How many points is a hard inquiry for a mortgage?

How many points does a hard inquiry affect credit score mortgage

about five points

How does a hard inquiry affect credit While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®.

Cached

How many points does your credit drop when applying for a mortgage

Tracking The Credit Score Trajectory

Then once you actually take out the home loan, your score can potentially dip by 15 points and up to as much as 40 points depending on your current credit.

How many hard inquiries is too many when buying a house

Each lender typically has a limit of how many inquiries are acceptable. After that, they will not approve you, no matter what your credit score is. For many lenders, six inquiries are too many to be approved for a loan or bank card.

Cached

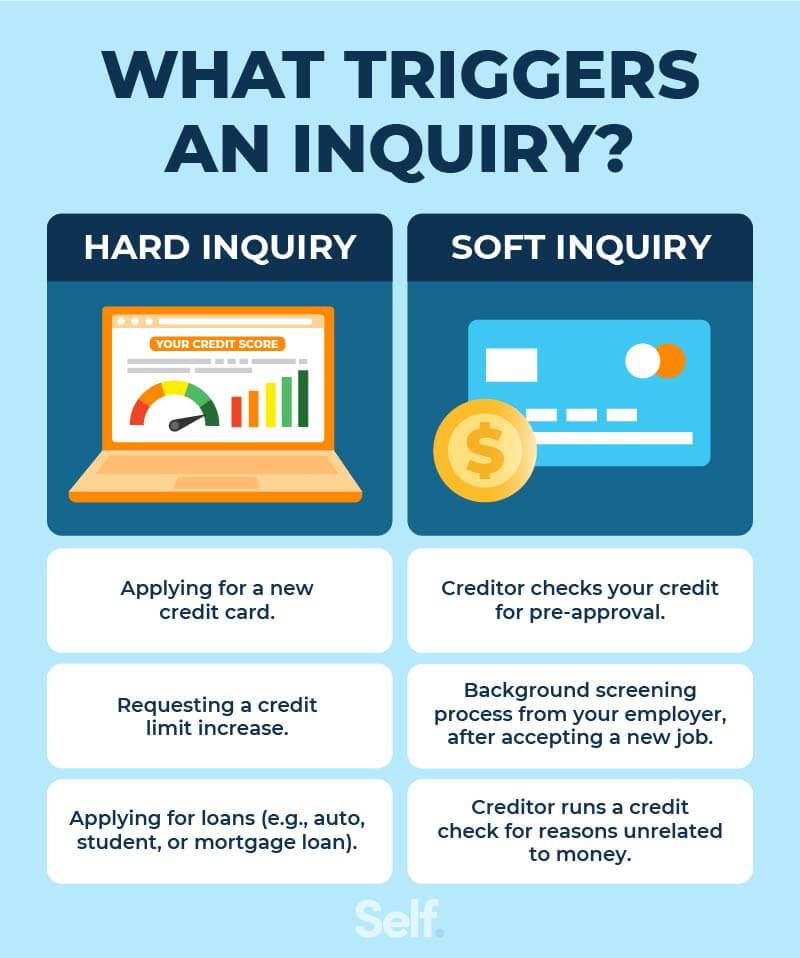

Will a hard inquiry affect my mortgage application

Your credit score might take an initial hit when you apply for a mortgage because the lender will have to open up a hard inquiry into your credit report. A hard inquiry (a.k.a., a “hard pull”) is when a lender pulls your credit report from one of the three main credit bureaus (Experian, Equifax or TransUnion).

Why did my credit score drop 40 points for a hard inquiry

You recently applied for credit

If you applied for a credit card or are shopping around for a loan, a hard inquiry can appear on your credit report, which temporarily lower a score. Hard inquiries happen when a lender or company reviews your report with the intent to make a lending decision.

Is 3 hard inquiries bad

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

How can I raise my credit score 40 points fast

Here are six ways to quickly raise your credit score by 40 points:Check for errors on your credit report.Remove a late payment.Reduce your credit card debt.Become an authorized user on someone else's account.Pay twice a month.Build credit with a credit card.

Why did my credit score drop 50 points after paying off mortgage

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How bad is 3 hard inquiries

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Is having 10 inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

What do lenders see on a hard inquiry

A hard inquiry requests your full credit history and credit score from a credit bureau. The lender or creditor making the request has the option to choose the bureau and credit report style that best fit its needs. Most lenders will rely on one or more of the top three credit bureaus: Experian, TransUnion, and Equifax.

How long after credit check can I get a mortgage

The period of time may vary depending on the credit scoring model used, but it's typically from 14 to 45 days. This allows you to check different lenders and find out the best loan terms for you.

Can your credit score go up 50 points in a month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How long is a credit pull good for mortgage

for 120 days

This initial credit inquiry is standard for all mortgage applications. Occasionally, the lender will need to pull your credit report again while the loan is processed. Credit reports are only valid for 120 days, so your lender will need a new copy if closing falls outside that window.

Can I raise my credit score 100 points in 3 months

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score drop 90 points for no reason

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

What is a high number of inquiries

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

How many hard inquiries are bad for financing

In general, six or more hard inquiries are often seen as too many. Based on the data, this number corresponds to being eight times more likely than average to declare bankruptcy. This heightened credit risk can damage a person's credit options and lower one's credit score.

Do lenders check credit right before closing

The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.