How many Pell grants do you need to qualify for 20k?

How much in Pell Grants to qualify for 20k forgiveness

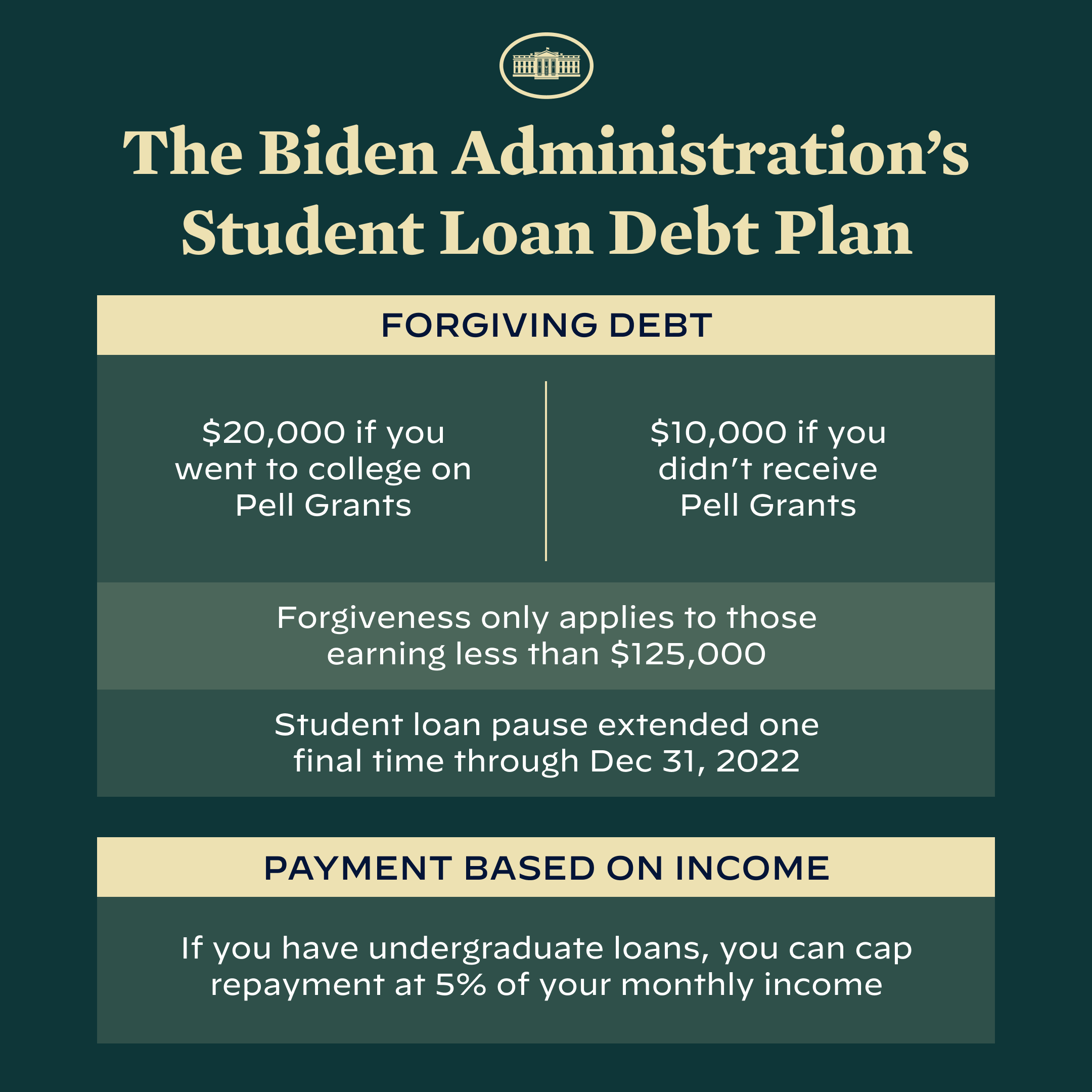

The application for $20,000 in student loan forgiveness is only available to those who received Pell Grants and whose income is less than $125,000 for single people and $250,000 for married couples who file a joint tax return. In the meantime, you can consider refinancing your private student loans.

Cached

Who gets $20,000 in student loan forgiveness

How much student loan debt will be forgiven The amount of debt forgiven depends on whether or not the borrower received a Pell Grant; those who did will receive up to $20,000 in debt cancellation. Other borrowers (who meet the income threshold requirements) will receive $10,000 in debt cancellation.

