How long does it take to get 941x refund?

Can I track my employee retention credit refund

Employers who have claimed the Employee Retention Tax Credit (ERC) and are waiting for their refund can check the status of their return through two primary methods as noted on the IRS “Where's My Refund” website, specifically the Business Tax Return section.

Cached

How long is the IRS 941x processing time

approximately five to six months

If you filed your business's ERC claim with the Form 941-X:

Currently, the IRS has been processing these claims within approximately five to six months from the date they received them.

Cached

How much will I get back from ERTC

$26,000 per employee

Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2023 and 2023. The ERC / ERTC Program is a valuable tax credit you can claim.

How do I check the status of my 941x refund

Q: How do I check the status of my 941x refund A: You can check the status of your 941x refund by logging into your account on the IRS website. Once you are logged in, click on the “My Account” tab and then select the “Payments” option.

Why is my ERC refund taking so long

The way the IRS handles retroactive filings for companies looking to claim the ERC also contributes to longer wait times. Trained IRS staff must hand-process claims that are made on amended payroll returns. Additionally, the IRS has had staffing issues in recent years, compounding the delays.

Can I track my 941x refund

Q: How do I check the status of my 941x refund A: You can check the status of your 941x refund by logging into your account on the IRS website.

Why are employee retention credit refunds taking so long

In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.

Is the IRS paying interest on ERC refunds

In addition to paying out the refund amount requested, the IRS adds interest to the refunds for the time value of money.

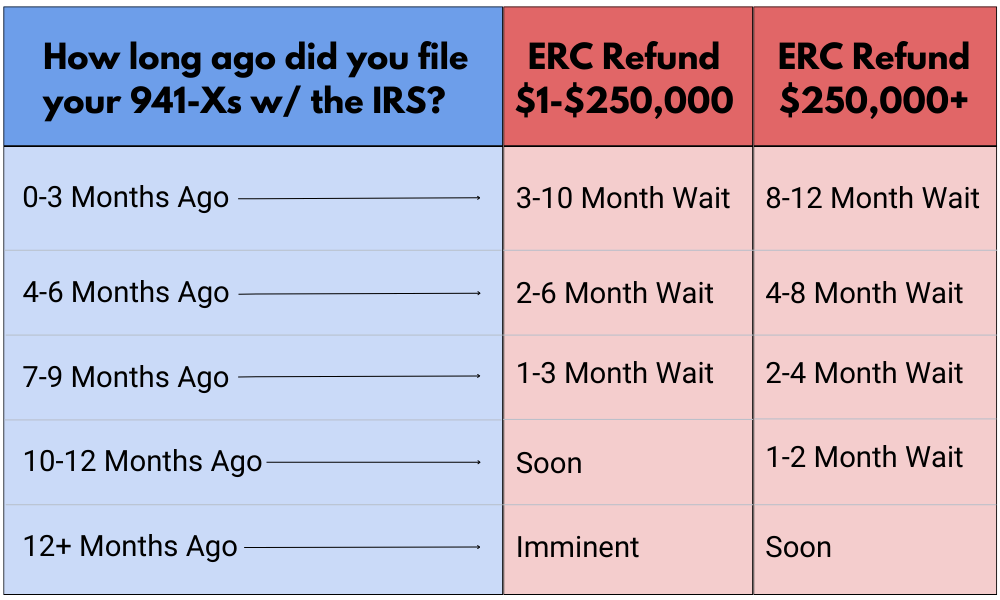

When should I expect my ERC refund

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

What is the backlog for IRS 941X

Just days before the release of the April 2023 draft version of Form 941-X (Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund), the Internal Revenue Service (IRS) announced a staggering backlog of nearly one million unprocessed Forms 941-X.

How long does it take to get ERC refund 2023

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

Why is my ERC credit taking so long

In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.

Why are ERC refunds taking so long

In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.

When should I expect my ERC money

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

How long are ERC refunds taking 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.