How many receive child tax credit?

How many people claimed Child Tax Credit

| State | Number of Qualifying Children (000s) | Total Payment Amount ($000s) |

|---|---|---|

| Arizona | 1,356 | 344,278 |

| Arkansas | 585 | 150,288 |

| California | 6,564 | 1,621,878 |

| Colorado | 992 | 244,566 |

How many monthly child tax credits are there

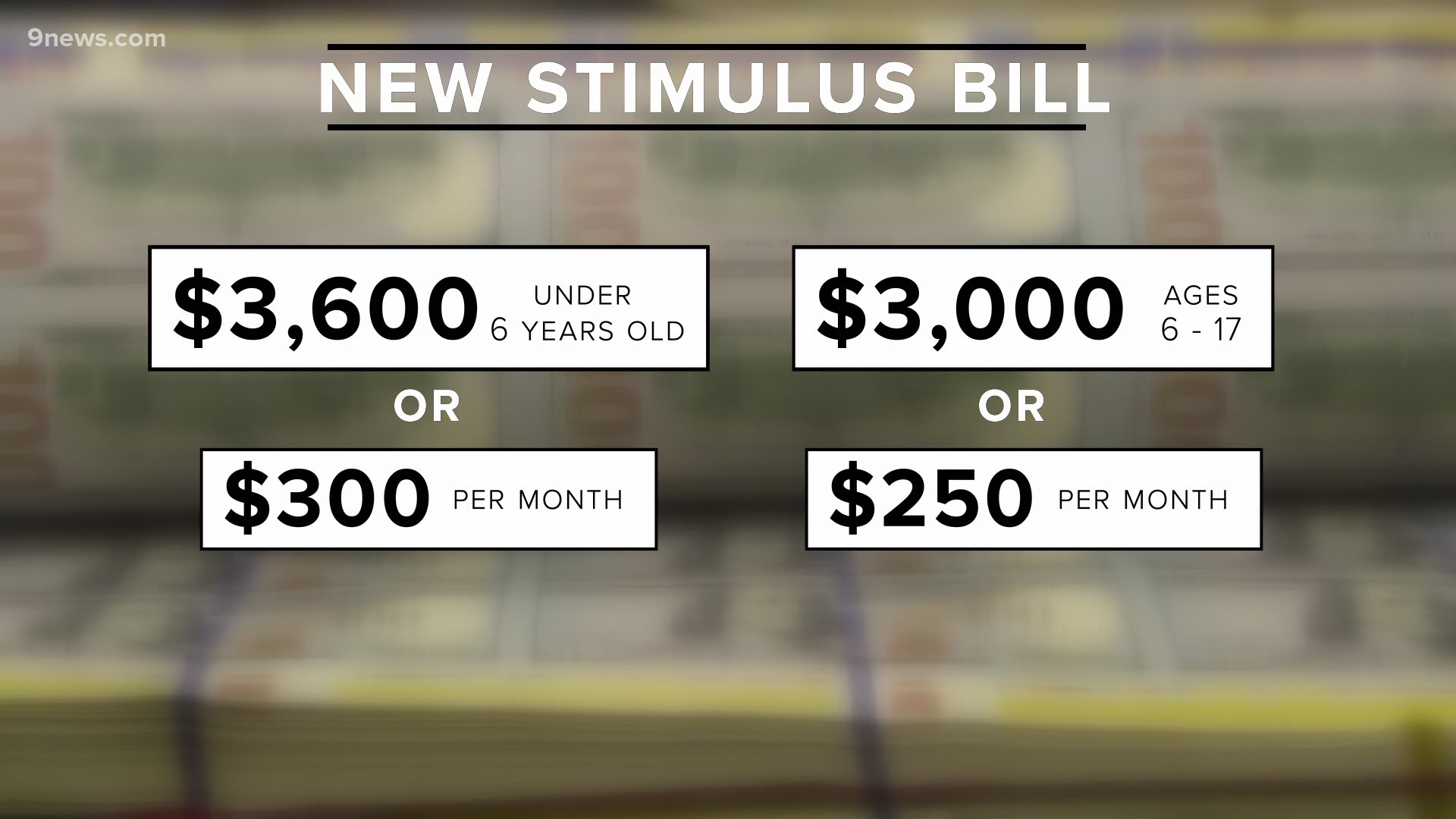

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

How do I know if I received Child Tax Credit

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

How many people receive earned income tax credit

2023 EITC Tax Returns by State Processed in 2023

As of December 2023, 31 million workers and families received about $64 billion in EITC.

How many Americans get earned income credit

EITCs are a tax benefit designed to help low- to moderate-income working people. The federal government, 31 states, the District of Columbia, Guam, Puerto Rico and some municipalities have EITCs. More than 25 million eligible tax filers received almost $60 billion in federal EITC during the 2023 tax year.

When did the Child Tax Credit end

The reason why is that the enhancements that Congress made to the child tax credit were temporary. They all expired on December 31, 2023, including the monthly payments, higher credit amount, letting 17-year-olds qualify, and full refundability.

Are we getting Child Tax Credit every month

For every child 6-17 years old, families will get a monthly payment of $250, and for children under 6 years old, families will get $300 each month. The 80% of families who get their refunds from the IRS through direct deposit will get these payments on the 15th of every month until the end of 2023.

Why I didn’t receive my Child Tax Credit

If you filed a 2023 tax return but didn't get the Child Tax Credit and were eligible for it, you can amend your tax return. Contact your local Volunteer Income Tax Assistance (VITA) site to see if they file 2023 tax returns. You can also use GetYourRefund.org. Learn more about filing prior year tax returns.

When can I check my refund status with Child Tax Credit

You can start checking on the status of your refund within: 24 hours after e-filing a tax year 2023 return. 3 or 4 days after e-filing a tax year 2023 or 2023 return. 4 weeks after filing a paper return.

Who receives the highest Earned Income Tax Credit

Earned Income Tax Credit (EITC): What It Is, How to Qualify in 2023-2023. In general, the less you earn, the larger the credit. Families with children often qualify for the largest credits.

Does everyone get earned income credit

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

Why did I get a $250 check from the IRS

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

Did the federal Child Tax Credit end

In 2023, parents were eligible to receive up to $3,600 for each child under six and $3,000 for other children, including 17-year-olds. Those enhancements have since expired, and the program has reverted to its original form in 2023, which is less generous at $2,000 per dependent under age 17.

Why did I get $250 from IRS today

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

Is child tax credit delayed

The bigger and better child tax credit from 2023 is not extended to 2023. It is replaced by a new set of rules for taking the credit on 2023 returns.

Why are refunds delayed with a child tax credit

It's all about preventing fraud

Because the EITC is fully refundable, it's been associated with higher levels of fraud. As such, the Protecting Americans from Tax Hikes (PATH) Act made changes to tax laws that now require the IRS to hold refunds associated with the EITC through mid-February.

Why is the IRS holding refunds with child tax credits

Why We Hold Your Refund. By law, we can't issue EITC or ACTC refunds before mid-February. This includes your entire refund, not just the part that's related to the credit you claimed on your tax return. If you claim the EITC or ACTC, we may need more information from you about your return.

What day does IRS deposit refunds 2023

The law requires the IRS to hold the entire refund – not just the portion associated with EITC or ACTC. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

Who benefited most from the Child Tax Credit

A wide range of Americans benefited from expanded child tax credit (CTC) payments in 2023. Bar chart showing that Americans who are middle-income, white, and have at least some college education made up the most substantial shares of CTC recipients.

How many people get earned income tax credit

Nationwide as of December 2023, about 31 million eligible workers and families received about $64 billion in EITC.