What is the $20000 in relief for Pell Grant recipients

The Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education, and up to $10,000 in debt cancellation to non-Pell Grant recipients.

Cached

What is 600% Pell limit

The Pell Grant lifetime limit is 100 percent of the total amount of aid you could receive each year over six years — totaling 600 percent of your scheduled award amount.

Which Pell Grants qualify for loan forgiveness

If you received a Pell Grant in college and meet the income threshold, you will be eligible for up to $20,000 in debt relief. If you did not receive a Pell Grant in college and meet the income threshold, you will be eligible for up to $10,000 in debt relief.

What is the maximum Pell Grant for 21 22

$6,495

The maximum Pell Grant award for the 2023-2023 award year is $6,495, and the corresponding maximum Pell Grant eligible expected family contribution (EFC) is 5846.

How do I know if I get 10k or 20k student loan forgiveness

If you meet the income criteria and owe money on federal student loans, you're eligible for $10,000 in student loan forgiveness, or up to your existing loan balance, whichever is less. If you also received a Pell Grant along with your student loans, you're eligible for up to $20,000 in loan forgiveness.

How to get up to $20,000 in student debt forgiveness that Biden just announced

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness. Pell grants are awarded to millions of low-income students each year, based on factors including their family's size and income and the cost charged by their college.

What is the largest Pell Grant you can receive

$7,395

The maximum amount of money you can get from a Pell Grant is: $7,395 (2023–24). The amount granted depends on your Expected Family Contribution (EFC), cost of attendance, your status as a full-time or part-time student, and your plans to attend school for a full academic year or less.

Can you pocket Pell Grant money

You can get over $6,000 in financial aid to pay for your education per academic year, and Pell Grants don't have to be repaid. If you're eligible for a larger Pell Grant than you need for school, you could even receive a Pell Grant refund and get the unused money to use for other expenses.

What does 200% Pell Grant mean

Pell Lifetime Eligibility Used

| <51% | The student has received Pell Grants for the equivalent of up to one-half of a school year. |

|---|---|

| 151% — 200% | The student has received Pell Grants for the equivalent of between one and one-half and two school years. |

How do I know if I maxed out my Pell Grant

You can receive the Pell Grant for no more than 12 terms or the equivalent (roughly six years). This is called the Federal Pell Grant Lifetime Eligibility Used (LEU). You'll receive a notice if you're getting close to your limit. If you have any questions, contact your school's financial aid office.

Do I get 20000 if I receive a Pell Grant once

Even receiving a single Pell Grant qualifies eligible borrowers for the $20,000 in student loan relief—even if their remaining loans are graduate school loans.

How do I know if I got a Pell Grant for forgiveness

You can log in to StudentAid.gov to see if you received a Pell Grant. We display information about the aid you received, including Pell Grants, on your account Dashboard and My Aid page. This information can be delayed. Reach out to your school's financial aid office if your information is outdated.

What is the highest income for Pell Grant

Amounts can change yearly. The maximum Federal Pell Grant award is $7,395 for the 2023–24 award year (July 1, 2023, to June 30, 2024). your plans to attend school for a full academic year or less.

How much is the full Pell for 2023

$7,395

The maximum Federal Pell Grant for the 2023–24 award year (July 1, 2023, through June 30, 2024) is $7,395. The amount an individual student may receive depends on a number of factors. Learn more via the links below: Learn what factors go into determining the amount of Pell Grant funding a student receives.

Who qualifies for $20 K student loan forgiveness

Current students who meet the income requirements and whose federal loans—including undergraduate, graduate, and Parent PLUS loans—were fully disbursed by June 30, 2023, are also eligible for forgiveness.

How to get $20 K student loan forgiveness

If you took out federal student loans and also received Pell Grants, you're eligible to have $20,000 of your federal debt forgiven. If you have federal student loans but didn't receive Pell Grants, your forgiveness amount is $10,000. Important information: The amount of your forgiveness is capped at your debt.

Who qualifies for Biden student loan forgiveness

Who qualifies for 2023 student loan forgiveness To be eligible for student loan debt cancellation, borrowers must have a 2023 or 2023 tax year income of less than $125,000 for individuals and less than $250,000 for married couples or heads of household.

Who doesn’t qualify for loan forgiveness

What student loans are not eligible for forgiveness Private student loans, by definition, are private and are not eligible to be forgiven. These are loans the borrower owes to student loan providers and not the federal government.