How many hard inquiries is too many for mortgage?

Can too many inquiries stop you from buying a house

Multiple inquiries from auto loan, mortgage or student loan lenders typically don't affect most credit scores. Second, you may also want to check your credit before getting quotes to understand what information is reported in your credit report.

Cached

How many hard inquiries is too many in 12 months

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Cached

How many hard inquiries are bad for financing

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

Cached

Do hard inquiries affect buying a house

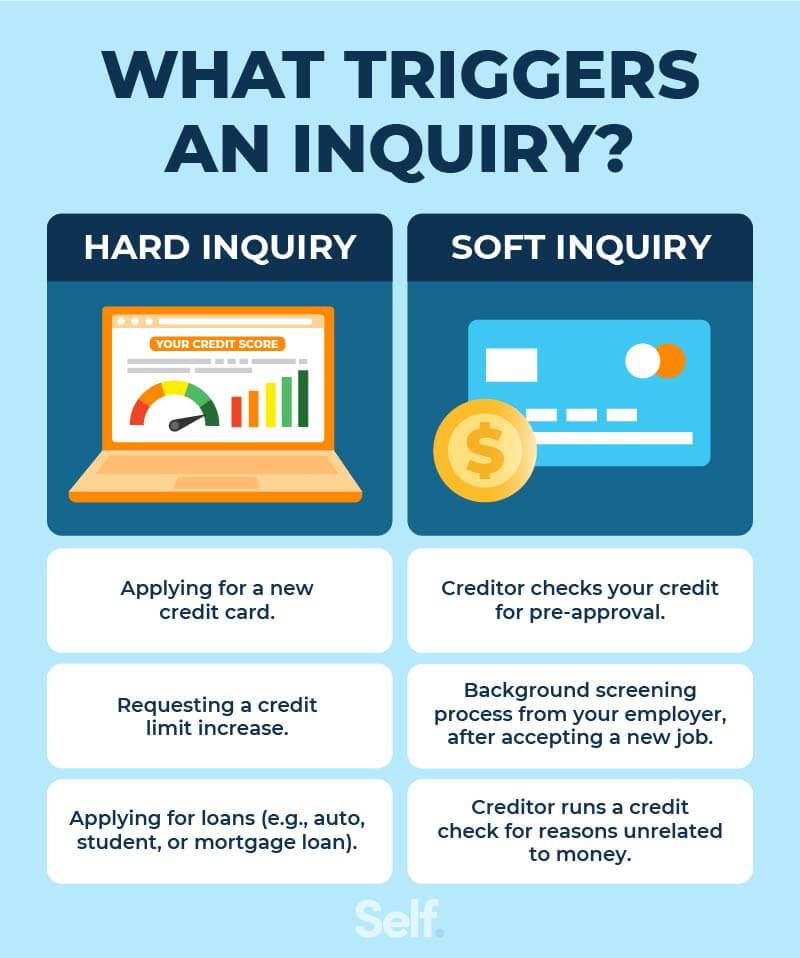

Here's why comparing rates can lower your credit score: Each time you apply for a home loan, a mortgage lender does an in-depth review of your credit report. This action is referred to as a hard inquiry, and it can impact your score. Read: Best FHA Loans.

Cached

Will a hard inquiry affect my mortgage approval

Your credit score might take an initial hit when you apply for a mortgage because the lender will have to open up a hard inquiry into your credit report. A hard inquiry (a.k.a., a “hard pull”) is when a lender pulls your credit report from one of the three main credit bureaus (Experian, Equifax or TransUnion).

Do mortgage lenders look at hard inquiries

Sometimes a credit inquiry during the mortgage application process. A hard pull on your credit report during the home loan application is not standard. But when a lot of time passes between being prepproved and closing on a home, then mortgage lenders may pull a second copy of your credit report.

Is 15 hard inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

How do you get rid of hard inquiries fast

The only way to get hard inquiries removed from your credit report in a single day is to dispute them as errors.

Is 10 hard inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

Do lenders care about hard inquiries

A hard inquiry will stay on your credit report for two years. While lenders can see all inquiries made during that time, the inquiries only directly affect your credit score for one year at most. That means that when you apply for a credit card, for instance, you may initially see a small drop in your credit score.

How many times can my credit be pulled when buying a house

three times

Many borrowers wonder how many times their credit will be pulled when applying for a home loan. While the number of credit checks for a mortgage can vary depending on the situation, most lenders will check your credit up to three times during the application process.

How far back do mortgage lenders look at credit inquiries

The typical timeframe is the last six years. Your credit history is one of the many factors that can affect your ability to get approved for a mortgage and a lender can pull up one of your credit reports to see financial information about you, within minutes.

How do I get rid of hard inquiries on my mortgage

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How many points does your credit drop when applying for a mortgage

Tracking The Credit Score Trajectory

Then once you actually take out the home loan, your score can potentially dip by 15 points and up to as much as 40 points depending on your current credit.

Is 7 hard inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

Can a lender remove a hard inquiry

If you did apply for a credit account or authorize a hard inquiry, you can't remove it from your reports. It remains on your credit reports as part of an accurate representation of your credit history. If that's the case, it should fall off your reports after about two years.

Is it bad to get multiple mortgage pre approvals

While many home buyers will only need one mortgage preapproval letter, there really is no limit to the number of times you can get preapproved. In fact, you can — and should — get preapproved with multiple lenders. Many experts recommend getting at least three preapproval letters from three different lenders.

How many times does underwriter pull credit

Number of times mortgage companies check your credit. Guild may check your credit up to three times during the loan process. Your credit is checked first during pre-approval. Once you give your loan officer consent, credit is pulled at the beginning of the transaction to get pre-qualified for a specific type of loan.

Will a hard inquiry affect my mortgage application

Your credit score might take an initial hit when you apply for a mortgage because the lender will have to open up a hard inquiry into your credit report. A hard inquiry (a.k.a., a “hard pull”) is when a lender pulls your credit report from one of the three main credit bureaus (Experian, Equifax or TransUnion).