How many full years do you need for full State Pension?

What is a full qualifying year for state pension

What is a qualifying year for the purpose of entitlement to state pension A qualifying year is a year when sufficient National Insurance contributions (NIC) have been paid, treated as having been paid, or credited to enable a claim to state benefits (mainly the new state pension) based on those contributions.

Do you have to do 20 years to get a pension

You are eligible to retire at any age after completing 20 years of creditable service. You may also receive a service retirement benefit at age 62, even if you do not have 20 years of creditable service.

How much pension will I get after 20 years

For example, retiring with 20 years of service means that your retirement pension will be 50% of that highest 36-month pay average. Waiting to leave after 40 years will make your pension 100% of your monthly pay average.

How many years does it take to get full retirement

For retirement benefits, at least 10 years. Social Security uses a system of credits, which you collect by working and paying Social Security taxes. You can earn up to four credits a year, and you need 40 credits to qualify for retirement benefits. The credit threshold may be lower for disability benefits.

What is the difference between the new and old State Pension

You can still delay taking your State Pension in the new system just like in the old scheme. You will get about 5.8% increase in your State Pension for every year you defer compared to the previous system which stood at 10.4%. The new State Pension, however, does not allow you take the deferred amount as a lump sum.

How can I increase my State Pension

How can I boost my state pension There are three main ways you can increase the amount you receive in your state pension – claiming free NI credits, buying extra years, or deferring.

How much Social Security will I get if I make $60000 a year

And older receive Social Security benefits. Making it an essential part of retiring in the u.s.. Benefits are based on your income. The year you were born and the age you decide to start taking money

Can you run out of a pension

In some cases, companies may terminate their pension plans. In other cases, defined benefit plans may be underfunded, meaning there are not enough assets to pay off the benefits promised to retirees. Pension plans can also be frozen, meaning no new benefits accrue and are no longer paid out to new retirees.

How much is a $30000 pension worth

As an example, examine how much an earned pension income of $30,000 would add to a person's net worth. A defined benefit plan income of $30,000 annually is $2,500 per month, which is 25 times $100.

What is the 100% retirement age

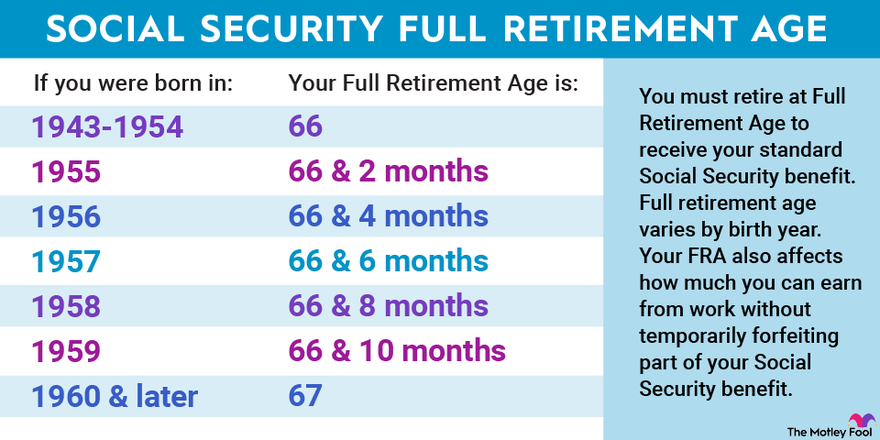

Once you reach your full retirement age, or FRA, you can claim 100 percent of the benefit calculated from your lifetime earnings. (Full retirement age is 66 and 4 months for people born in 1956 and 66 and 6 months for those born in 1957. It will incrementally increase to 67 over the next few years.)

Why am I not getting full State Pension

You may not qualify for the Basic State Pension yourself because you haven't paid enough national insurance contributions or received enough national insurance credits. You may still be able to claim Basic State Pension in some situations. You could also be eligible for Pension Credit to top-up your income.

Is a State Pension better than a 401k

Plan Stability

Pensions offer greater stability than 401(k) plans. With your pension, you are guaranteed a fixed monthly payment every month when you retire. Because it's a fixed amount, you'll be able to budget based on steady payments from your pension and Social Security benefits.

Which state government has the best pension

West Virginia has the highest percentage of its residents collecting Social Security benefits — one of the largest pension systems in the world — out of any state in the country.

How to retire at 62 with little money

A few options are available if you have little to no money saved for retirement. One option is to downsize your lifestyle and live in a more affordable location. Another option is to continue working part-time during retirement. Finally, you may collect monthly payments from Social Security.

How much Social Security will I get if I make $100000 a year

roughly $8,333

If your highest 35 years of indexed earnings averaged out to $100,000, your AIME would be roughly $8,333. If you add all three of these numbers together, you would arrive at a PIA of $2,893.11, which equates to about $34,717.32 of Social Security benefits per year at full retirement age.

Is $1,500 a month enough to retire on

That means that many will need to rely on Social Security payments—which, in 2023, averages $1,544 a month. That's not a lot, but don't worry. There are plenty of places in the United States—and abroad—where you can live comfortably on $1,500 a month or less.

What is an average pension amount

The average pension for all service retirees, beneficiaries, and survivors is $38,292 per year, while service retirees receive $41,040 per year. New retirees who just retired in FY 2023-22 receive $42,828 per year.

How much is a 50000 pension worth

Assuming you earn $50,000 and you're 61 years old now, Social Security's quick calculator says that you might expect roughly $19,260 per year at your Full Retirement Age of 67.

Is $500,000 enough to retire with a pension

With some planning, you can retire at 60 with $500k. Remember, however, that your lifestyle will significantly affect how long your savings will last. If you're content to live modestly and don't plan on significant life changes (like travel or starting a business), you can make your $500k last much longer.

What is a good monthly pension amount

Average Monthly Retirement Income

According to data from the BLS, average incomes in 2023 after taxes were as follows for older households: 65-74 years: $59,872 per year or $4,989 per month. 75 and older: $43,217 per year or $3,601 per month.