How much can FairMoney borrow?

What is the highest loan amount on FairMoney

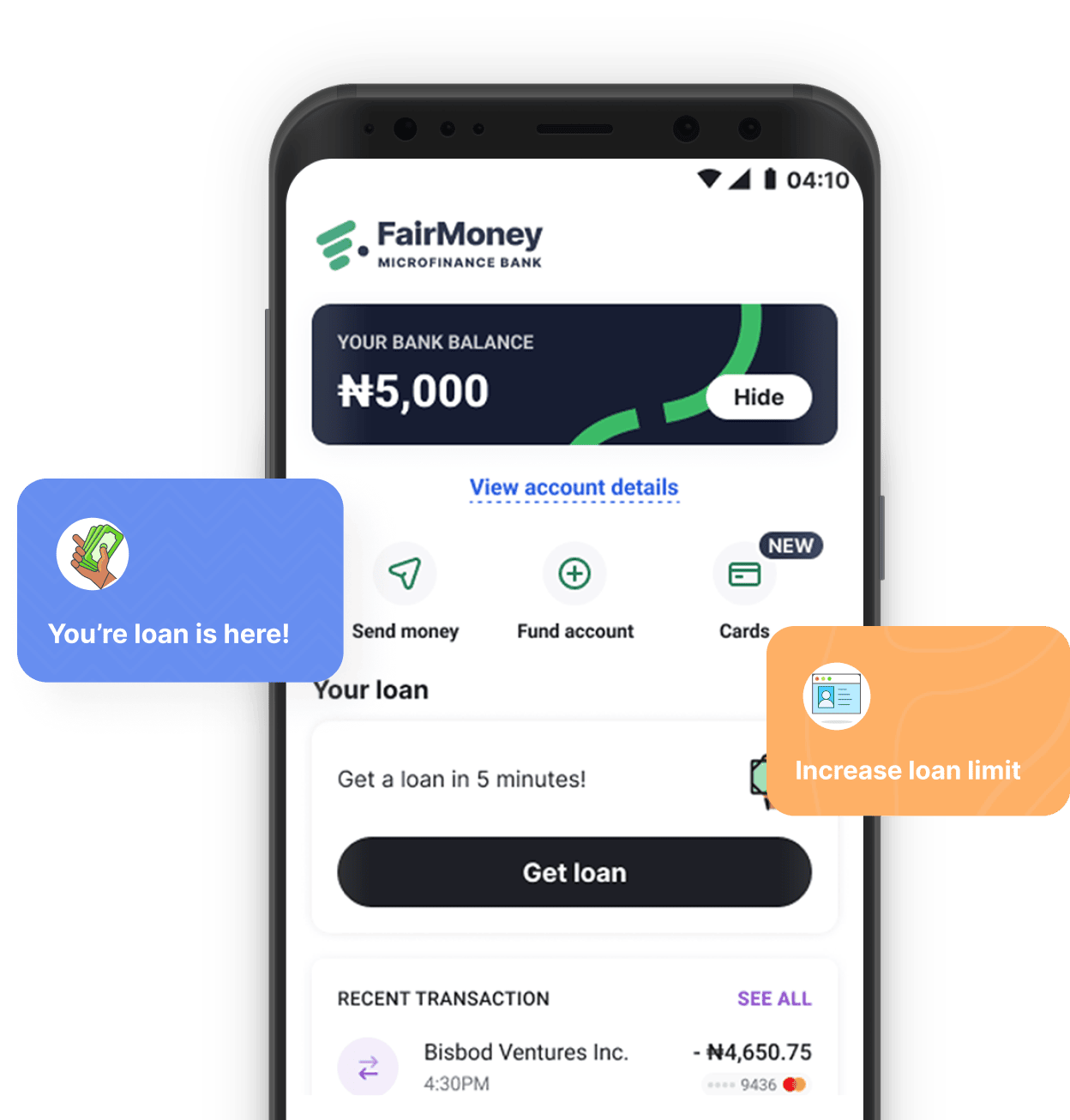

Products that meet all your life goalsPersonal Loans. You can now access quick loans of up to ₦3,000,000 in 5 mins, no collaterals & convenient repayment terms!Business Loans. Take your business to the next level with up to ₦5,000,000 FairMoney SME loans.FairLock.FairSave.Cards.Bank Account.Bill Payment.POS Service.

