How long is 20 credits for Social Security?

How long does it take to earn 20 credits for Social Security

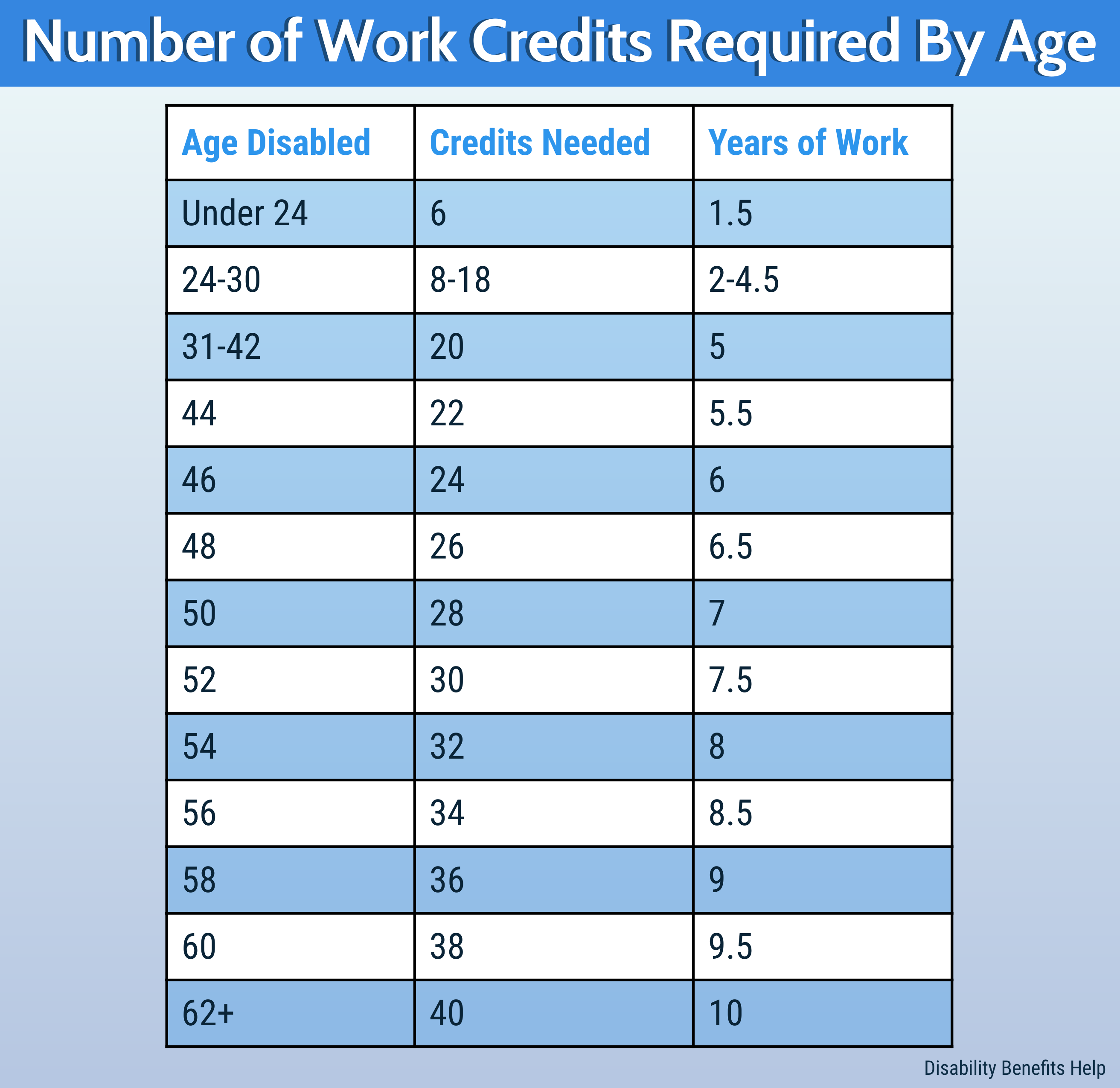

If you are between ages 24 through 30, you generally need credits for half of the time between age 21 and the time your disability began. A person with a qualifying disability at age 31 or older, generally needs at least 20 credits in the 10 years immediately before their disability began.

CachedSimilar

How do you get 40 work credits for Social Security

Earn 40 credits to become fully insured

You can work all year to earn four credits ($6,560), or you can earn enough for all four in a much shorter length of time. If you earn four credits a year, then you will earn 40 credits after 10 years of work.

Cached

Can I get Social Security if I only worked 10 years

You're eligible if: You're 62 or older. You've worked and paid Social Security taxes for 10 years or more.

What happens if you don t have 40 quarters for Social Security

If you don't earn 40 quarters of coverage, you, unfortunately, won't qualify for Social Security retirement benefits. Even if you fall just one quarter short, the SSA will not pay you retirement benefits.

What’s the lowest amount of Social Security you can get

The Social Security special minimum benefit provides a primary insurance amount (PIA) to low-earning workers. The lowest minimum PIA in 2023, with at least 11 years of work, is $49.40 per month. The full minimum PIA, which requires at least 30 years of work, is $1,033.50 per month.

How much Social Security will I get if I make 60000 a year

And older receive Social Security benefits. Making it an essential part of retiring in the u.s.. Benefits are based on your income. The year you were born and the age you decide to start taking money

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

Can I collect Social Security if I never worked

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

Can you collect Social Security if you never worked

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

How much Social Security will I get at 62 if I make 100k a year

If your highest 35 years of indexed earnings averaged out to $100,000, your AIME would be roughly $8,333. If you add all three of these numbers together, you would arrive at a PIA of $2,893.11, which equates to about $34,717.32 of Social Security benefits per year at full retirement age.

Can I draw Social Security at 62 and still work full time

You can get Social Security retirement or survivors benefits and work at the same time.

How do you get the $16000 Social Security bonus

How to Get a Social Security BonusOption 1: Increase Your Earnings. Social Security benefits are based on your earnings.Option 2: Wait Until Age 70 to Claim Social Security Benefits.Option 3: Be Strategic With Spousal Benefits.Option 4: Make the Most of COLA Increases.

What is the lowest Social Security payment

The Social Security special minimum benefit provides a primary insurance amount (PIA) to low-earning workers. The lowest minimum PIA in 2023, with at least 11 years of work, is $49.40 per month. The full minimum PIA, which requires at least 30 years of work, is $1,033.50 per month.

How much Social Security will I get if I make $60000 a year

And older receive Social Security benefits. Making it an essential part of retiring in the u.s.. Benefits are based on your income. The year you were born and the age you decide to start taking money

How much Social Security will I get at 62 if I make 40000 a year

The exact calculation produces a figure of about $1,172 per month.

How much Social Security will I get if I make $35000 a year

Simply put it's your monthly pay for the last 35 years there's still some math to get through your benefits are determined by been points in an equation. Almost like a tax bracket.

Can I draw Social Security at 62 and still work full time I 2023

If you will reach full retirement age in 2023, the limit on your earnings for the months before full retirement age is $56,520. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

How much Social Security will I get making 50000 a year

Suppose you were born on Jan. 1, 1960, and had an average annual income of $50,000. As of May 2023, you would get a monthly benefit of $1,386 if you filed for Social Security at 62; $1,980 at full retirement age (in this case, 67); or $2,455 at 70.

Do you get Social Security if you never worked

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

Is Social Security based on last 3 years of work

We: Base Social Security benefits on your lifetime earnings. Adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Calculate your average indexed monthly earnings during the 35 years in which you earned the most.