How many is too many credit inquiries?

How many credit inquiries is too many in 12 months

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Cached

How many credit inquiries is normal

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

Cached

How many inquiries on credit is too much

A hard inquiry occurs when a lender or creditor pulls your credit report to make a lending decision. Too many hard inquiries on your credit report can lower your credit score and suggest that you're a high-risk borrower. Generally, having more than six hard inquiries within a six-month period is considered too many.

Cached

Is having 3 hard inquiries bad

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

Cached

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How long should I wait between credit inquiries

Bottom line. Generally, it's a good idea to wait about six months between credit card applications. Since applying for a new credit card will result in a slight reduction to your credit score, multiple inquiries could lead to a significantly decrease.

Why do I have 3 hard inquiries

Sometimes when you apply for credit, each application triggers a hard inquiry. That's how credit card applications work, for example. That means applying for multiple credit cards over a short period of time will lead to multiple hard inquiries.

How many points will my credit score go down with 3 hard inquiries

While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How hard is it to get a 750 credit score

To get a 750 credit score, you need to pay all bills on time, have an open credit card account that's in good standing, and maintain low credit utilization for months or years, depending on the starting point. The key to reaching a 750 credit score is adding lots of positive information to your credit reports.

What is Chase 2 30 rule

Two Cards Per 30 Days

Chase generally limits credit card approvals to two Chase credit cards per rolling 30-day period. Data points conflict on this but a safe bet is to apply for no more than two personal Chase credit cards or one personal and one business Chase credit card every 30 days.

What is the Capital One 6 month rule

Capital One also has a hard-and-fast rule when timing your applications. You're only able to get approved for one card every six months. This lumps personal and small-business cards together.

Why did my credit score drop 40 points for a hard inquiry

You recently applied for credit

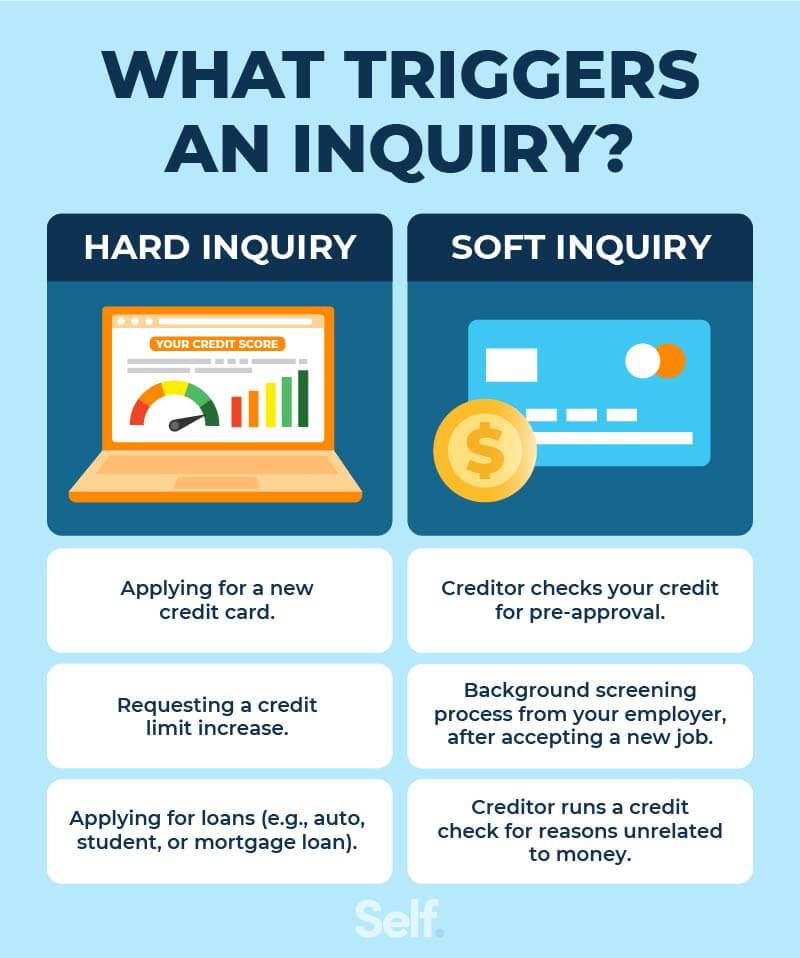

If you applied for a credit card or are shopping around for a loan, a hard inquiry can appear on your credit report, which temporarily lower a score. Hard inquiries happen when a lender or company reviews your report with the intent to make a lending decision.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

Is 525 a good credit score

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 525 FICO® Score is significantly below the average credit score.

What is 5 24 credit card rule

The Chase 5/24 rule is an unofficial policy that applies to Chase credit card applications. Simply put, if you've opened five or more new credit card accounts with any bank in the past 24 months, you will not likely be approved for a new Chase card.

How do you get around the Chase 5 24 rule

If you're at a Chase branch and told (without prompting) that you have been pre-approved for a credit card, you may be able to get approved in branch, thus getting around 5/24. Some data points also suggest submitting a paper credit card application in a branch location may also bypass 5/24.

Does Capital One raise your credit limit after 5 months

Some Capital One cards offer the possibility of a credit line increase after as few as six months of card membership. If you have a card that doesn't offer this opportunity, you might also be able to get a credit line increase by requesting one from the card issuer.

Can your credit score go up 50 points in a month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.