How long does it take for credit limit to go up after payment?

How long does it take for available credit to increase after payment

Allow a few billing cycles—one to two months—for the credit card company to report your new information and for credit scoring models to see that you aren't immediately taking on new debt. Once your information is updated and a new score is calculated, you may see an increase in your credit score.

Does credit limit reset after full payment

Credit limits don't reset after a specific time period. Once your current balance has been settled–either when your statement is due or after you've made an early payment–you'll have access to the full limit again.

Why is my credit limit not updating after payment

If you've paid off your credit card but have no available credit, the card issuer may have put a hold on the account because you've gone over your credit limit, missed payments, or made a habit of doing these things.

Why is my available credit zero after payment

That means the available credit for a credit card holder is the amount left when you subtract all your purchases (and the interest on those charges) from the maximum credit limit on the credit card. Once the account balance reaches the credit limit, the account has been maxed out and the available credit is zero.

When I pay the minimum on my credit card can I use it again

Yes, if you pay your credit card early, you can use it again. You can use a credit card whenever there's enough credit available to complete a purchase. Your available credit decreases by the amount of any purchase you make and increases by the amount of any payment.

What’s a good credit limit

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt. What qualifies as a good credit limit differs from person to person, though.

How much should I spend on a $300 credit limit

You should try to spend $90 or less on a credit card with a $300 limit, then pay the bill in full by the due date. The rule of thumb is to keep your credit utilization ratio below 30%, and credit utilization is calculated by dividing your statement balance by your credit limit and multiplying by 100.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

How do I refresh my credit card limit

Higher your Credit Score, higher your credit limit will be. Of course, this limit is not written in stone; it's possible to increase credit limit. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best out of your rewards and offers.

How long does it take for credit card available balance to update

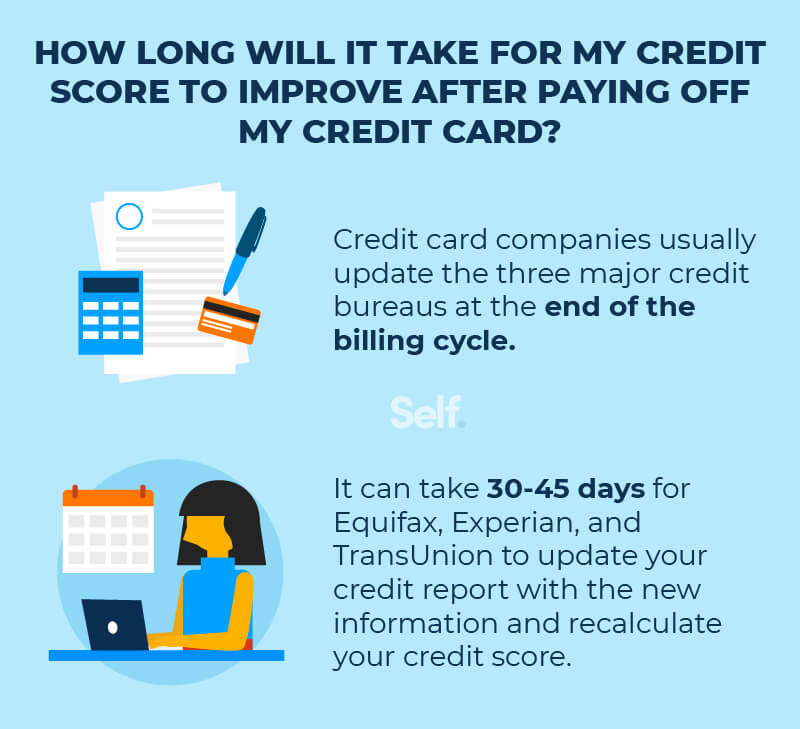

Lenders, including credit card providers, usually update your account information once a month. For that reason, we suggest you allow a minimum of 30 days and up to 45 days for the new balance to be reported.

Can I overpay my credit card to increase limit

An overpayment will not help boost your credit limit, not even temporarily. Your credit limit remains the same – you'll just have a negative balance that will be applied toward your next statement. Details like credit score and income are usually factored into a credit limit increase.

What’s the minimum payment on a $5000 credit card

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable. If you were late making a payment for the previous billing period, the credit card company may also add a late fee on top of your standard minimum payment.

What is the minimum payment on a $1000 credit card

Method 1: Percent of the Balance + Finance Charge

1 So, for example, 1% of your balance plus the interest that has accrued. Let's say your balance is $1,000 and your annual percentage rate (APR) is 24%. Your minimum payment would be 1%—$10—plus your monthly finance charge—$20—for a total minimum payment of $30.

How much should I use at the $2000 credit limit

According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

Is $1500 credit limit good

A $1,500 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

How much of a $1,500 credit limit should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

How much of a $5,000 credit limit should I use

If you have a $5,000 credit limit and spend $1,000 on your credit card each month, that's a utilization rate of 20%. Experts generally recommend keeping your utilization rate under 30%, ideally closer to 10% if you can.

How much of $1 500 credit card limit should I use

You should aim to use no more than 30% of your credit limit at any given time. Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score.

Is a $500 credit limit good

A $500 credit limit is good if you have fair, limited or bad credit, as cards in those categories have low minimum limits. The average credit card limit overall is around $13,000, but you typically need above-average credit, a high income and little to no existing debt to get a limit that high.

How long does it take to update credit card limit

It could take anywhere from a few minutes to 30 days to increase your credit limit from the time you request the increase, depending on the issuer and your credit profile. When you request a credit limit increase, the issuer will review your annual income, existing debt, and other factors.