How long does it take for IRS to approve refund after it is accepted 2023?

How long are 2023 tax refunds taking

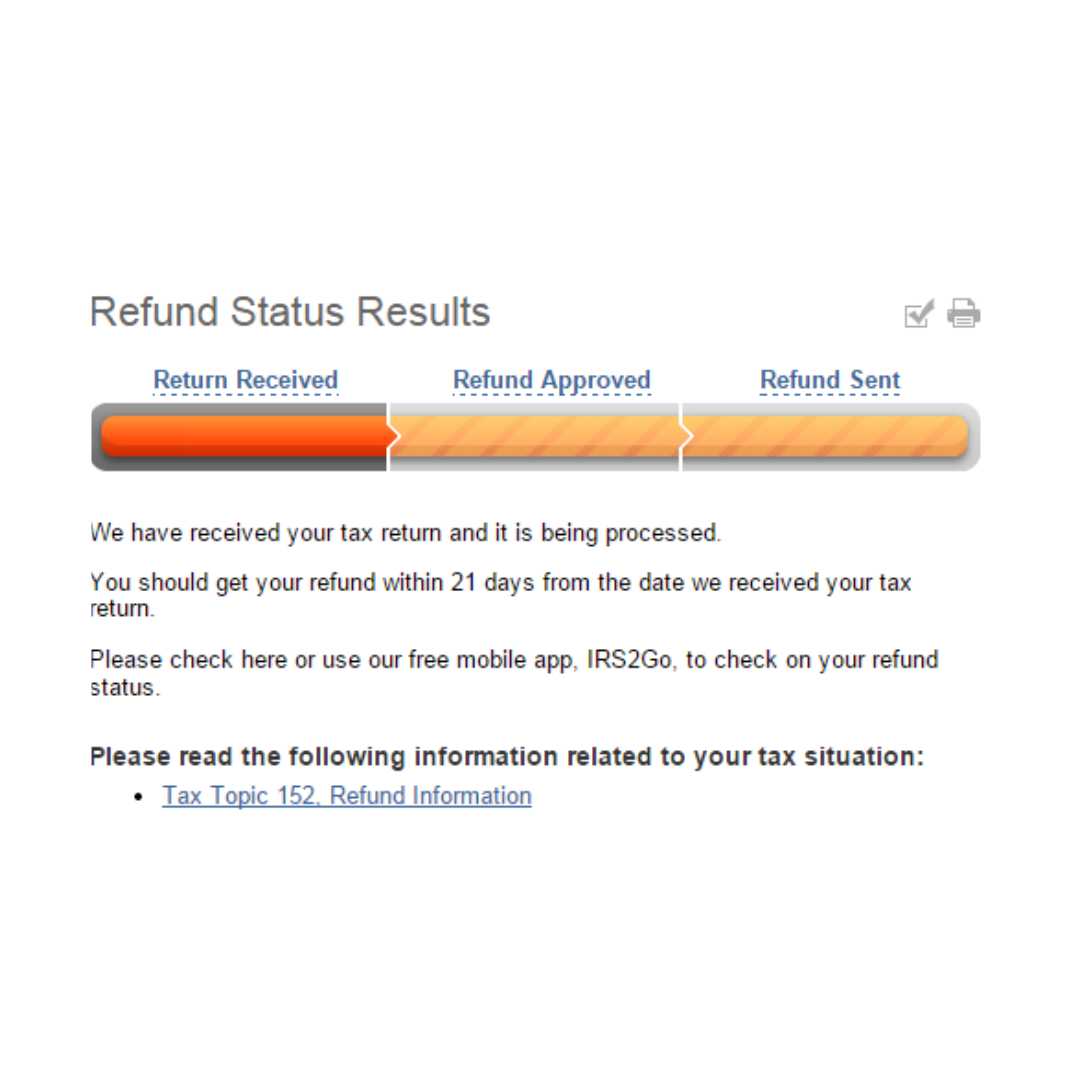

within 21 days

In general, the IRS says that returns with refunds are processed and payments issued within 21 days, and often in as little as 10 days. For paper filers, this can take much longer. The IRS and tax professionals strongly encourage electronic filing.

