How many times can I use Self credit builder?

Can I have 2 credit builder accounts

If you previously had a Credit Strong account that is now closed, you can still open a second account. However, you won't be eligible for a third account. The information from your account will be automatically filled in on your new application, making it easy to add another credit builder loan to your credit history.

Cached

What happens after you complete self credit builder

Once you finish your first Self loan, you close your account and get your principal back. That means you get back the money you paid into your loan (minus interest). While some people use that savings to set up an emergency fund, or apply it as a down payment on a car loan or secured credit card, the choice is yours.

How often should I use my self credit card

Use the card for everyday expenses that fit within your credit limit, and remember to make on-time payments every month so that you can continue to establish a positive credit history. Another good way to build your credit with the Self Visa is to pay off your card in full as often as possible.

Cached

What is the downside to self credit builder

Self credit builder pros include flexible payment options, nationwide availability, and access to the Self Visa secured credit card. Cons include relatively high APRs and non-refundable fees.

Cached

How many self builder loans can you have

At any given time, you can only have one active Credit Builder Account. After you've successfully completed one Credit Builder Account, you are welcome to re-apply for another account, with a few exceptions.

Can I add money to my credit builder

The easiest way to move money into Credit Builder is by using Move My Pay. This optional feature will move the amount of your choice into Credit Builder on every payday. You can also manually move money from your checking account at any time. Just tap Move money in the app to get started.

Can I use self credit builder again

After you've successfully completed one Credit Builder Account, you are welcome to re-apply for another account, with a few exceptions. To help you build positive credit habits, there is a limit to the number of new Credit Builder Accounts you can open during a certain time period.

Does paying more on self build credit faster

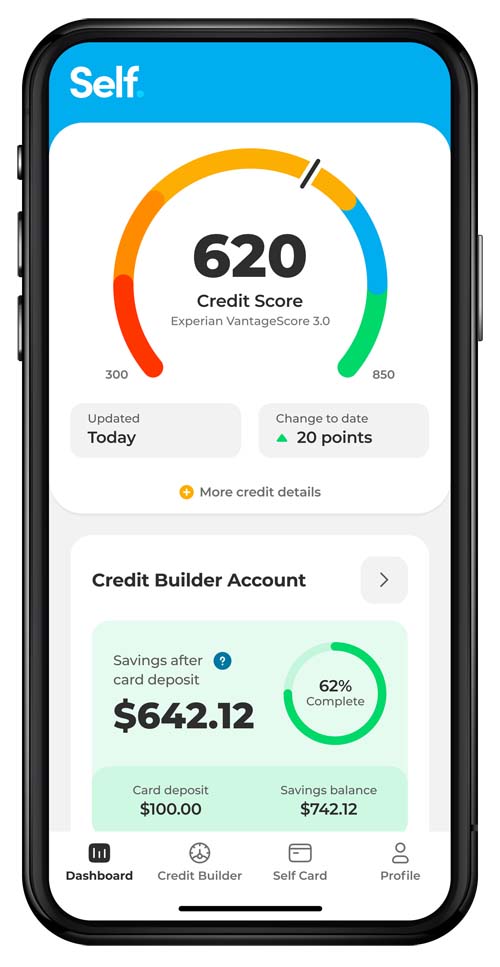

On average, consumers see a 32-point increase in their credit score from the Self Credit Builder Account. But the change in your credit score may be more or less significant. It depends on your credit profile, credit history, how long you keep the Credit Builder Account open and if you make timely payments.

How often should I use my $200 credit card

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

What is the limit on credit builder

On-time payments to your Credit Builder strengthens your payment history and helps improve credit. The Line of Credit that comes with Credit Builder has a limit of $1,000, which increases your overall credit limit and can help to lower your overall credit utilization when you keep your balance low.

Can I spend my credit builder balance

Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month.

Can I reopen my self lender account

It is the company's decision as to whether they honor your request. The chances are that they will hinge on two factors: their discretion and why the account was closed in the first place. If you closed the account yourself, you may have more success in asking the company to reopen it.

How high does self credit limit go

$3,000

The minimum credit limit is $100. As you make payments on your Credit Builder Account each month, you can choose to increase your credit limit up to a maximum limit of $3,000. Plus, Self considers those who have held a Self Visa card for six months or longer for an unsecured credit limit increase.

How long does it take for self to raise credit score

six months

How Fast Could Self Build Your Credit Score It generally takes at least six months to build your credit score from scratch. This is the amount of time FICO needs to calculate your credit score. You could get a VantageScore from the moment your new Credit Builder Account is reported to the credit bureaus.

How much of my $500 credit card should I use

The less of your available credit you use, the better it is for your credit score (assuming you are also paying on time). Most experts recommend using no more than 30% of available credit on any card.

How much of my $600 credit card should I use

What is a good credit utilization ratio According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

Can you have 2 self cards

Right now, you can only have one Self Credit Builder Account open at a time. After you complete one Credit Builder Account though, you can apply for another, with a few exceptions. You can also access the Self Visa ® Credit Card a few months after opening a Credit Builder Account if you're eligible.

Is a credit builder loan a good idea

If you make regular on-time monthly payments, credit-builder loans are a good opportunity to improve your credit scores. Higher credit scores mean you'll have a better chance of being approved to take on important future debt, such as mortgages and auto loans.

Can I use my credit builder card with no money on it

The money you move into the Credit Builder secured account is the amount you can spend on your card (no minimum deposit required!). Turn on Safer Credit Building and have your monthly balance automatically paid on time.

How much can I withdraw from credit builder

$500 every

You can withdraw your available spend amount or up to $500 every 24 hours. The limit is $500 for withdrawals and $7,500 for purchases per day. Can I overdraft my Chime Credit Builder Visa® Card Your Chime Credit Builder card is secured, which means you cannot overdraft it.