How many days late before it is reported to credit bureau?

How late does a payment have to be to show up on credit report

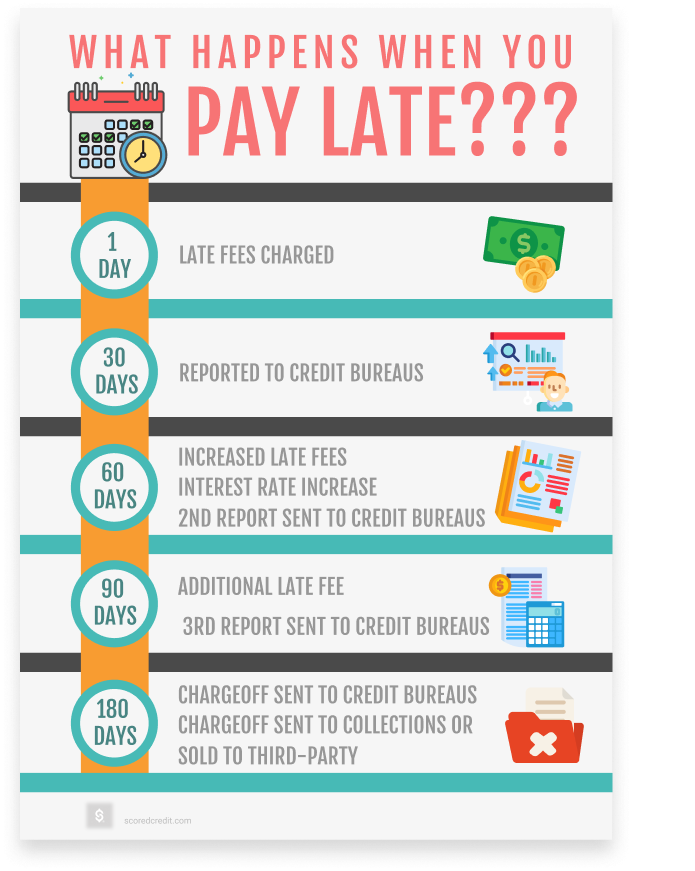

Creditors don't report a late payment to the credit bureaus until it's 30 days past due. However, you may still incur a late fee. Payments 30 or more days late: Once a late payment is 30 days overdue, it will appear on your credit report.

How much does 1 late payment affect credit score

Your credit score can drop by as much as 100+ points if one late payment appears on your credit report, but the impact will vary depending on the scoring model and your overall financial profile.

How many days after credit card due date does it report to credit bureaus

30 to 45 days

Add to that the fact that credit card issuers generally report every 30 to 45 days, but there aren't set guidelines and each creditor can choose when to report and whether to report to one, two or all three bureaus. And they do just that — they decide for themselves when to report and to whom.

Do credit cards report 1 day late

If you missed a credit card payment by one day, it's not the end of the world. Credit card issuers don't report payments that are less than 30 days late to the credit bureaus. If your payment is 30 or more days late, then the penalties can add up.

Does a 3 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Can you have a 700 credit score with late payments

It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates. Late payments (past due 30 days) appear in the credit reports of 33% of people with FICO® Scores of 700.

Can a late payment be removed from credit report

Remember: Accurately reported late payments can't be removed from your credit reports. And you can't pay someone else to remove accurate information from your reports either. But late payments will fall off your credit reports after seven years.

Will 2 days late show on credit report

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

What is the grace period after due date of credit card

A late payment fee is charged if the credit cardholder fails to clear dues even after three days past the due date. The late fee is typically added to the next billing cycle. Banks or credit card issuers decide the quantum of the late payment charges.

What happens if I pay my credit 1 day late

If you pay your credit card bill a single day after the due date, you could be charged a late fee in the range of $25 to $35, which will be reflected on your next billing statement. If you continue to miss the due date, you can incur additional late fees. Your interest rates may rise.

What happens if I pay my credit card bill 2 days late

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Will 3 late payments affect my credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Does a 7 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Will being 3 days late affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How does 1 30 day late affect credit score

A late payment can drop your credit score by as much as 180 points and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once you're 30 days past due, meaning your credit score won't be damaged if you pay within those 30 days.

What happens if you pay credit card 2 days late

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won't end up on your credit reports for at least 30 days after you miss the payment. Late fees may quickly be applied after the payment due date.

How much is the late fee for credit card

The charge will be ₹100 for the amount due between ₹101 to ₹500. You will have to pay INR 500 if the outstanding amount is between ₹501 to ₹5000. ₹700 if the outstanding amount is between ₹5001 to ₹15000. The charge will be ₹800 for the amount due is above ₹15000.

Can 2 days late payment affect credit

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

How much does a 2 day late payment affect credit score

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

What is the grace period for credit card

A grace period is the period between the end of a billing cycle and the date your payment is due. During this time, you may not be charged interest as long as you pay your balance in full by the due date. Credit card companies are not required to give a grace period.