How long does your refund stay in processing?

How long does refund say processing

How quickly will I get my refund (updated May 16, 2023) We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

What does it mean when the IRS says they are processing your refund

This means the IRS has your tax return and is processing it. Your personalized refund date will be available as soon as the IRS finishes processing your return and confirms that your refund has been approved. Most refunds are issued in less than 21 days.

Cached

What happens after your refund is processed

After the IRS approves your refund it can take several days for your bank to process and post the direct deposit to your account. Some institutions will issue your direct deposit on the same business day. However, the time it takes can depend on how busy your bank or credit union is.

Does processing mean accepted by IRS

Return Being Processed Means The IRS Received Your Tax Return, But It Could Still Be Delayed. Many taxpayers use the Where's My Refund tool and wonder what "Return being processed" means for them and their refund.

Does being processed mean approved

Return Received – The IRS has received your return and it's being processed. Refund Approved – They've processed your return and your refund has been approved. It will also provide an actual refund date. Refund Sent – Your refund has been sent to your bank for direct deposit or a paper check has been mailed.

Does processing mean approved

Return Received – The IRS has received your return and it's being processed. Refund Approved – They've processed your return and your refund has been approved. It will also provide an actual refund date.

How do I know if my refund is processing

Check your federal tax refund status

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can call the IRS to check on the status of your refund.

Is refund being processed a good thing

Key Takeaways: Receiving an IRS message that states, “We have received your tax return and it is being processed,” after filing your federal income tax return is a positive sign that your tax fund is likely to be released on the scheduled day.

How do I know if the IRS is processing my return

Tracking the status of a tax refund is easy with the Where's My Refund tool. It's available anytime on IRS.gov or through the IRS2Go App. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Does processed mean done

That has completed a required process.

What does it mean when it says processing

Processing is subjecting something to a series of actions in order to achieve a particular result.

What’s the difference between still processing and being processed

If their refund status changes from “still being processed” status to “being processed” status, the IRS may have detected an issue in your tax return that could cause a delay in the release of their tax refund.

Does being processed mean accepted

Return Received – The IRS has received your return and it's being processed. Refund Approved – They've processed your return and your refund has been approved. It will also provide an actual refund date. Refund Sent – Your refund has been sent to your bank for direct deposit or a paper check has been mailed.

What comes after processing

Data storage. The final stage of data processing is storage. After all of the data is processed, it is then stored for future use.

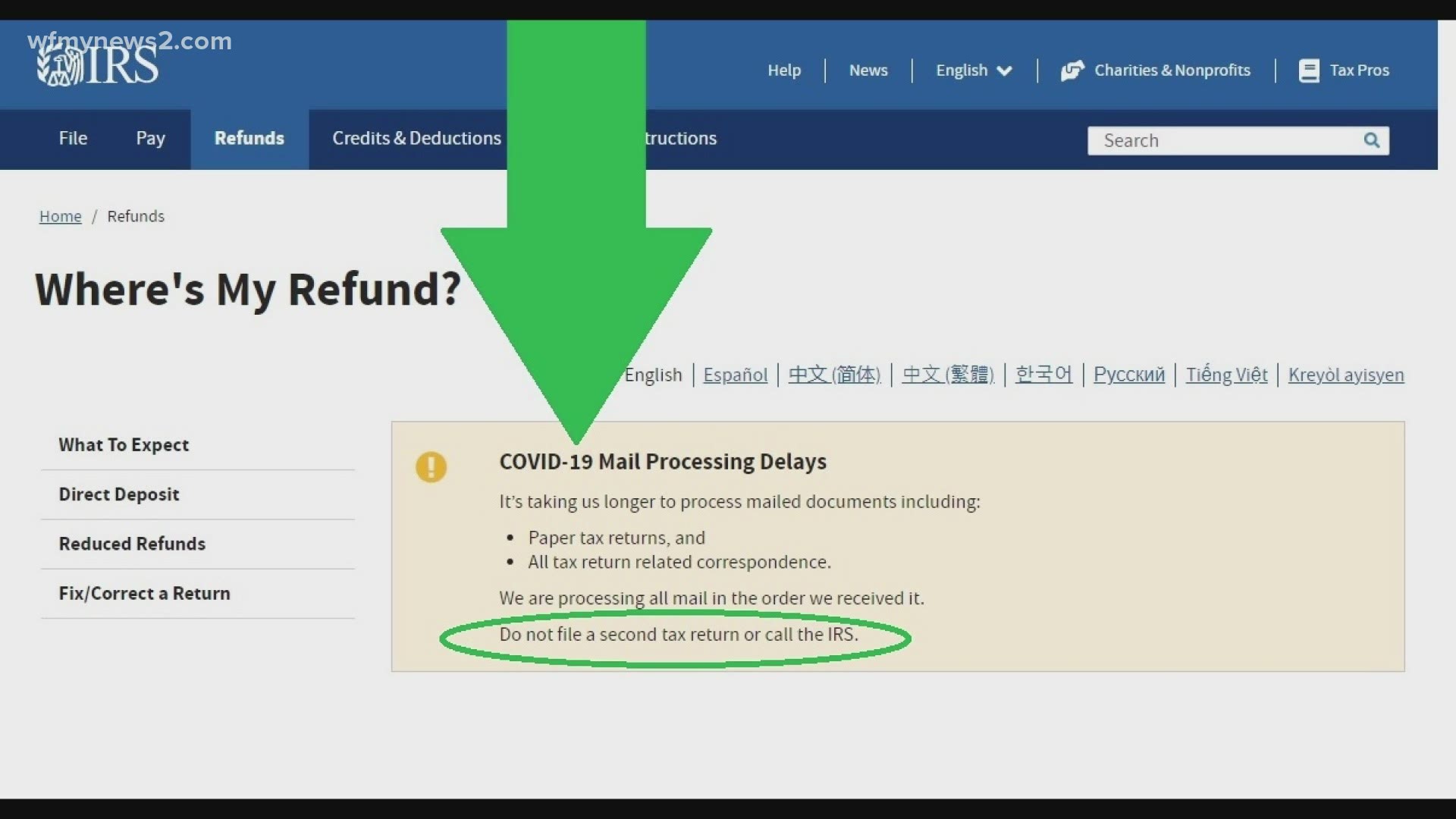

Should I call the IRS if my refund is still being processed

If none of these seem to fit

If you still aren't sure what happened with your refund, contact an IRS representative at IRS Tax Help Line for Individuals – 800-829-1040 (TTY/TDD 800-829-4059).

What’s the difference between being processed and still processing

Tax Return “Still Being Processed” vs. “Being Processed” The word “still” is the key difference and can have significant implications. If you see still being processed, it likely means your return processed has been delayed beyond the 21 day standard timeline.

What are the stages in processing

Six stages of data processingData collection. Collecting data is the first step in data processing.Data preparation. Once the data is collected, it then enters the data preparation stage.Data input.Processing.Data output/interpretation.Data storage.

Does still being processed mean approved

If their refund status changes from “being processed” status to “still being processed” status, the issue detected in the tax forms was likely resolved and the refund may be released when it is approved for a future cycle date.

What are the four 4 types of processing

Data processing modes or computing modes are classifications of different types of computer processing.Interactive computing or Interactive processing, historically introduced as Time-sharing.Transaction processing.Batch processing.Real-time processing.

What are the 4 main types of processing

This lesson introduces students to four common types of processing: if/then (conditionals), finding a match (searching), counting, and comparing.