How many points will a foreclosure affect my credit score?

How much does your credit score drop with a foreclosure

Some homeowners with strong credit scores may see their scores drop by as much as 100 points or more after suffering a foreclosure. Homeowners with lower credit scores may see a smaller decline, but only because there's less room to fall.

Cached

Do foreclosures ruin your credit

Every late or missed payment can negatively impact your credit scores. Unfortunately, a foreclosure remains on your record with all three nationwide credit bureaus for seven years. However, the negative impact of a foreclosure lessens over time.

How long is credit ruined after foreclosure

Foreclosure information generally remains in your credit report for seven years from the date of the foreclosure. Even if you have a bad credit history or a low credit score, you may qualify for an Federal Housing Administration (FHA) loan.

How do I fix my credit after a foreclosure

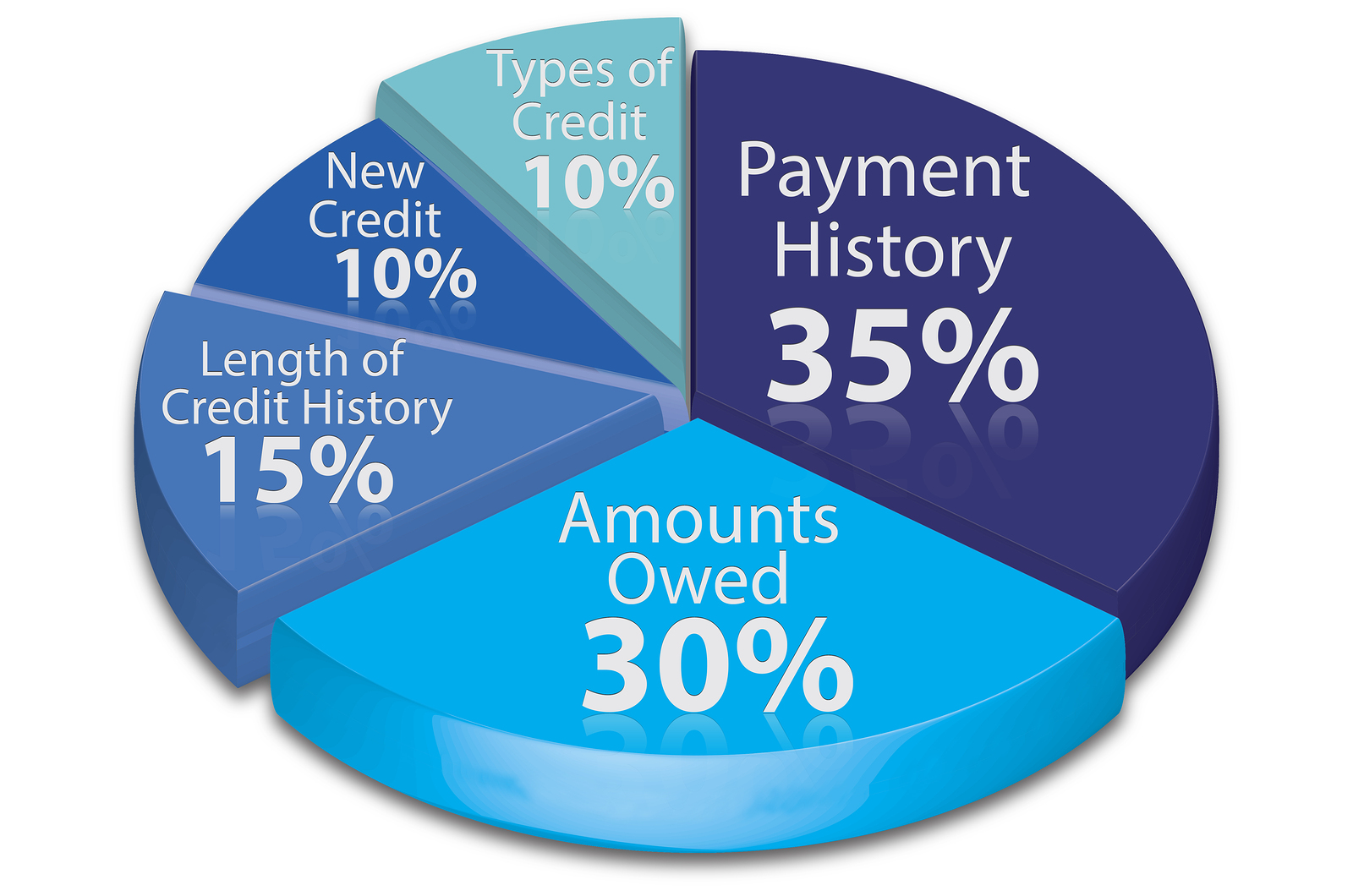

How to improve your credit scores after an eviction or foreclosureMonitor your credit reports and credit scores. Keep a careful eye on your credit reports and scores as you work to rebuild your credit history.Work on your payment history.Lower your credit utilization ratio.Consider a secured credit card.

