How many days before my statement date should I pay my credit card?

Is it best to pay credit card before statement date

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

Cached

Should you pay credit card on statement date or due date

You should always pay your credit card bill by the due date, but there are some situations where it's better to pay sooner. For instance, if you make a large purchase or find yourself carrying a balance from the previous month, you may want to consider paying your bill early.

How does the 15 3 rule work

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

What happens if you pay your credit card statement early

Increases your available credit

So, if you make payments to your card before your due date, you'll have a lower balance due (and higher available credit) at the close of your cycle. That means less credit card debt gets reported to the credit bureaus, which could help your credit score.

Is it bad to pay off credit card immediately

By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your chances of increasing your credit scores. Paying early can also help you avoid late fees and additional interest charges on any balance you would otherwise carry.

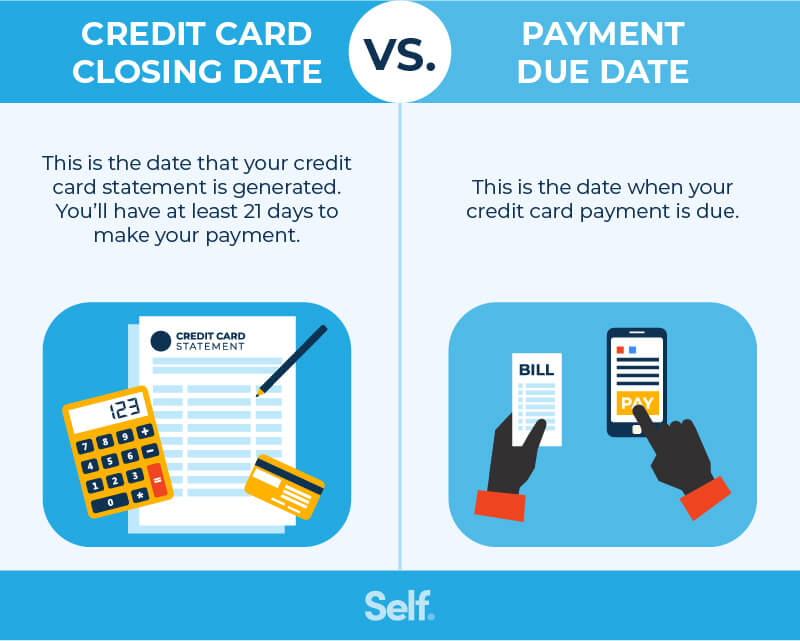

How many days between statement date and due date

21 to 25 days

Your statement closing date is the last day of your billing cycle, and it usually occurs at least 21 to 25 days before your due date. This is when interest and minimum payments are calculated, and your statement posts to your account or gets sent to you in the mail.

Can I pay my credit card the same day I use it

Yes, if you pay your credit card early, you can use it again. You can use a credit card whenever there's enough credit available to complete a purchase.

Does paying twice a month increase credit score

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.

What is the 15 and 3 credit hack

The 15/3 credit card hack is a payment plan that involves making two payments during each billing cycle instead of only one. Anyone can follow the 15/3 plan but it takes some personal management and discipline. The goal is to reduce your credit utilization rate and increase your credit score.

Is it bad to pay credit card a few days early

No. It's not bad to pay your credit card early, and there are many benefits to doing so. Unlike some types of loans and mortgages that come with prepayment penalties, credit cards welcome your money any time you want to send it.

Is it better to pay credit card early or on time

While there's no single answer to whether it's best to pay your credit card early vs. on time, it is safe to say you should avoid paying late. Aside from potentially incurring a late fee, making a late payment or missing a credit card payment can negatively impact your payment history and credit score.

Does paying early help credit score

Increases your available credit

So, if you make payments to your card before your due date, you'll have a lower balance due (and higher available credit) at the close of your cycle. That means less credit card debt gets reported to the credit bureaus, which could help your credit score.

What is the best billing cycle date for credit card

28th of every month is a sweet spot. Reason is as some banks report credit utilisation to CIBIL on 30/31 and some on Billing date. So if the date is kept on 28th no need to remember the credit utilisation reporting date for each card.

Why is my due date before my statement date

Your card's due date is the last moment your credit card company wants payment before they start charging late penalties and interest. You'll often have 20 to 25 days between your statement closing date and payment due date, known as the grace period.

What happens if I pay my credit card as soon as I use it

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.

What happens if I pay my credit card the day before its due

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

Is it bad to pay off your credit card multiple times a month

There is no limit to how many times you can pay your credit card balance in a single month. But making more frequent payments within a month can help lower the overall balance reported to credit bureaus and reduce your credit utilization, which in turn positively impacts your credit.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

How to get credit score to 800 in 3 months

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time.Keep Your Credit Card Balances Low.Be Mindful of Your Credit History.Improve Your Credit Mix.Review Your Credit Reports.

Does it matter how early you pay your credit card bill

4. Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.