How long till medical bills affect your credit?

How long does it take for medical bills to hit credit

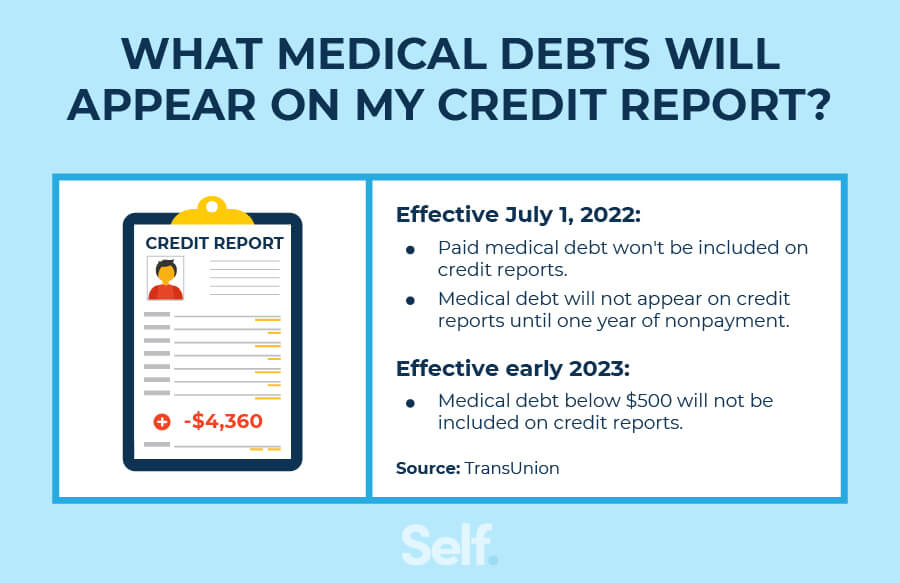

Even after your bill goes to collections, the account won't show up on your credit report right away, or possibly ever. The three main consumer credit bureaus—Experian, TransUnion and Equifax—give you a 365-day waiting period to resolve any medical debt before the collection account appears in your credit history.

Cached

How much do medical bills affect credit score

Most healthcare providers do not report to the three nationwide credit bureaus (Equifax, Experian and TransUnion), which means most medical debt billed directly by physicians, hospitals or other healthcare providers is not typically included on credit reports and does not generally factor into credit scores.

Cached

Do medical bills screw up your credit

Medical debt can ruin people's credit rating — making it hard to get a loan, mortgage or credit card.

Is it true that after 7 years your credit is clear

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Do medical bills under $100 affect credit

On April 11, 2023, Equifax, Experian and TransUnion announced that any medical collection debt below $500 will no longer be included on credit reports, regardless of whether the debt has been paid. Most medical collection debt on credit reports is under $500, according to the CFPB (PDF).

Will medical debt be forgiven

It's unlikely you'll get your medical debt forgiven, but there are ways to get some financial relief for those who qualify. Consider hospital forgiveness programs, assistance from specialized organizations and government assistance programs.

How do I remove medical debt from my credit report

However, medical collections can be inaccurate, and if you believe your medical collections were reported inaccurately to the credit bureaus, you have the right to dispute them with each credit bureau and may be able to get them removed or updated based on verification from the collection agency.

Is it true medical bills don t affect credit

The three nationwide credit reporting companies – Equifax, Experian, and TransUnion – also removed all paid medical debts from consumer credit reports and those less than a year old.

Can you have a 700 credit score with collections

It is theoretically possible to get a 700 credit score with a collection account on your credit report. However, it is not common with traditional scoring models. A derogatory mark like a collection account on your credit report can make it incredibly difficult to obtain a good credit score like 700 or over.

Can I be chased for debt after 10 years

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

What is the lowest you can pay for medical bills

Many people have heard an old wives' tale that you can just pay $5 per month, $10 per month, or any other minimum monthly payment on your medical bills and as long as you are paying something, the hospital must leave you alone. But there is no law for a minimum monthly payment on medical bills.

What is the new credit law in 2023

March 30, 2023: Reporting of Medical Debt

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

Will medical bills under $500 be removed from credit report

Have medical debt Anything already paid or under $500 should no longer be on your credit report.

What medical bills will be removed from credit report

On Tuesday, the three major credit bureaus — Equifax, Experian, and TransUnion — announced that medical collections with balances of $500 or less would no longer appear on consumer credit reports.

Does medical debt under 500 affect credit score

Have medical debt Anything already paid or under $500 should no longer be on your credit report. Consumer Financial Protection Bureau.

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

Is A 650 A good credit score

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Should I pay a debt that is 7 years old

Although the unpaid debt will go on your credit report and cause a negative impact to your score, the good news is that it won't last forever. Debt after 7 years, unpaid credit card debt falls off of credit reports. The debt doesn't vanish completely, but it'll no longer impact your credit score.

What is the highest credit score possible 2023

850

The perfect credit score number is 850. The highest FICO credit score you can have is 850, and the highest possible VantageScore is 850, too. That said, anything over 800 is basically perfect.

Does credit matter in 2023

Prices for FICO-issued mortgage credit scores for most in the lending industry will be increasing by 400% in 2023 — but the costs aren't rising as much for a small select group.