How long does it take to rebuild credit after Chapter 13?

How long after Chapter 13 will credit score increase

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can't remove bankruptcy from your credit report unless it is there in error.

Cached

How do I get my credit back after filing Chapter 13

You can work on building credit after a bankruptcy by disputing any errors on your reports, taking out a secured credit card or loan, having your rent payments reported to the consumer credit bureaus or becoming an authorized user on someone's credit card.

Cached

Is it hard to get credit after Chapter 13

It's usually harder to get new credit after a Chapter 13 or Chapter 7 bankruptcy. Interest rates and fees might be higher, and it could be harder to get approved. But it's vital that you get new credit after bankruptcy to show that you're a responsible borrower.

Cached

What happens after you pay off Chapter 13

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

How do I know when my Chapter 13 is over

About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.

What is the average credit score after Chapter 13

Your credit score will lower dramatically due to Chapter 13 being on your credit report. It will be removed after seven years. Credit scores tend to drop between 150 to 200 points after filing for bankruptcy. The average score is around 579.

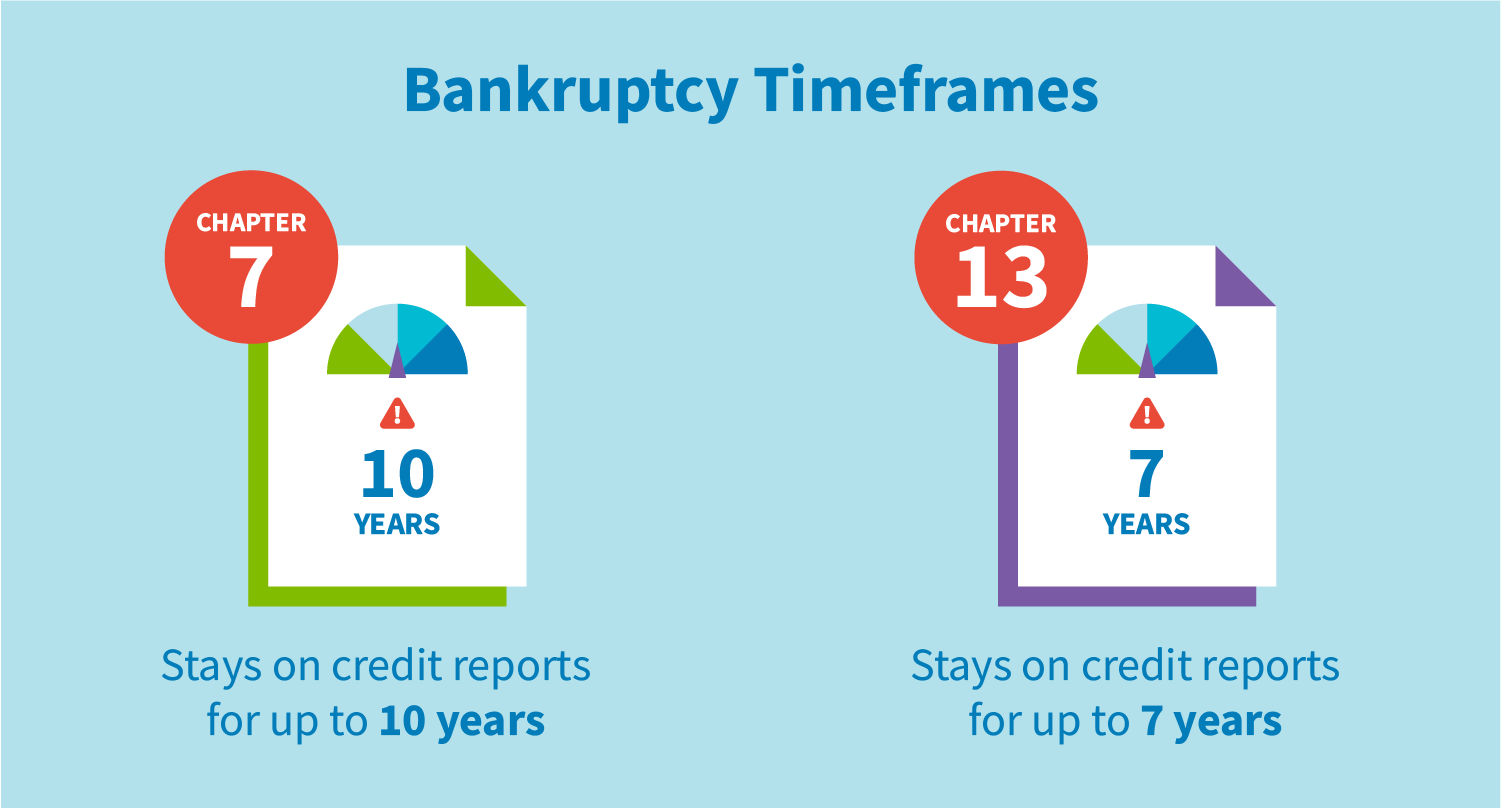

How long is your credit ruined from Chapter 13

seven years

Key takeaways. Filing for bankruptcy can hurt an individual's credit, and the impact can last for years. A Chapter 7 bankruptcy may stay on credit reports for 10 years from the filing date, while a Chapter 13 bankruptcy generally remains for seven years from the filing date.

How will I know when my Chapter 13 is over

About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.

How long does it take to clear Chapter 13

three to five years

Chapter 13 bankruptcy typically takes three to five years. During that time, you'll be on a repayment plan to repay some or a portion of your debts. There are a few factors that will determine how long your Chapter 13 repayment plan will last, including your income.

Why do most Chapter 13 bankruptcies fail

In most cases, failure is due to one of several reasons: Life circumstances. Not having the guidance of an experienced bankruptcy attorney. Over-ambition.