Cached

How much can I borrow from FairMoney and for how long

FairMoney offer loans from N1,500 to N150,000 for a period of up to 3 months. You can access higher loan amounts and longer repayment periods if you repay your loan on time or make payments in the app. Adewale Adebimpe and 86 others like this.

Cached

Can FairMoney borrow me 50k

An Overview of FairMoney Loan

With FairMoney Loan, you can get an instant loan of up to as much as ₦500,000 without needing any paperwork or even collateral.

Why is FairMoney not giving me loan

If you're having issues getting a loan as a new customer or getting a higher loan as a returning customer, it is usually linked to your credit score on the FairMoney app. These are efforts you can do to improve your credit score on FairMoney.

Can I borrow 100k from FairMoney

Once you accept the offer, you will receive your loan within 5 minutes. How much can I borrow and for how long FairMoney offers loans of up to N3,000,000 for a period of up to 24 months. The better your lending history and positive behaviour, the more you can access and the longer your repayment period!

How much can FairMoney borrow me for the first time

FairMoney is an automated online moneylender that provides single payment loans, installment loans and payroll loans for borrowers. The amount borrowed is then deducted from your account. Their minimum loan amount is N10,000 and the upper limit for a new customer is N40,000 with no collateral or guarantor required.

How much would it cost to borrow $50000

Cost to repay a $50,000 personal loan

| Repayment term | Interest rate | Total interest |

|---|---|---|

| 3 years | 7% | $5,203 |

| 4 years | 8% | $7,817 |

| 5 years | 9% | $10,888 |

| 7 years | 10% | $16,595 |

May 17, 2023

Which bank owns FairMoney

These Terms and Conditions apply to and regulate the provision of financial services provided by FairMoney MFB, a digital microfinance bank that is licensed by the Central Bank of Nigeria (CBN) which provides financial services via its flagship mobile app – FairMoney™ to the Customer herein.

How much does it cost to borrow $100 000

Assuming principal and interest only, the monthly payment on a $100,000 loan with an APR of 3% would come out to $421.60 on a 30-year term and $690.58 on a 15-year one. Check Out: 20- vs 30-Year Mortgage: Is an Unusual Option Right for You

What happens if I don’t pay back my FairMoney loan

As required by law FairMoney reports to all credit bureaus including CIBIL. Not repaying your loan on time will negatively impact your CIBIL score and may prevent you from obtaining future loans.

How much is a $10,000 loan for 5 years

Example 1: A $10,000 loan with a 5-year term at 13% Annual Percentage Rate (APR) would be repayable in 60 monthly installments of $228 each.

How much would a $5000 loan cost per month

Based on the OneMain personal loan calculator, a $5,000 loan with a 25% APR and a 60-month term length would be $147 per month.

Can FairMoney deduct money from my bank account

5.12 You consent that FairMoney MFB can deduct funds from customer's account when such funds have been established as erroneous or fraudulent in nature.

How much is a payment on a $200 000 loan

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 — not including taxes or insurance. But these can vary greatly depending on your insurance policy, loan type, down payment size, and more.

How much is a $20000 loan for 5 years

A $20,000 loan at 5% for 60 months (5 years) will cost you a total of $22,645.48, whereas the same loan at 3% will cost you $21,562.43. That's a savings of $1,083.05. That same wise shopper will look not only at the interest rate but also the length of the loan.

What is 6% interest on a $30000 loan

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.

How much is a 2 million dollar loan monthly payment

What Is the Monthly Mortgage Payment for a $2 Million Home The national average for a 30-year fixed-rate jumbo loan mortgage is around 3.5%. At that rate, the monthly mortgage payment for a $2 million home will be around $7,800 per month, with a 20% down payment.

What is a monthly payment on a $10000 loan

Advertising Disclosures

| Loan Amount | Loan Term (Years) | Estimated Fixed Monthly Payment* |

|---|---|---|

| $5,000 | 5 | $104.11 |

| $10,000 | 3 | $308.73 |

| $10,000 | 5 | $205.12 |

| $15,000 | 3 | $463.09 |

How much is a $50000 loan payment for 7 years

But if you take out a $50,000 loan for seven years with an APR of 4%, your monthly payment will be $683. Almost all personal loans offer payoff periods that fall between one and seven years, so those periods serve as the minimum and maximum in our calculations.

What is 7% interest on a 500000 loan

Your total interest on a $500,000 mortgage

On a 30-year mortgage with a 7.00% fixed interest rate, you'll pay $697,544 in interest over the loan's life.