How long does it take to receive Ertc funds?

Can I track my ERC refund

Employers who have claimed the Employee Retention Tax Credit (ERC) and are waiting for their refund can check the status of their return through two primary methods as noted on the IRS “Where's My Refund” website, specifically the Business Tax Return section.

How is the ERTC paid out

The ERTC is fully refundable, and it is applied to the portion of payroll taxes paid by the employer.

How is the ERC credit received

The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back. For most taxpayers, the refundable credit is in excess of the payroll taxes paid in a credit-generating period.

Cached

Is money received from ERTC taxable

The short answer is no. The refund is not taxable under IRC § 280C. However, because these refunds are payroll tax credits, they'll reduce the amount your business can expense for payroll in each qualifying quarter.

Why is my ERC refund taking so long

The way the IRS handles retroactive filings for companies looking to claim the ERC also contributes to longer wait times. Trained IRS staff must hand-process claims that are made on amended payroll returns. Additionally, the IRS has had staffing issues in recent years, compounding the delays.

How can I check my ERC payment status

The best way to check the status of your ERC refund is by calling the IRS at 1-877-777-4778.

How long does it take to get a refund from ERC

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business. Early on in the process, refunds took four to six weeks.

How much will I get back from ERTC

$26,000 per employee

Depending on eligibility, business owners and companies can receive up to $26,000 per employee based on the number of W2 employees you had on the payroll in 2023 and 2023. The ERC / ERTC Program is a valuable tax credit you can claim.

Do I take the ERC into income when I receive it

Does the ERC Count Toward Your Income For Federal Taxes No, you do not need to include any part of the employee retention credit in gross income for federal income tax purposes. That's true of ERC funds received for any qualified wages, including allocable qualified health plan expenses.

How is ERC refund reported on tax return

When filing your federal tax return, the amount of your ERC refund is subtracted from your wages and salaries deduction. For example, a company that paid $100,000 in wages but received an ERC refund of $60,000 will only be able to report a wages and salaries deduction of $40,000.

How long does it take to get ERC refund

Unfortunately, average wait times can vary significantly. In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.

How long does it take to get ERC refund 2023

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

When should I expect my ERC money

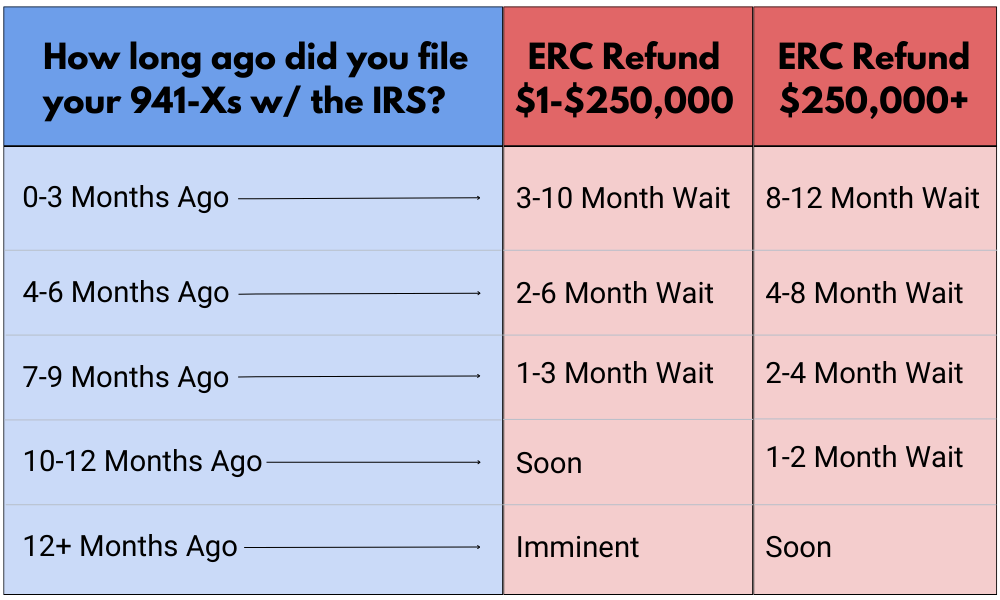

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

How long are ERC refunds taking 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

Why is my ERTC refund taking so long

Why Are Employee Retention Credit Refunds Taking So Long One reason so many eligible businesses have experienced such ERC refund delays is the large amount of 941-X forms the IRS has received. As of February 8, 2023, the agency lists its total inventory of unprocessed Forms 941-X at approximately 557,000.

What is the 26k for each employee

The ERTC is a refundable tax credit. It rewards businesses who kept employees during the COVID-19 pandemic, up to $26,000 per employee.

How long to receive ERC refund 2023

6-8 weeks

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it. Just keep in mind that the waiting time for ERC refunds varies from business to business.

When should I expect my ERC refund

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

How long are ERC refunds taking in 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

How long will it take to get my ERC refund

Unfortunately, average wait times can vary significantly. In the early days of the program, the estimated time for receiving ERC refunds was about two months or less. Since then, backlogs at the IRS have led to longer wait times. The agency is working to process all of the claims it has, but you should expect delays.