How much do 17 year olds get for Child Tax Credit?

What is the Child Tax Credit for a 17 year old

$3,000 per child

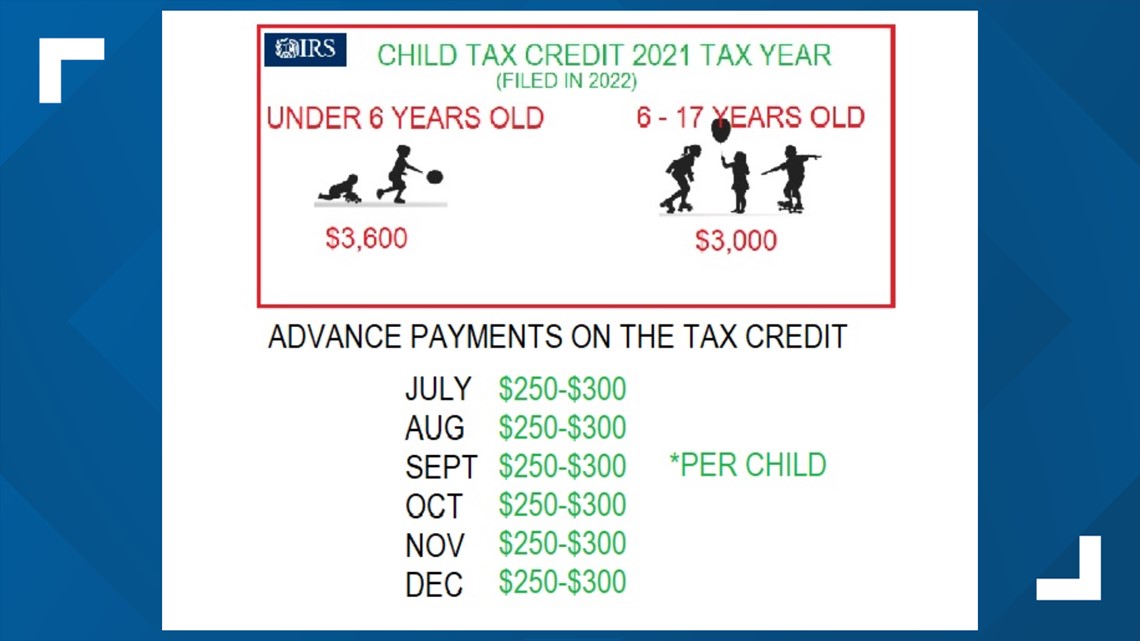

The American Rescue Plan raised the maximum Child Tax Credit in 2023 to $3,600 per child for qualifying children under the age of 6 and to $3,000 per child for qualifying children ages 6 through 17.

Cached

How much is a 17 year old dependent worth

$3,000

For 2023, the Child Tax Credit is $3,600 for each qualifying child under the age of 6 and to $3,000 for qualifying children ages 6 through 17.

Can a 17 year old get earned income credit

The amount of California Earned Income Tax Credit (CalEITC) you may receive depends on your income and family size. To qualify for CalEITC you must meet all of the following requirements during the tax year: You're at least 18 years old or have a qualifying child.

Can I claim my 17 year old as a dependent on my taxes

To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year. There's no age limit if your child is "permanently and totally disabled" or meets the qualifying relative test.

Will I receive a stimulus check for my child at 17

Why millions of college students and young adults won't get a stimulus check. Any person age 17 to 24 who was claimed as a dependent won't be eligible for the $1,200 payment or the $500 child bonus.

Do you get a stimulus check for a 17 year old child

For a third check, if you're in the 17-to-24 age range and listed as a dependent, you'll be eligible for a payment of up to $1,400.

Are 17 year old dependents eligible for stimulus

Eligible taxpayers and their dependents of all ages, not just those under 17, will receive $1,400 stimulus checks. That means college students and adult dependents will be eligible for crucial aid, giving a lifeline to those who may live on their own and are working but are still claimed on their parents' taxes.

How much Child Tax Credit will I get

How much is the child tax credit worth For the 2023 tax year (returns filed in 2023), the child tax credit is worth up to $2,000 per qualifying dependent. The credit is also partially refundable, meaning some taxpayers may be able to receive a tax refund for any excess amount up to a maximum of $1,500.

How much money can a child make and still be claimed as a dependent

A child who has only earned income must file a return only if the total is more than the standard deduction for the year. For 2023, the standard deduction for a dependent child is total earned income plus $400, up to a maximum of $12,950. So, a child can earn up to $12,950 without paying income tax.

Do minors get taxes taken out of their paycheck

Just like adults, teens have to pay federal and state income taxes once their income hits a certain threshold. If you're a teen working a part-time job, summer job, or side hustle, it's important to know when you're subject to tax and how you're expected to pay it.

Will 17 year olds get the third stimulus check

For a third stimulus payment, if you're in the 17-to-24 age range and listed as a dependent, you will be eligible for a payment of up to $1,400.

Did kids under 18 get stimulus

That's because the massive $2 trillion stimulus package, the Coronavirus Aid, Relief, and Security (CARES) Act, excludes some Americans from receiving the one-time payments, which are set at $1,200 for adults and $500 for children. Here's who won't get a stimulus check: Children who are 17 or 18 years old.

What is the $450 per child

First Lady Casey DeSantis announced last week that $35.5 million in DeSantis' budget will "support nearly 59,000 Florida families with a one-time payment of $450 per child, which includes foster families."The American Rescue Plan Act created a $1 billion fund to assist needy families affected by the pandemic within the …

Who qualifies for the $300 child payment

Nearly all families with children qualify. Families will get the full amount of the Child Tax Credit if they make less than $150,000 (two parents) or $112,500 (single parent). There is no minimum income, so families who had little or no income in the past two years and have not filed taxes are eligible.

How much do you get for a dependent over 18

$500

The maximum credit amount is $500 for each dependent who meets certain conditions. This credit can be claimed for: Dependents of any age, including those who are age 18 or older. Dependents who have Social Security numbers or Individual Taxpayer Identification numbers.

How much will the Child Tax Credit be per month

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

What should a 17 year old claim on w4

On the W-4 form, simply write “Exempt” as shown below. “Exempt” indicates that the teenager Is not obligated to pay taxes; therefore, they do not need to have taxes withheld from their paycheck. This is not an exemption from paying Social Security and Medicare. Those will still be deducted from the teenager's paycheck.

Can I still claim my child as a dependent if they work

Share: You can usually claim your children as dependents even if they are dependents with income and no matter how much dependent income they may have or where it comes from.

Do you get $600 per child

The COVID-related Tax Relief Act of 2023, enacted in late December 2023, authorized additional payments of up to $600 per adult for eligible individuals and up to $600 for each qualifying child under age 17.

Am I getting $300 a month per child

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.