How long does TD take to approve?

How long does it take to get approved for a loan from TD

At TD Bank, the approval process for an unsecured personal loan typically takes about two days. Once you're approved, the funds are usually made available to you within 7 to 10 business days. If you're getting a TD Express Loan, the funds are available within 48 hours.

Cached

Does TD Bank give instant approval

In most cases, you'll receive an instant decision if you apply for a TD credit card online, by phone, or in person at a TD Bank branch. In some cases, however, TD Bank will need more time to review your application.

Is it hard to get a loan with TD Bank

TD Bank does not disclose a minimum credit score to take out a loan. As with other lenders, you'll need a strong credit score to get the lowest rates. We recommend a score of at least 670 to improve your chances of approval.

Cached

Which credit score does TD Bank use

TD Bank typically pulls credit reports from Experian when evaluating credit card applications, but it could use any of the three major credit bureaus (TransUnion, Equifax, Experian). So if any of your credit reports are frozen, you should unfreeze them before submitting an application for a TD Bank credit card.

What are the easiest loans to get approved for

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

How fast can a bank approve a loan

Almost every online lender, as well as most banks, can fund personal loans within five to seven business days. And in some cases, lenders may even offer same-day funding.

Which TD credit card is easiest to get approved

The easiest credit card to get from TD Bank is the TD Cash Secured Credit Card, which is available to applicants with bad credit. Depending on your credit score, you may be able to qualify for other TD Bank credit cards, too.

How long does TD Bank pending take

3 to 5 business days

When you make a Pending transaction, the Available Credit on your Account is automatically reduced by the amount of that transaction. It usually takes 3 to 5 business days for the Pending Transaction to post to your Account.

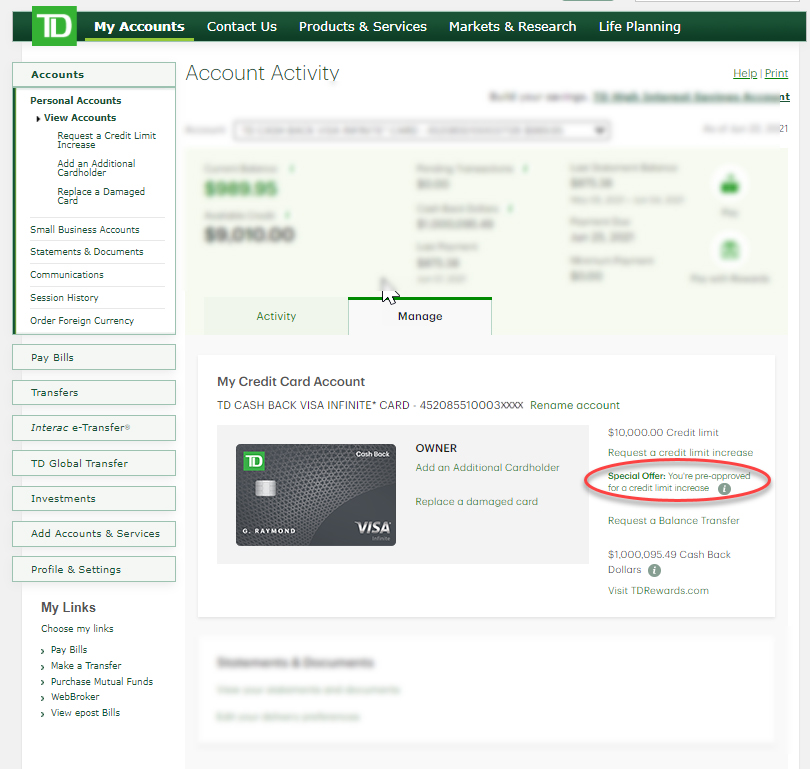

What is the minimum credit limit for TD

$300 to $5,000

TD Bank credit limits are $300 to $5,000, at a minimum, depending on the card. The TD Bank credit card with the highest starting credit limit is the TD First Class Credit Card, which is also rumored to offer limits as high as $18,000 to people with a lot of income.

What is the easiest TD Bank credit card to get

TD Cash Secured Credit Card

The easiest credit card to get from TD Bank is the TD Cash Secured Credit Card, which is available to applicants with bad credit. Depending on your credit score, you may be able to qualify for other TD Bank credit cards, too.

What is the lowest credit score to borrow

Generally, borrowers need a credit score of at least 610 to 640 to even qualify for a personal loan.

Which bank loan is easiest to get

The easiest banks to get a personal loan from are USAA and Wells Fargo. USAA does not disclose a minimum credit score requirement, but their website indicates that they consider people with scores below the fair credit range (below 640).

Can a bank deny a loan after approval

Yes, a loan can be denied after approval, but it rarely happens. It's more common for a loan to be denied after preapproval, which is a preliminary process that you can use to estimate how much you can borrow and what rates you may qualify for.

What is the fastest way to get a loan approved

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

What is TD minimum credit limit

The minimum credit limit for the Credit Card Account is $300, and you must deposit and maintain an amount up to your Credit Card Account credit limit in the Collateral Account within fifteen (15) business days from approval (if your account is approved).

Which bank gives fastest credit card

best instant approval credit cards in IndiaHDFC Bank instant approval credit card.Bajaj Finserv RBL Bank super card.Kotak 811 #Dream Different credit card.Standard Chartered virtual credit card.SimplySAVE SBI credit card.Axis Bank Insta Easy credit card.

What happens when you deposit over $10000 check

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.

Does TD Bank process on weekends

The role of business days and holidays

It's important to realize that weekends and federal holidays don't count as business days, even if your bank is open. If you make a deposit on or the day before a holiday, or on a weekend, you can expect to wait a little longer to access that money.

Is $1500 credit limit good

A $1,500 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

What is a good first credit limit

Generally, first-time credit card applicants receive small credit limits. A credit limit of $500 to $1,000 is average for a first credit card, but it may be higher if you have, say, a history of on-time car payments on your credit file.