How much are payments on a 50000 HELOC?

How do you calculate a HELOC monthly payment

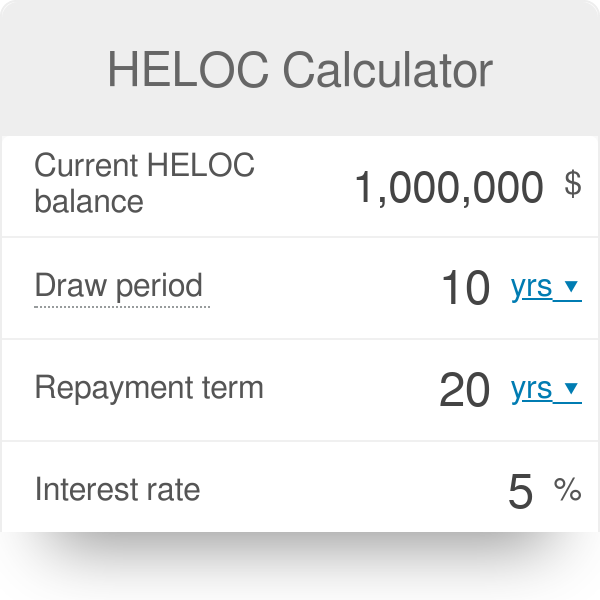

Multiply the current HELOC balance by the annual interest rate charged on loan. Divide the value by 12 to determine how much you will pay monthly.

What is the payment on a 500k HELOC

Home Equity Loan Payment Examples

| Indicative monthly repayments for a $500,000 home equity loan | ||

|---|---|---|

| Loan Term | 3% | 4% |

| 5 years | $8,984.00 | $9,208.00 |

| 10 years | $4,828.00 | $5,062.00 |

| 15 years | $3,453.00 | $3,698.00 |

How do I calculate my minimum payment for HELOC

The minimum monthly payment is calculated as 100% of the interest owed for the period.

Cached

How is a $50000 home equity loan different from a $50000 home equity line of credit

With a home-equity loan, you'll pay interest on the entire lump sum, whether or not you use it all. But HELOCs give you more control over the amount you borrow—and thus how much interest you'll end up paying.

Cached

What is the average HELOC repayment period

10 to 20 years

How long does a HELOC repayment period typically last HELOC repayment periods vary based on the terms of your agreement but typically last 10 to 20 years.

Is a HELOC a good idea right now

Home equity loans can be a good option if you know exactly how much you need to borrow and you want the stability of a fixed rate and fixed monthly payment. HELOCs come with variable rates, which make them less predictable. But rates are expected to drop this year, which means getting a HELOC might be the smarter move.

What is a good amount for a HELOC

Lender guidelines vary, but the average HELOC limit offered by most lenders is 80%-85%. That means your HELOC amount and your current mortgage balance, when combined, can't exceed 80%-85% of the home's appraised value.

Do HELOCs have minimum payments

Most lenders only require you to make interest-only payments during the HELOC draw period. But some lenders will require you to make a minimum monthly payment that includes some of the principal. Once the draw period is over, you must start paying back the principal and interest with each monthly payment.

Is there a better option than a HELOC

Pros: A cash-out refinance could be a wiser option than a HELOC if you can get a better interest rate and you want the predictability of borrowing at a fixed rate.

Is a HELOC a good idea in 2023

Interest rates for home equity loans and lines of credit will keep rising in 2023 as the Federal Reserve continues to battle inflation. “As long as the Fed is active, HELOC rates are going to continue to march higher,” says Greg McBride, CFA, Bankrate chief financial analyst.

Why is my HELOC payment so high

If your HELOC has a variable interest rate, and that rate increases while you're still paying back what you borrowed, your monthly payment could be higher than what you can afford. If this happens, you should contact your lender.

Is it a good idea to get a HELOC

A HELOC can be a worthwhile investment when you use it to improve your home's value. But it can become a bad debt when you use it to pay for things that you can't afford with your current income and savings. You may make an exception if you have a true financial emergency that can't be covered any other way.

What is the downside of HELOC

Disadvantages Of Getting A HELOC

Interest Rates May Rise: All HELOCs start with a variable rate and quite often it is a promotional rate that changes to a higher variable rate after the promotion ends. After the HELOC draw period (usually 10 years) a HELOC will adjust to a fixed rate.

Why not to do a HELOC

The main drawback of a HELOC is that it increases the risk of foreclosure if you can't pay the loan. Regardless of your goal, avoid a HELOC if: Your income is unstable. If it's possible that your income will change for the worse, a HELOC may be a bad idea.

Is it smart to get a HELOC

A HELOC can be a worthwhile investment when you use it to improve your home's value. But it can become a bad debt when you use it to pay for things that you can't afford with your current income and savings. You may make an exception if you have a true financial emergency that can't be covered any other way.

How long do you have to pay off a HELOC

How long do you have to repay a HELOC HELOC funds are borrowed during a “draw period,” typically 10 years. Once the 10-year draw period ends, any outstanding balance will be converted into a principal-plus-interest loan for a 20-year repayment period.

Is there a downside to having a HELOC

Disadvantages Of Getting A HELOC

Interest Rates May Rise: All HELOCs start with a variable rate and quite often it is a promotional rate that changes to a higher variable rate after the promotion ends. After the HELOC draw period (usually 10 years) a HELOC will adjust to a fixed rate.

Is it a bad idea to get a HELOC right now

Home equity loans can be a good option if you know exactly how much you need to borrow and you want the stability of a fixed rate and fixed monthly payment. HELOCs come with variable rates, which make them less predictable. But rates are expected to drop this year, which means getting a HELOC might be the smarter move.

Is it wise to get a HELOC right now

Home equity loans can be a good option if you know exactly how much you need to borrow and you want the stability of a fixed rate and fixed monthly payment. HELOCs come with variable rates, which make them less predictable. But rates are expected to drop this year, which means getting a HELOC might be the smarter move.

What is a reasonable rate for a HELOC

Average 15-year home equity loan interest rates

| State | Average rate | Range |

|---|---|---|

| California | 6.32% | 3.25%-9.03% |

| Colorado | 6.12% | 5.45%-7.25% |

| Connecticut | 5.95% | 3.88%-7.60% |

| Delaware | 5.63% | 4.90%-6.24% |