is good for simple trades, while Fidelity's mobile offering is more comprehensive and a better platform when it comes to the complete mobile trade experience.

What is Fidelity fast cash

FCASH is known as a free credit balance. It is not a money market mutual fund. Your FCASH balance represents funds held by Fidelity payable to you on demand. Fidelity may, but is not required to, pay interest on FCASH balances.

Why can’t I withdraw all my money from Fidelity

The maximum withdrawal amount using Fidelity.com or telephone is $100,000 per account. For withdrawals greater than $100,000, requests must be made via a completed paper form. To get a copy of the form, contact a Fidelity representative at 800-544-6666. For brokerage IRAs, only one withdrawal per day may be processed.

Why does it take 3 days for a trade to settle

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

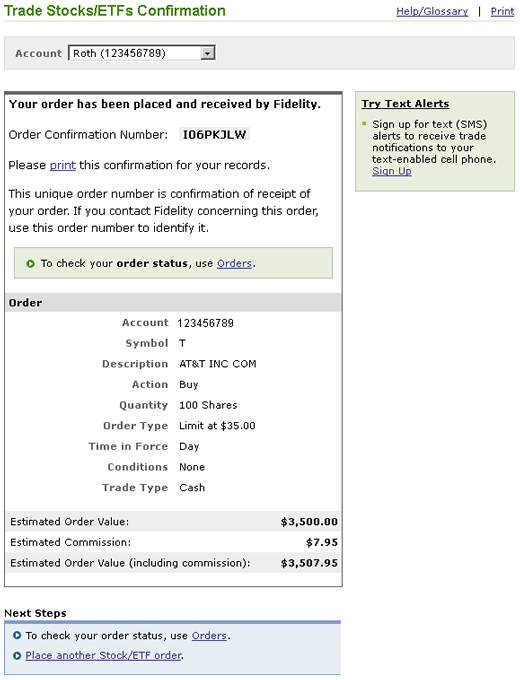

Why is my order still open Fidelity

Orders may remain open because certain conditions such as limit price have not yet been met. Market orders, on the other hand, do not have such restrictions and are typically filled fairly instantaneously.

How long does mobile deposit take fidelity bank

Mobile deposits must be made by 5:00 pm to receive same day availability. If mobile deposits are made after 5:00 p.m. funds will be available on the next business day.

Does Fidelity update in real time

Unless you sign up for real-time quotes, the quotes you receive may be delayed by 15 minutes. Real-time quotes are just that—provided to you in "real time."

How long does 401k processing take

Depending on who administers your 401(k) account, it can take between three and 10 business days to receive a check after cashing out your 401(k). If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

How long does Fidelity 401k withdrawal direct deposit take

Withdrawals by check generally require 5 to 7 business days, Electronic Funds Transfer (EFT) or Fidelity Electronic Funds Transfer generally require 1 to 3 business days, and withdrawals that are directed to a Fidelity non-retirement account generally require 1 to 2 business days for processing.

Do billionaires use Fidelity

What brokerage firms do billionaires use Many very wealthy individuals use the top brokerage firms, such as Fidelity, Schwab, Vanguard, and TD Ameritrade, among others. They invest in private equity and hedge funds.

What are the cons of Fidelity

Fidelity has low trading and non-trading fees, including commission-free US stock trading. On the negative side, margin rates and fees for some mutual funds can be high. Confused about fees

Does Fidelity give instant access to funds

Fidelity Bank will receive your deposits directly and deposit them to your account same day.

Does Fidelity have instant funds

A general money transfer into your Fidelity account via EFT, bank wire, or mobile check deposit may be immediately available for trading.

How do I withdraw large amounts of cash from Fidelity

To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666.