Can you recover from a foreclosure

A foreclosure can cause your credit scores to drop dramatically, but it's possible to bounce back from one. After your home is foreclosed upon, you can immediately start taking steps to restore your credit.

What is the downside of a foreclosure

Increased maintenance concerns: Some homeowners have no incentive to maintain the home's condition when they know they're going to lose their property to foreclosure. If something breaks, the homeowner won't spend money to fix it, and the problem could get worse over time.

Can I rebuild credit after foreclosure

Foreclosures may remain on your credit report for seven years, but maintaining payments on your other credit accounts during those seven years will help balance out the negative entry. Make sure you pay your bills on time, in full and consider applying for a credit card that can help you bounce back.

How bad is foreclosure really

A foreclosure won't ruin your credit forever, but it will have a considerable impact on your credit scores, as well as your ability to qualify for another mortgage. Also, a foreclosure could impact your ability to get other forms of credit, like a car loan, and affect the interest rate you receive as well.

Is there life after foreclosure

About half of homeowners don't even move from their home after a foreclosure, meaning the foreclosure is worked out via refinancing or mortgage adjustments. If you have to move, you'll probably live in a neighborhood just like the one you lived in before the foreclosure.

Why is my foreclosure not on my credit report

Foreclosures, like other negative marks, won't be on your credit report forever. In fact, a foreclosure must be removed seven years after the date of the first late payment that led to its default. In credit reporting terms, this is called the date of first delinquency, or DoFD.

How long does it take to build credit after foreclosure

seven years

Foreclosure stays on your credit report for seven years.

A foreclosure stays on your credit report for seven years from the date of the first missed payment that led to it, but its impact on your credit score will likely fade earlier than that.

How hard is it to recover from foreclosure

It can take anywhere from three to seven years to fully recover. A low credit score due to foreclosure can result in expensive interest rates and limited credit, making financial recovery difficult.

How does foreclosure affect your future

Once a home is lost to foreclosure, the homeowner's credit score could drop dramatically. According to FICO, for borrowers with a good credit score, a foreclosure can drop your score by 100 points or more. If your credit score is excellent, a foreclosure could reduce your score by as much as 160 points.

What is worse than foreclosure

A foreclosure or short sale, as well as a deed in lieu of foreclosure, are all pretty similar when it comes to impacting your credit. They're all bad. But bankruptcy is worse.

What are the repercussions of a foreclosure

The significant impacts for homeowners include the loss of Down Payment, Mortgage Loan Payments, and of the Equity in the home. Through foreclosure, homeowners lose the down payment made at the time of purchase and the mortgage loan payments they made during the ownership of their home.

Can a person recover from foreclosure

A foreclosure can cause your credit scores to drop dramatically, but it's possible to bounce back from one. After your home is foreclosed upon, you can immediately start taking steps to restore your credit.

How long does it take for a foreclosure to show on your credit report

A foreclosure entry typically appears on your credit report within a month or two after the lender initiates foreclosure proceedings. The entry remains on your credit report for seven years from the date of the first missed payment that led to the foreclosure. After that, it is deleted from your report.

Can you ever recover from a foreclosure

The negative effects of foreclosure don't last forever. If you improve your finances, you can also improve your credit score. After a few years, it may be possible to get another mortgage or another type of loan with credit terms that are comparable to what you could have gotten before the foreclosure.

How many months behind before you go into foreclosure

In general, mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage payment. Late fees are charged after 10-15 days, however, most mortgage companies recognize that homeowners may be facing short-term financial hardships.

What is the best alternative to foreclosure

Your mortgage servicer might offer the following options as an alternative to foreclosure:Forbearance. This option temporarily suspends payments, allowing you time to make up the shortfall.Repayment Plan.Loan Modification.Refinance.Partial Claim.Forgiving a Payment.