How long should you wait before requesting a credit limit increase?

How soon is too soon to ask for a credit limit increase

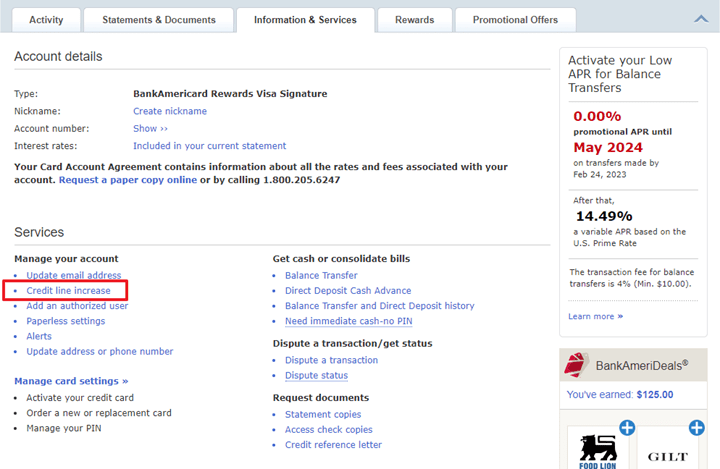

When you just opened the card or requested a credit limit increase: Many card issuers require you to wait at least three months after account opening before requesting a credit limit increase.

What is a reasonable credit limit increase request

The typical increase amount is about 10% to 25% of your current limit. Anything further may trigger a hard inquiry on your credit. If the bank denies the request, you may be able to make a counteroffer. Depending on the bank, you may not even have the opportunity to request a specific amount.

Cached

Does asking for a limit increase hurt credit

Bottom line

Regardless of whether your credit card issuer performs a hard or soft credit check (or both), when you ask for a higher credit limit, the impact those inquiries have on your credit score is typically negligible in the long run.

Is now a good time to ask for a credit limit increase

Simply put, the best time to ask for one is when your credit is good and you're making more money than you did before. Asking for a credit limit increase too soon could ding your credit score, so make sure you pay attention to these tips because timing is everything.

Cached

What’s a normal credit limit

What is considered a “normal” credit limit among most Americans The average American had access to $30,233 in credit across all of their credit cards in 2023, according to Experian. But the average credit card balance was $5,221 — well below the average credit limit.

What are the disadvantages of increasing credit limit

Higher limit means more total debt

One big downside of a higher limit is the potential for more debt. If you're experiencing financial difficulty and have used the rest of your available credit, you're likely better off refinancing your credit card debt via a lower-interest personal loan or line of credit.

What is a respectable credit limit

As such, if you have one of these cards, you might consider a $5,000 credit limit to be bad and a limit of $10,000 or more to be good. Overall, any credit limit of five figures or more is broadly accepted as a high credit limit. The main exception to the usual credit limit rules are secured credit cards.

What is the disadvantage of increasing credit limit

Higher limit means more total debt

One big downside of a higher limit is the potential for more debt. If you're experiencing financial difficulty and have used the rest of your available credit, you're likely better off refinancing your credit card debt via a lower-interest personal loan or line of credit.

What’s a good credit limit

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt. What qualifies as a good credit limit differs from person to person, though.

What is a good credit limit

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt. What qualifies as a good credit limit differs from person to person, though.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

How much is a good credit limit

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt. What qualifies as a good credit limit differs from person to person, though.

Is a 10k credit card limit good

Is a $10,000 credit limit good Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

Is a $10,000 credit limit high

Is a $10,000 credit limit good Yes a $10,000 credit limit is good for a credit card. Most credit card offers have much lower minimum credit limits than that, since $10,000 credit limits are generally for people with excellent credit scores and high income.

Is $25,000 a high credit card limit

Yes, a $25,000 credit limit is good, as it is above the national average. The average credit card limit overall is around $13,000, and people who have higher limits than that typically have good to excellent credit, a high income and little to no existing debt.