Cached

What day does IRS deposit refunds 2023

The law requires the IRS to hold the entire refund – not just the portion associated with EITC or ACTC. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

How long does it take tax refund to go from accepted to approved

When you e-file, it typically takes 24 to 48 hours for the IRS to accept your return. Once your return is accepted, you are on the IRS' refund timetable. The IRS typically issues refunds in less than 21 days after your e-filed return is accepted.

Cached

Why has my refund been accepted but not approved

“Accepted” simply means that the IRS has received your tax return. This does not necessarily mean that your tax return has been approved, and it does not mean that you will receive a refund. Your return is marked as “accepted” usually within 24-48 hours of submitting it electronically.

Cached

Will refunds be bigger in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

Will I get more tax refund in 2023

Changes for 2023

When you file your taxes this year, you may have a lower refund amount, since some tax credits that were expanded and increased in 2023 will return to 2023 levels. The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit.

What time does IRS update refund status 2023

It has to be noted that the IRS update the refund status just once per day, which means that you shouldn't try to check the website more times if your status has already been already updated on that day. IRS updates on tax return statuses usually take place between midnight and 06:00.

Does tax refund accepted mean approved

Accepted means your tax return is now in the government's hands and has passed the initial inspection (your verification info is correct, dependents haven't already been claimed by someone else, etc.). After acceptance, the next step is for the government to approve your refund.

Are tax refunds delayed 2023

The IRS is warning of weekslong and even monthslong delays in 2023 for mailed-in taxes. If you mailed in your taxes and are waiting for your refund, the IRS says not to file a second time and not to call.

Does it really take 9 weeks after identity verification to get refund 2023

After you verify your identity and tax return information using this service, it may take up to nine weeks to complete the processing of the return. Visit Where's My Refund or use the IRS2Go mobile app 2-3 weeks after using this service to check your refund status.

Does still being processed mean approved

If their refund status changes from “being processed” status to “still being processed” status, the issue detected in the tax forms was likely resolved and the refund may be released when it is approved for a future cycle date.

What will the tax refund be in 2023

As of Apr. 21, the IRS reported the average refund amount (aka money taxpayers overpaid the government) in 2023 as $2,753. This is almost a 9% drop from what the average refund amount was last year, which clocked in at $3,012.

Will tax refunds be better in 2023

Changes for 2023

When you file your taxes this year, you may have a lower refund amount, since some tax credits that were expanded and increased in 2023 will return to 2023 levels. The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit.

What will tax refunds look like in 2023

The average refund amount in 2023 is trending lower than this time last year. The page has turned on another tax filing season and here's the data on what refunds looked like this year. As of Apr. 21, the IRS reported the average refund amount (aka money taxpayers overpaid the government) in 2023 as $2,753.

How to get the biggest tax refund in 2023

Follow these six tips to potentially get a bigger tax refund this year:Try itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Will my refund be bigger in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

Has anyone received tax refund 2023

Tax refund 2023: The IRS has issued 8 million refunds. Here's the average amount. – CBS News.

Are you good if the IRS accepts your return

When you receive confirmation that the IRS accepted your return, it means that they have reviewed your return, and it has passed their initial inspection. They verify your personal information and other basic items, like if your dependents have already been claimed by someone else.

How long does it take IRS to release funds after identity verification

If you provide the information the IRS requested, the IRS should correct your account and resolve the refund issue (generally within 60 days). If you file a missing or late return, the IRS will process your returns and issue your refunds (generally within 90 days).

Does refund being processed mean approved

This means the IRS has your tax return and is processing it. Your personalized refund date will be available as soon as the IRS finishes processing your return and confirms that your refund has been approved. Most refunds are issued in less than 21 days.