How much a month is a 1000 loan?

How much would a $1,000 loan cost per month

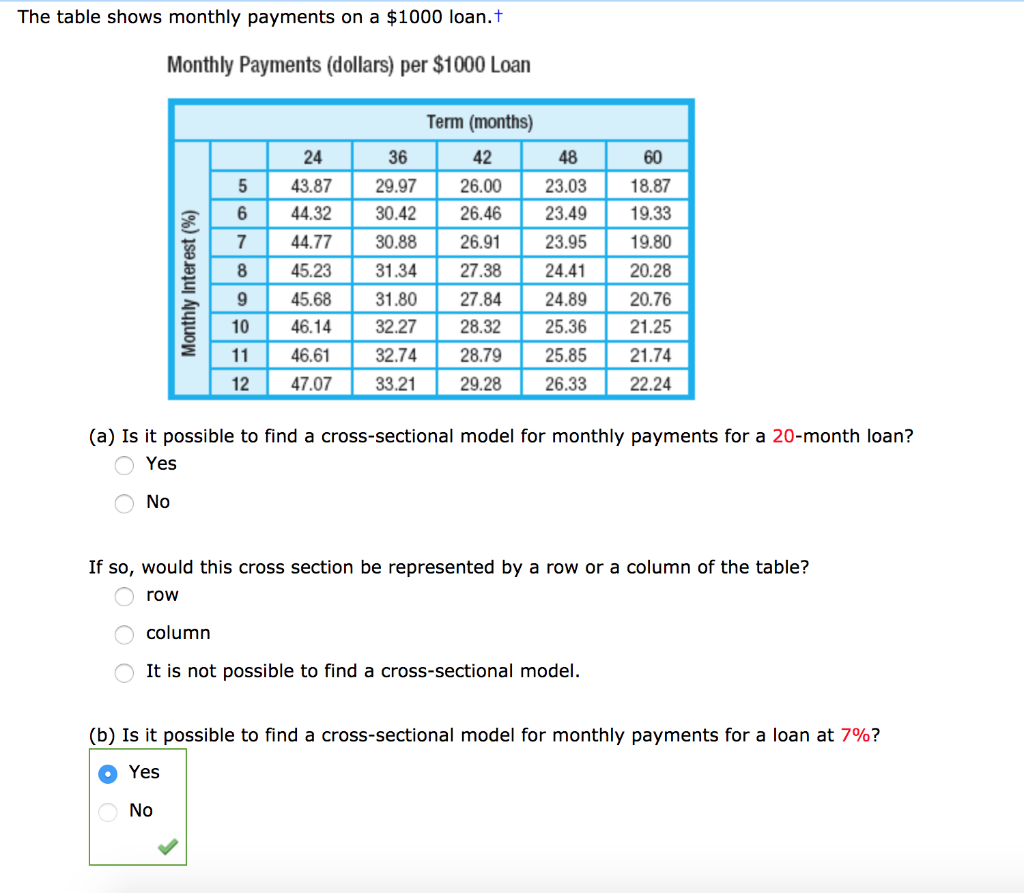

Divide the total amount you'll pay (including the principal and interest) by the loan term (in months). For example, say the total amount you'll pay is $1,000, and the loan term is 12 months. Your monthly loan payment would be $83.33 ($1,000 ÷ 12 = $83.33).

How much interest is on a $1,000 dollar loan

The interest rate on a $1,000 loan from a major lender could be anywhere from 5.35% to 35.99%. It's difficult to pinpoint the exact interest rate that you'll get for a $1,000 loan since lenders take many factors into account when calculating your interest rate, such as your credit score and income.

Is it easy to get a $1,000 dollar loan

Yes, $1,000 personal loans exist and are accessible for most types of borrowers. Since this is a smaller loan amount, you may not need excellent credit to qualify. If you need to borrow $1,000 for a few weeks, you may be able to charge it to a credit card and pay the balance before your next statement.

Cached

How much a month is a 10000 dollar loan

Advertising Disclosures

| Loan Amount | Loan Term (Years) | Estimated Fixed Monthly Payment* |

|---|---|---|

| $10,000 | 3 | $308.73 |

| $10,000 | 5 | $205.12 |

| $15,000 | 3 | $463.09 |

| $15,000 | 5 | $307.68 |

Cached

How much is a $2 500 loan monthly

What is the monthly payment on a $2,500 loan The monthly payment on a $2,500 loan will vary depending on your interest rate and repayment terms. On average, you can expect to pay around $20 to $300 per month.

How much a month is a 2000 dollar loan

For example, if you take out a $2,000 loan for one year with an APR of 36%, your monthly payment will be $201. But if you take out a $2,000 loan for seven years with an APR of 4%, your monthly payment will be $27.

How much is $1000 at 6% interest

Hence, if a two-year savings account containing $1,000 pays a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years.

Can I get a $1,000 dollar loan from my bank

Banks and credit unions

But you may also be able to get a $1,000 personal loan by walking into a traditional financial institution, like a bank or credit union, and applying in person. If you're an existing customer with a particular bank, you might be eligible for an interest rate discount.

Can I take out a $2,000 dollar loan with no job

Provided you have a regular source of income, a lender will likely not care where that income is from. This means you should be able to get an emergency loan without a job. Income sources can include: Social Security or disability benefits.

What is the monthly payment on a $5 000 personal loan

Based on the OneMain personal loan calculator, a $5,000 loan with a 25% APR and a 60-month term length would be $147 per month.

How much is a $20000 loan over 5 years

A $20,000 loan at 5% for 60 months (5 years) will cost you a total of $22,645.48, whereas the same loan at 3% will cost you $21,562.43. That's a savings of $1,083.05. That same wise shopper will look not only at the interest rate but also the length of the loan.

What’s a good monthly income for loan

The 35%/45% rule emphasizes that the borrower's total monthly debt shouldn't exceed more than 35% of their pretax income and also shouldn't exceed more than 45% of their post-tax income. To use the first part this rule, you'll need to determine your gross monthly income before taxes and multiply it by 0.35.

What is the minimum income for a personal loan

You need at least $10,500 in annual income to get a personal loan, in most cases. Minimum income requirements vary by lender, ranging from $10,500 to $100,000+, and a lender will request documents such as W-2 forms, bank statements, or pay stubs to verify that you have enough income or assets to afford the loan.

What is 5% interest on $1000

5% = 0.05 . Then multiply the original amount by the interest rate. $1,000 * 0.05 = $50 . That's it.

How long will it take $1000 to double at 5% interest

Answer and Explanation: The answer is: 12 years.

What is the lowest amount of money you can loan

For the most personal loan lenders, $1,000-$5,000 is the lowest amount you can borrow. But the minimum loan amount can vary substantially from one lender to another.

What is the easiest loan to get

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit.

How much money can you borrow with no credit

Just keep in mind that if you are approved for the loan with a lower (or no) credit score, you may be subject to a higher interest rate. You can apply for loan amounts as low as $1,000 and as much as $50,000.

Do you need proof of income for a personal loan

Most personal loan lenders will require proof of income, even if they don't disclose their minimum income requirements. Only a few lenders, like Upgrade and Universal Credit, offer unsecured loans for a single borrower with no income verification.

How much is the monthly payment on a 2500 loan

The monthly payment on a $2,500 loan will vary depending on your interest rate and repayment terms. On average, you can expect to pay around $20 to $300 per month.