How much can you deduct for medical expenses 2023?

Are health insurance premiums tax deductible in 2023

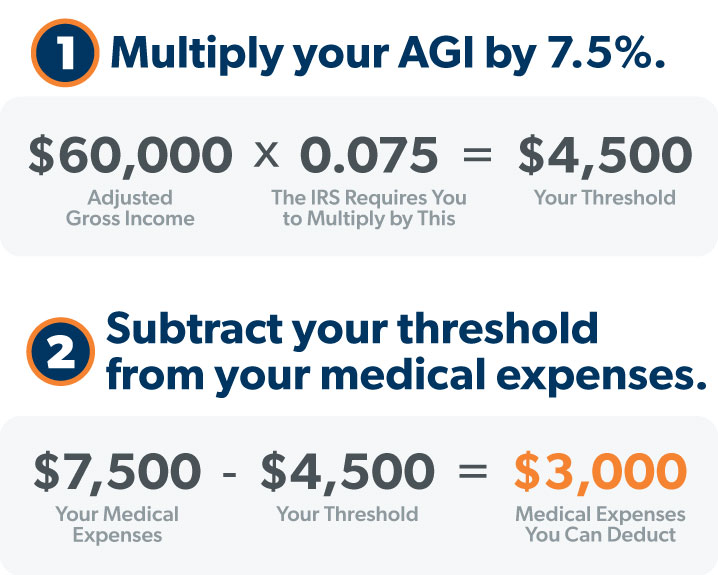

The short answer is yes, Medicare premiums can be tax-deductible. However, the amount you can deduct depends on your income and tax filing status. The IRS allows you to deduct medical and dental expenses that exceed 7.5% of your adjusted gross income on form 1040 or 1040 senior.

Cached

What is the new tax deduction for 2023

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.

What are the above the line deductions for 2023

Most Common Above-the-Line Deductions

Single Filers and Heads of Households: $68,000 to $78,000 (2023) and $73,000 to $83,000 (2023) Married Filing Jointly: $109,000 to $129,000 (2023) and $116,000 to $136,000 (2023) if the contributing spouse participates in an employer-sponsored plan.

What is the medical insurance trend for 2023

Platinum and catastrophic plans saw the highest rate increases in 2023, at 10 percent and 5 percent, respectively. Increases for gold plans were relatively modest at 2 percent. Premiums for the lowest-price silver plan also increased across all plan categories, with the highest increases coming from insurtechs.

Will there be healthcare subsidies in 2023

It depends on how much you earn. In 2023, you're eligible for Obamacare subsidies if the cost of the “benchmark plan” (the second-lowest-cost silver plan on the exchange) costs more than a given percent of your income, up to a maximum of 8.5%. The cut-off threshold increases on a sliding scale depending on your income.

Is it worth claiming medical expenses on taxes

Normally, you should only claim the medical expenses deduction if your itemized deductions are greater than your standard deduction (TurboTax can also do this calculation for you). If you elect to itemize, you must use IRS Form 1040 to file your taxes and attach Schedule A.

What are the projected 2023 federal tax brackets

The 2023 tax year—the return you'll file in 2024—will have the same seven federal income tax brackets as the 2023-2023 season: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income, including wages, will determine the bracket you're in.

What is the income limit for ACA subsidies 2023

In 2023, you'll typically be eligible for ACA subsidies if you earn between $13,590 and $54,360 as an individual, or between $27,750 and $111,000 for a family of four. For most people, health insurance subsidies are available if your income is between 100% and 400% of the federal poverty level (FPL).

What percentage of medical bills can be claimed on taxes

7.5%

You can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), found on line 11 of your 2023 Form 1040.

What proof do I need to deduct medical expenses

You should also keep a statement or itemized invoice showing:What medical care was received.Who received the care.The nature and purpose of any medical expenses.The amount of the other medical expenses.

What is the IRS inflation adjustment for 2023

Inflation last year reached its highest level in the United States since 1981. As a result, the IRS announced the largest inflation adjustment for individual taxes in decades: 7.1 percent for tax year 2023.

What is the maximum taxable income for Social Security for 2023

1, 2023, the maximum earnings subject to the Social Security payroll tax will increase by nearly 9 percent to $160,200—up from the $147,000 maximum for 2023, the Social Security Administration (SSA) announced Oct.

What are the income limits for 2023 healthcare gov chart

2023 Federal Poverty Guidelines

| # of People in Household | 100% of FPL | 400% of FPL |

|---|---|---|

| 1 | $ 13,590 | $ 54,360 |

| 2 | $ 18,310 | $ 73,240 |

| 3 | $ 23,030 | $ 92,120 |

| 4 | $ 27,750 | $ 111,000 |

How to calculate ACA affordability 2023 rate of pay

To calculate ACA affordability for the 2023 tax year under the Rate of Pay Safe Harbor using hourly workers' earnings, take the employee's lowest hourly rate as of the first day of the coverage period and multiply it by 130, the minimum total of hours an employee must work on average to be ACA full-time.

Is there a maximum medical expenses deduction

You can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), found on line 11 of your 2023 Form 1040.

What is the maximum medical expense deduction

You may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. You figure the amount you're allowed to deduct on Schedule A (Form 1040).

How much out of pocket medical expenses can you claim on taxes

See if you qualify. In 2023, the IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted gross income. You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses instead of taking the standard deduction.

What is the IRS rule for deducting medical expenses

You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). This publication also explains how to treat impairment-related work expenses and health insurance premiums if you are self-employed.

What are the IRS indexed limits for 2023

Cost-of-Living Adjusted Limits for 2023

The limitation for defined contribution plans under section 415(c)(1)(A) is increased in 2023 from $61,000 to $66,000. The Code provides that various other dollar amounts are to be adjusted at the same time and in the same manner as the dollar limitation of section 415(b)(1)(A).

How much money can I make without affecting my Social Security in 2023

If you will reach full retirement age in 2023, the limit on your earnings for the months before full retirement age is $56,520. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.