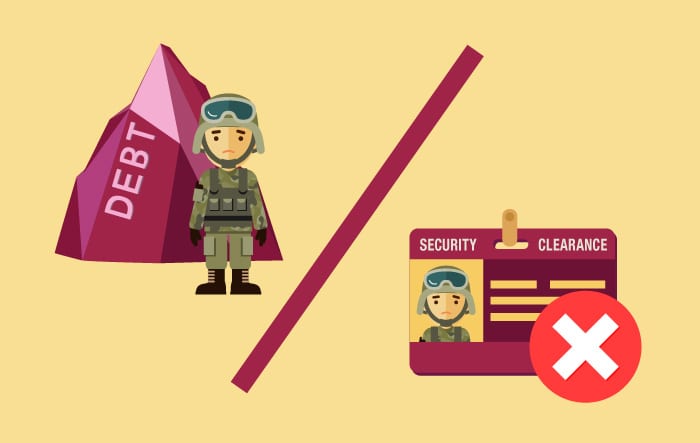

How much debt do you need to be denied a security clearance?

Does debt affect secret security clearance

While excessive debt can be a reason for denying a security clearance application, there is not a set amount of debt in the military that will result in the application being denied. The term used for disqualifying an applicant is “excessive indebtedness.”

Cached

Can you be denied security clearance for bad credit

Imperfect financial circumstances, such as bad credit scores, can have a negative influence on your application and potentially cause your security clearance to be denied. In fact, financial issues comprise a large percentage of security clearance denials.

Can you get a security clearance with debt in collections

[1] While a debt collector has no power to deny or revoke a security clearance, the government can and does do so frequently for delinquent debts. Resolving delinquent debts in good faith is critical to obtaining or maintaining a security clearance.

What disqualifies you from getting a security clearance

During the background check process, certain factors may lead to a person's clearance being denied—such as having a criminal record, financial issues such as bankruptcy or delinquent debts, having affiliations with groups or organizations connected with espionage, and/or drug use or addiction.

How much debt is too much for clearance

Is There a Debt Limit to Obtain a Security Clearance No branch of the military has a set amount of debt that is the breaking point for security clearance. You could owe $5,000 or $50,000 and be granted or denied clearance. It's all a matter of how you deal with the debt.

Does security clearance check bank accounts

If you've never been subjected to this line of questioning during a security clearance background investigation, you may be surprised to learn that, yes, the government does review your finances as part of the process, albeit not in the way you may think.

Is there a minimum credit score for clearance

There is no specific credit score needed for security clearance. “It's one component,” said Edmunds, whose law firm has been handling security clearance cases for more than three decades and has offices in six cities across the country.

Does collections count as debt

When you have a debt in collections, it usually means the original creditor has sent the debt to a third-party person or agency to collect it. Credit card debt, mortgages, auto loans and student loans are a few types of debt that can be passed on to a debt collection agency.

What are the red flags for security clearance

Financial Risk Factors

Many security clearance applications are denied due to specific financial concerns. For example, large quantities of debt that are potentially unmanageable or unpaid taxes are both considered red flags.

What shows up on a security clearance check

Credit and criminal history checks will be conducted on all applicants. For a Top Secret security clearance, the background investigation includes additional record checks which can verify citizenship for the applicant and family members, verification of birth, education, employment history, and military history.

What is a bad debt can they be recovered

Bad debt recovery is a payment received for a debt that had been written off and considered uncollectible. Bad debt may be fully or partially recovered in the form of a payment from a bankruptcy trustee or the proceeds a bank receives when it sells collateral put up by the borrower.

What percentage should you stay under if you have debt

Most credit experts advise keeping your credit utilization below 30 percent, especially if you want to maintain a good credit score.

Do security clearance investigators look at credit card statements

If you've never been subjected to this line of questioning during a security clearance background investigation, you may be surprised to learn that, yes, the government does review your finances as part of the process, albeit not in the way you may think.

What is an unacceptable credit score

A bad credit score is a FICO credit score below 670 and a VantageScore lower than 661.

How much credit history is sufficient

How long does my credit history have to be to help my credit scores In general, you need to have at least one account open that has been reporting to the credit bureaus for six months to have enough information to generate a credit score.

How long does a debt stay in collections

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt. State where you live.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

Does anxiety affect security clearance

A past or present mental, emotional, or personality disorder is not by itself a disqualifying condition for a final security clearance. A psychological condition does not have to be formally diagnosed as a disorder to be a security concern.

Does security clearance check bank statements

If you've never been subjected to this line of questioning during a security clearance background investigation, you may be surprised to learn that, yes, the government does review your finances as part of the process, albeit not in the way you may think.

Do security clearances check Internet history

Although security clearance background checks can be intensely thorough, the government can't view your emails, Internet browsing history, hard drive data, and other virtual assets without a subpoena or warrant.