How long does it take for a line of credit increase?

How quickly can I get a credit line increase

If you are eligible for a credit limit increase, your request may be approved immediately. But sometimes requests can take a few days to review. And sometimes your issuer may ask for additional information before it can approve your request.

Cached

Is it hard to get a credit line increase

It's easy to request a credit line increase, but several factors impact your chances of approval. Being a responsible cardholder and asking for the increase at the right time will improve your odds of getting the full amount you request.

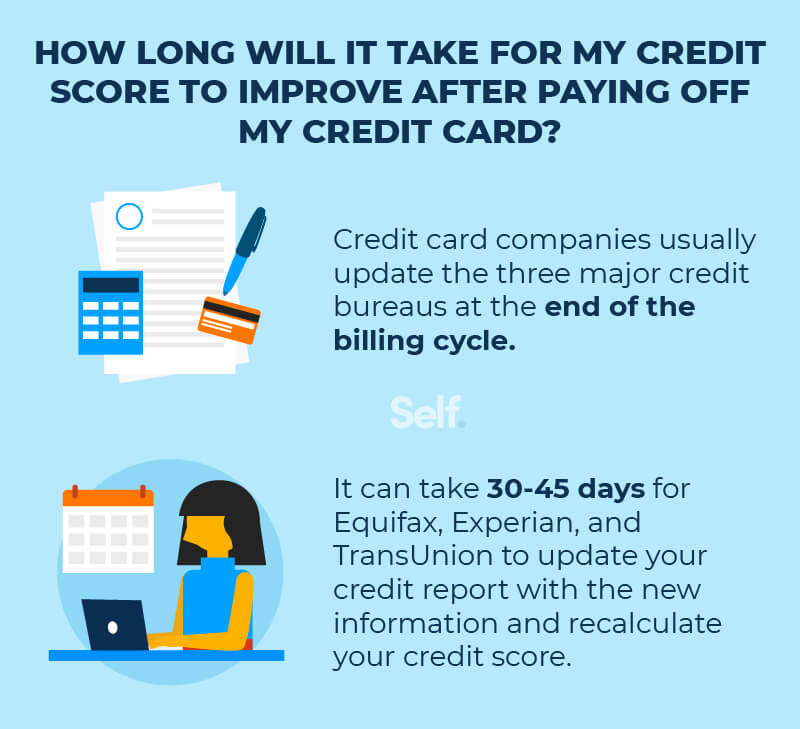

How long does it take for a credit limit increase to show on credit report

Typically, you'll want to request a credit limit increase if your income has increased recently and you have good credit habits. Keep in mind, however, that if you're approved for a higher line of credit, it may still take several weeks to appear on your credit report.

How often does your credit line increase

Do Card Issuers Increase Your Credit Limit Automatically Credit card issuers may review your credit file and account every six to 12 months and may offer you a credit line increase when they do.

Cached

Why won t Capital One increase my limit

The most common reasons Capital One may decline a credit limit increase request include: Your credit card account is not old enough. You've received a credit limit increase in the last six months. You've been past due on your account in the last several months.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

What makes you eligible for a credit line increase

What factors determine if I'm eligible for a credit line increase You make on-time payments (with all creditors). You make larger monthly payments that pay down your balance. Learn more about the factors that affect your credit score.

Why was I denied a credit limit increase

You could be denied a credit limit increase for many reasons, such as a history of late payments, too low of a credit score, too little credit history, too many recent applications, or an inadequate verifiable income. If you were already approved for a credit limit increase recently, that could be another reason.

What triggers a credit limit increase

Reasons your credit line gets boosted

You've used your existing credit line responsibly. Your credit card offers a built-in path to a higher credit limit. You've reported an increase in income. It may help the card issuer with retention.

How are credit line increases determined

This means that factors such as payment history, credit utilization, length of credit history, credit mix and recent inquiries will impact your new card limit. Issuers will likely also consider things like your household income, employment and monthly expenses.

How fast does Capital One increase credit limit

Sometimes your new limit is approved immediately. Other times, it can take a few days. We'll send you a letter by mail with details about the decision. We approve you for the highest amount we can offer and give you the option to choose a lower one if that works better for you.

How much will Capital One approve over limit

Capital One will assess transactions that put balances over the limit and approve or deny them on an individual basis. There is no fixed amount that you can go over your limit and each transaction is approved individually. So, there is no guarantee that you will always be approved to exceed your credit limit.

Is a $10,000 credit limit high

Is a $10,000 credit limit good Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

Is it good or bad to request a credit line increase

Increasing your credit limit can lower your credit utilization ratio, potentially boosting your credit score. A credit score is an important metric that lenders use to judge a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

How much should you request credit line increase

Decide how much you want to ask for

The typical increase amount is about 10% to 25% of your current limit. Anything further may trigger a hard inquiry on your credit. If the bank denies the request, you may be able to make a counteroffer.

Does it hurt to ask for a credit increase

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.

What’s a normal credit limit

What is considered a “normal” credit limit among most Americans The average American had access to $30,233 in credit across all of their credit cards in 2023, according to Experian. But the average credit card balance was $5,221 — well below the average credit limit.

Is requesting a credit line increase good

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.

Is it hard to get a credit line increase with Capital One

Requesting a credit limit increase from Capital One is as easy as logging into your online account to answer a few questions or calling the number on the back of the card. Requests may be approved automatically or they might take a few days to process.