How many people in us are credit invisible?

What percentage of Americans are credit invisible

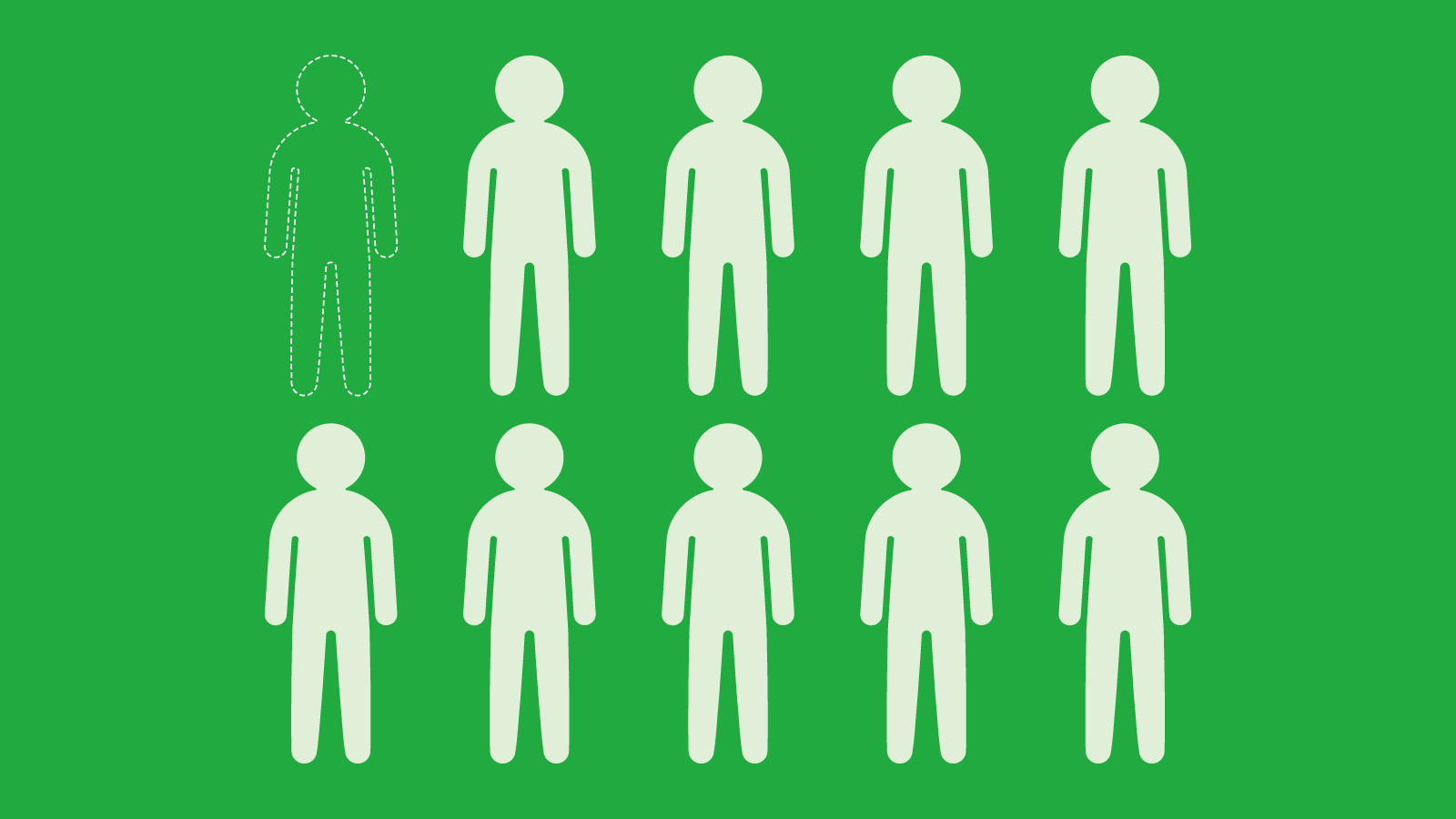

11%

Credit Invisible Total Population. The credit population of the U.S. can be broken down by location and credit classifications. Invisibles account for 11% of the total population, or 26 million U.S. residents. Unscorables account for 8% of the total population, or 21 million U.S. residents.

Cached

How many people in the US have no usable credit scores

These barriers include: Nearly 50 million people in the United States have no usable credit scores, making credit less accessible and more expensive for them.

Cached

What percent of people don’t have a credit score

The bottom line is that if you're among the 22% of Americans who don't have a credit score, it can be in your financial best interest to establish one.

Cached

What percentage of Americans have a credit score over 750

The latest data reveals that 16.4% of Americans have a FICO score of between 700 and 749. With 23.1% of consumers with a credit score between 750 and 799 and 23.3% of Americans in the highest credit score percentile, a total of 62.8% of the US population have a credit score over 700.

What percentage of US population has no debt

Fewer than one quarter of American households live debt-free. Learning ways to tackle debt can help you get a handle on your finances.

Is it bad to have no credit history

Not having a credit score isn't necessarily bad, but it's not ideal. It can prevent you from qualifying for loans, credit cards and housing and complicate your ability to rent cars and get cellphone and cable subscriptions. Establishing credit as early as possible is a good way to set yourself up for the future.

Does anyone have a credit score of 0

But your credit score won't start at zero, because there's no such thing as a zero credit score. The lowest score you can have is a 300, but if you make responsible financial decisions from the beginning, your starting credit score is more likely to be between 500 and 700.

How many Americans have a perfect credit score

1.2 percent

Although a lot of people might like the idea of a perfect credit score, Experian reports that only 1.2 percent of consumers' FICO scores are a perfect 850.

Is it normal to have no credit

Not having a credit score isn't necessarily bad, but it's not ideal. It can prevent you from qualifying for loans, credit cards and housing and complicate your ability to rent cars and get cellphone and cable subscriptions. Establishing credit as early as possible is a good way to set yourself up for the future.

Can you really live without a credit score

Living without a credit score (or with a bad one) is possible, but it will present challenges from time to time even if you never borrow money.

How rare is 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How rare is an 820 credit score

Membership in the 800+ credit score club is quite exclusive, with fewer than 1 in 6 people boasting a score that high, according to WalletHub data.

How many Americans are 100% debt free

Fewer than one quarter of American households live debt-free. Learning ways to tackle debt can help you get a handle on your finances.

Is it rare to have no debt

Between mortgage loans, credit cards, student loans, and car loans, it's not uncommon for the typical American to have one or more types of debt. The ones who are living debt-free may seem like a rarity, but they aren't special or superhuman, nor are they necessarily wealthy.

How many people have no credit

According to data from the Consumer Financial Protection Bureau (CFPB), as many as 26 million Americans are “credit invisible,” meaning they have no credit history.

Why do people have no credit history

Reasons you might not have a score are: You've never been listed on a credit account. You haven't used credit in at least six months. You have only recently applied for credit or been added to an account.

Can you live without a credit score

Living without a credit score (or with a bad one) is possible, but it will present challenges from time to time even if you never borrow money.

Is it OK to have no credit score

Not having a credit score isn't necessarily bad, but it's not ideal. It can prevent you from qualifying for loans, credit cards and housing and complicate your ability to rent cars and get cellphone and cable subscriptions. Establishing credit as early as possible is a good way to set yourself up for the future.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

What’s worse bad credit or no credit

Generally, having no credit is better than having bad credit, though both can hold you back. People with no credit history may have trouble getting approved for today's best credit cards, for example — while people with bad credit may have trouble applying for credit, renting an apartment and more.