How long does it take for disputed charges to come back?

How long does it take to get a disputed transaction back

While many cases can be resolved quickly, some are more complex and can take up to 90 days.

Cached

What happens after you dispute a charge

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

Will I get my money back in a disputed transaction

Generally, you'll have two options when disputing a transaction: refund or chargeback. A refund comes directly from a merchant, while a chargeback comes from your card issuer. The first step in the dispute process should be to go directly to the merchant and request a refund.

How long does it take to hear back from a bank dispute

However, most banks give their customers 120 days to dispute a fraudulent charge and have more generous liability policies than the law requires. Once notified, the bank has 10 business days to investigate the claim and reach a decision.

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

What happens to the merchant when you dispute a charge

Once the payment dispute is officially filed, it officially progresses to a chargeback. The funds are moved from the merchant's account to the consumer's. The merchant has no say in this; in fact, the seller may not even know about the dispute until the money is debited from their account.

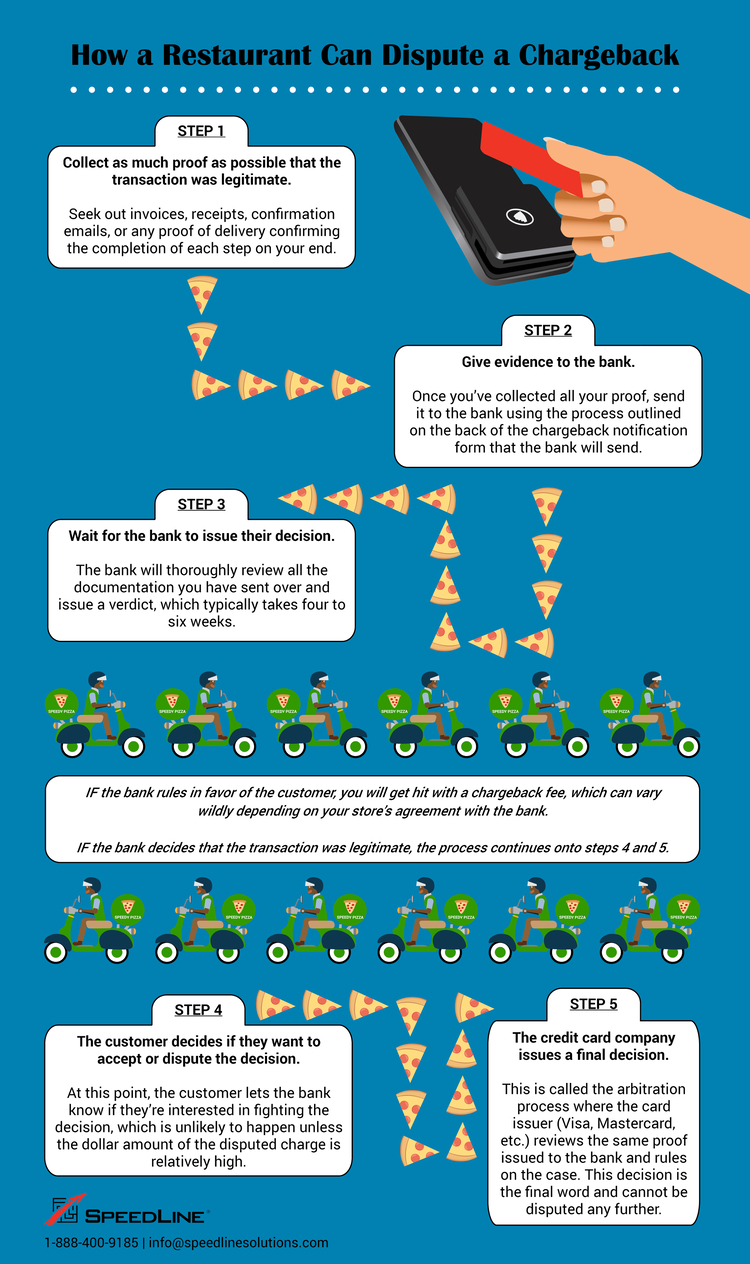

How do you win a charge back dispute

To win a chargeback dispute as a merchant, you must have evidence that is compelling enough to persuade the cardholder's bank to reevaluate the case. Depending on the reason for the chargeback, your evidence needs to prove you: verified the identity of the shopper. processed the transaction correctly.

How do banks investigate disputed transactions

The bank initiates a payment fraud investigation, gathering information about the transaction from the cardholder. They review pertinent details, such as whether the charge was a card-present or card-not-present transaction. The bank also examines whether the charge fits the cardholder's usual purchasing habits.

How often do you win bank disputes

What are the chances of winning a chargeback The average merchant wins roughly 45% of the chargebacks they challenge through representment. However, when we look at net recovery rate, we see that the average merchant only wins 1 in every 8 chargebacks issued against them.

How do you win a disputed charge

How to Win a Credit Card DisputeContact the Merchant First. If there's a clerical error or another issue with your credit card bill, it's best to try and resolve it with the retailer.Avoid Procrastinating.Prepare to Make Your Case.Know Your Rights.Stand Your Ground.

Is disputing a charge guaranteed

Federal law provides protection to credit card consumers when disputing billing errors and charges for fraudulent purchases. Disputing a charge doesn't necessarily mean you won't have to pay it though. Whether you're responsible for paying the disputed amount depends on the results of the card issuer's investigation.

Can a merchant win a dispute

Chargeback Disputes: Final Thoughts

Fighting customer chargebacks can be a costly, time-consuming headache for merchants. Unfortunately, there's no way to prevent all chargebacks—but with thorough records, a convincing rebuttal letter, and compelling evidence, merchants can fight chargebacks and win.

What is a good excuse to dispute a charge

We can divide all valid disputes into one of five basic categories: criminal fraud, authorization errors, processing errors, fulfillment errors, or merchant abuse.

What are the chances of winning a bank dispute

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Can a bank dispute be denied

Receiving a dispute denial

After conducting an investigation, your card issuer may deny your dispute. For example, if the issuer may not find evidence that the transaction you disputed was unauthorized.

Do banks decline disputes

After conducting an investigation, your card issuer may deny your dispute. For example, if the issuer may not find evidence that the transaction you disputed was unauthorized.

Who pays when a charge is disputed

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

What happens if a disputed charge is denied

If your dispute is denied, the charge will go back to your credit card. You should receive an explanation from the credit card issuer detailing the reason the dispute was denied. If you refuse to pay, they can put your account in collections or seek legal action.

How often do merchants win disputes

What are the chances of winning a chargeback The average merchant wins roughly 45% of the chargebacks they challenge through representment. However, when we look at net recovery rate, we see that the average merchant only wins 1 in every 8 chargebacks issued against them.

How often are credit card disputes successful

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.