How much debt does the average American have 2023?

What is the average amount of debt at 23

Here's the average debt balances by age group: Gen Z (ages 18 to 23): $9,593. Millennials (ages 24 to 39): $78,396. Gen X (ages 40 to 55): $135,841.

How to get out of debt in 2023

5 Steps to Get Out of Debt in 2023Build a better budget. If you don't have a budget, now is the time to create one—and if you do have a budget already in place, make some tweaks and hold force yourself to follow it.Pay down credit cards.Save your money.Make an appointment with a credit counselor.Educate yourself.

How much debt is the average 30 year old in

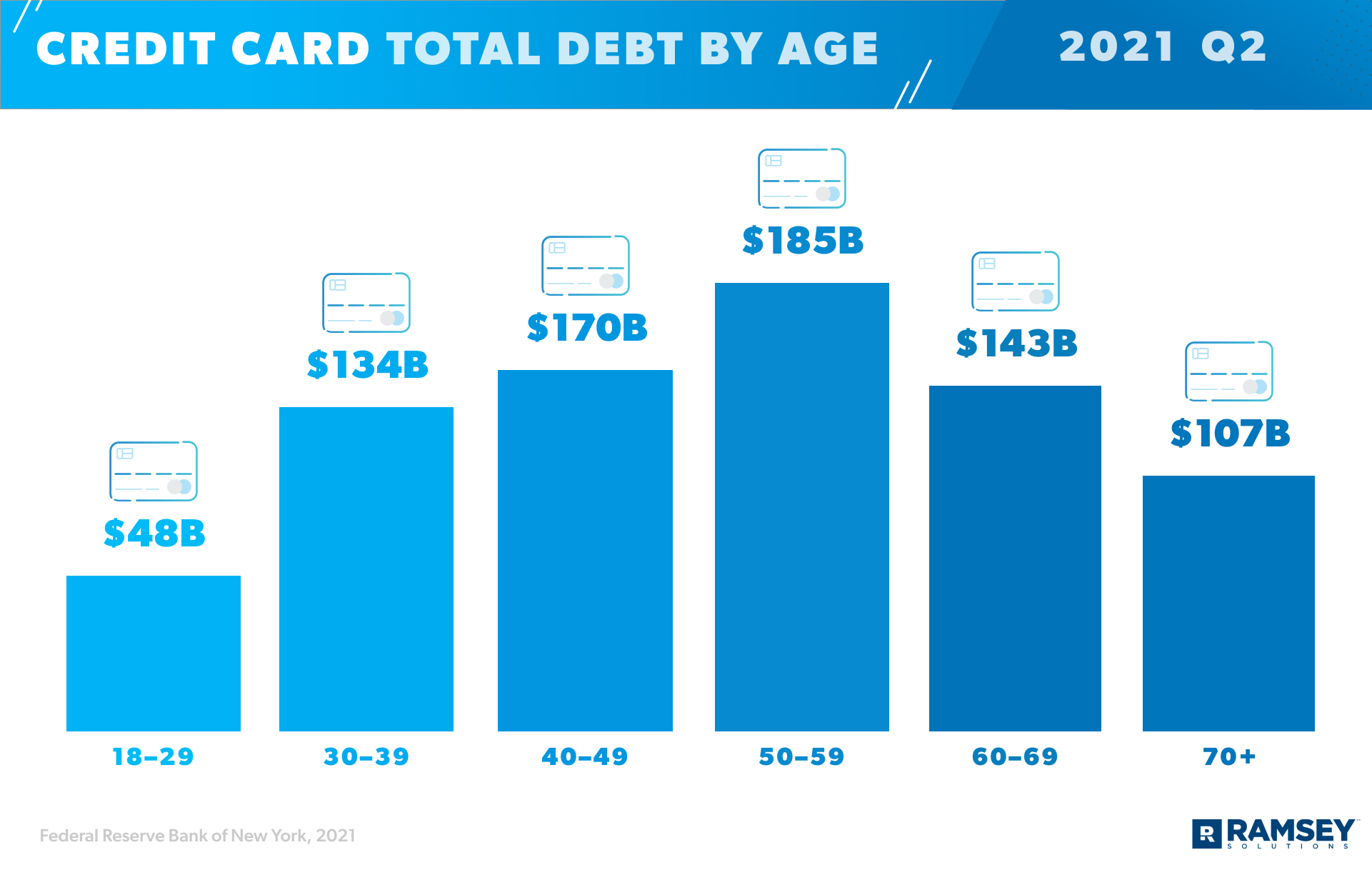

The average credit card debt for 30 year olds is roughly $4,200, according to the Experian data report. Compared to people in their 50s, this debt is not so high. According to Experian, the people in their 50s have the highest average credit card debt, at around $8,360.

What age group has the most average debt

While Americans 75 and older have the highest average credit card debt, it's likely due to outliers with especially large balances. Their median credit card debt is $2,700, tied for second-lowest with several other age groups. It's Americans from 45 to 54 who have the highest median credit card debt at $3,200.

Is $30,000 in debt a lot

Many people would likely say $30,000 is a considerable amount of money. Paying off that much debt may feel overwhelming, but it is possible. With careful planning and calculated actions, you can slowly work toward paying off your debt. Follow these steps to get started on your debt-payoff journey.

Is 20k debt a lot

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

Is 2023 going to be bad financially

There is broad consensus that the U.S. is likely to see an economic slowdown in Q1 2023 as the impacts of the Federal rate rises from late 2023 start to feed into the economy; however, there is a significant divergence with regards to the quarters that follow.

How can I pay off $50000 in debt in one year

What it takes to pay off $50,000 in debt in one year in 5 stepsThe benefits of paying off all your debt in a year.Tips to pay off $50,000 of debt in a year.Create a budget and track all expenses.Be mindful of debt fatigue.Prioritize paying high-interest debt first.Get a higher-paying new job.Freelance on the side.

Is $20,000 a lot of debt

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

At what age are people debt free

The Standard Route. The Standard Route is what credit companies and lenders recommend. If this is the graduate's choice, he or she will be debt free around the age of 58.

What is the average middle class debt

The average American holds a debt balance of $96,371, according to 2023 Experian data, the latest data available. That's up 3.9 percent from 2023's average balance of $92,727, largely due to the rising balance of mortgage and auto loans.

What is an OK amount of debt

A common rule-of-thumb to calculate a reasonable debt load is the 28/36 rule. According to this rule, households should spend no more than 28% of their gross income on home-related expenses, including mortgage payments, homeowners insurance, and property taxes.

How much debt is unhealthy

Debt-to-income ratio targets

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high.

What will 2023 look like financially

In 2023, economic activity is projected to stagnate, with rising unemployment and falling inflation. Interest rates are projected to remain high initially and then gradually decrease in the next few years as inflation continues to slow.

Is a recession coming in 2023 in usa

Geopolitical tensions, energy market imbalances, persistently high inflation and rising interest rates have many investors and economists concerned that a U.S. recession is inevitable in 2023. The risk of recession has been rising as the Federal Reserve has raised interest rates in its ongoing battle against inflation.

Is 20k in debt a lot

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

How many Americans are 100% debt-free

Fewer than one quarter of American households live debt-free. Learning ways to tackle debt can help you get a handle on your finances.

How much debt is normal

The average American holds a debt balance of $96,371, according to 2023 Experian data, the latest data available.

What is considered a lot of debt

Debt-to-income ratio targets

Now that we've defined debt-to-income ratio, let's figure out what yours means. Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high.

Is 30k a lot of debt

Many people would likely say $30,000 is a considerable amount of money. Paying off that much debt may feel overwhelming, but it is possible. With careful planning and calculated actions, you can slowly work toward paying off your debt. Follow these steps to get started on your debt-payoff journey.